Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on January 29, 2010

Registration Number 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

DOUGLAS DYNAMICS, INC.

(Exact name of Registrant as specified in its charter)

| Delaware | 3531 | 134275891 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

7777 North 73rd Street

Milwaukee, Wisconsin 53233

(414) 354-2310

(Address, including zip code, and telephone number, including

area code, of registrant's of principal executive offices)

James L. Janik

President and Chief Executive Officer

Douglas Dynamics, Inc.

7777 North 73rd Street

Milwaukee, Wisconsin 53233

(414) 354-2310

(Name, address and telephone number, including area code, of agent for service)

Copies to:

| Bruce D. Meyer Ari B. Lanin Gibson, Dunn & Crutcher LLP 333 South Grand Avenue Los Angeles, CA 90071 (213) 229-7000 |

Gregg A. Noel Skadden, Arps, Slate, Meagher & Flom LLP 300 South Grand Avenue Los Angeles, CA 90071 (213) 687-5000 |

As soon as practicable after this Registration Statement becomes effective.

(Approximate date of commencement of proposed sale to the public)

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

|

||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee |

||

|---|---|---|---|---|

Common Stock, $.01 par value |

$150,000,000 | $10,695 | ||

|

||||

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933, OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

The information in this prospectus is not complete and may be changed. We and the selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED , 2010

Shares

Douglas Dynamics, Inc.

Common Stock

This is the initial public offering of our common stock. We are selling shares of common stock and the selling stockholders are selling shares of common stock. We will not receive any proceeds from the sale of shares of common stock by the selling stockholders. Prior to this offering there has been no public market for our common stock. The initial public offering price of our common stock is expected to be between $ and $ per share. We will apply to list our common stock on the New York Stock Exchange under the symbol " ."

The underwriters have a 30-day option to purchase on a pro rata basis up to additional shares from us and an aggregate of additional outstanding shares from the selling stockholders to cover over-allotments of shares.

Investing in our common stock involves risks. See "Risk Factors" beginning on page 15.

| |

Price to Public |

Underwriting Discounts and Commissions |

Proceeds to Douglas Dynamics Holdings, Inc. |

Proceeds to to Selling Stockholders |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Per Share | $ | $ | $ | $ | |||||||||

| Total | $ | $ | $ | $ | |||||||||

Delivery of the shares of our common stock will be made on or about , 2010.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Credit Suisse | Oppenheimer & Co. | |

Baird |

Piper Jaffray |

The date of this prospectus is , 2010.

You should rely only on the information contained in this prospectus. We have not, and the underwriters have not, authorized anyone to provide you with information that is different. The information in this prospectus may only be accurate as of the date on the front cover of this prospectus. This prospectus does not constitute an offer to sell, or a solicitation of an offer to buy, any securities offered hereby in any jurisdiction where, or to any person to whom, it is unlawful to make such offer or solicitation.

Information contained in this prospectus concerning the snow and ice control equipment industry for pickup trucks and sport utility vehicles, which we refer to as "light trucks" in this prospectus, our general expectations concerning this industry and our market positions and other market share data regarding this industry are based on estimates our management prepared using end-user surveys, anecdotal data from our distributors and distributors that carry our competitors' products, our results of operations and management's past experience, and on assumptions made by our management, based on its knowledge of this industry, all of which we believe to be reasonable. These estimates and assumptions are inherently subject to uncertainties and may prove to be inaccurate. In addition, we have not independently verified the information from any third-party source, although management also believes such information to be reasonable.

"WESTERN," "FISHER" and "BLIZZARD" and their respective logos are trademarks. Solely for convenience, from time to time we refer to our trademarks in this prospectus without the ® symbols, but such references are not intended to indicate that we will not assert, to the fullest extent under applicable law, our rights to our trademarks.

Dealer Prospectus Delivery Obligation

Until , 2010 (25 days after the commencement of this offering), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealer's obligation to deliver a prospectus when acting as an underwriter and with respect to their unsold allotments or subscriptions.

The following summary should be read together with, and is qualified in its entirety by, the more detailed information and financial statements and related notes included elsewhere in this prospectus. The following summary does not contain all of the information you should consider before investing in our common stock. For a more complete understanding of this offering, we encourage you to read this entire prospectus, including the "Risk Factors" section, before making an investment in our common stock.

In this prospectus, unless the context indicates otherwise: "Douglas Dynamics," the "Company," "we," "our," "ours" or "us" refers to Douglas Dynamics, Inc. (formerly known as Douglas Dynamics Holdings, Inc.), a Delaware corporation ("Douglas Holdings"), the issuer of the common stock being offered hereby, and its subsidiaries; the "Aurora Entities" refers to Aurora Equity Partners II L.P., a Delaware limited partnership and Aurora Overseas Equity Partners II, L.P., a Cayman Islands exempt limited partnership; "Ares" refers to Ares Corporate Opportunities Fund, L.P., a Delaware limited partnership; our "principal stockholders" refers to the Aurora Entities and Ares, collectively; and the "selling stockholders" refer to our principal stockholders together with certain co-investors who will be selling shares of our common stock in this offering as described in "Principal and Selling Stockholders."

Our Company

We are the North American leader in the design, manufacture and sale of snow and ice control equipment for light trucks, which consists of snowplows and sand and salt spreaders, and related parts and accessories. We sell our products under the WESTERN®, FISHER® and BLIZZARD® brands which are among the most established and recognized in the industry. We believe that in 2009 our share of the light truck snow and ice control equipment market was greater than 50%. In the first nine months of 2009, we generated net sales, Adjusted EBITDA (as defined in "—Summary Historical Consolidated Financial and Operating Data") and net income of $125.2 million, $28.0 million and $2.7 million, respectively. See "—Summary Historical Consolidated Financial and Operating Data" for a discussion of why management uses Adjusted EBITDA to measure our financial performance, and a reconciliation of net income to Adjusted EBITDA.

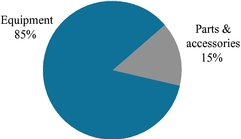

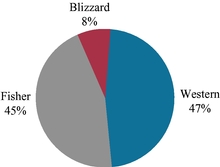

We offer the broadest and most complete product line of snowplows and sand and salt spreaders for light trucks in the U.S. and Canadian markets. Our snowplows use custom-designed mounts which allow each of our snowplow models to be used on a variety of light truck brands and models. In addition, we manufacture a broad portfolio of hopper and tailgate-mounted sand and salt spreaders that are used for snow and ice control on driveways, roads and parking lots. We also provide a full range of related parts and accessories, which generates an ancillary revenue stream throughout the lifecycle of our snow and ice control equipment. The following charts highlight our net sales by product type and brand for the nine months ended September 30, 2009:

| Net Sales by Product Type | Net Sales by Brand | |

|

|

We sell our products through a distributor network primarily to professional snowplowers who are contracted to remove snow and ice from commercial, municipal and residential areas. Because of the short snow season (which we calculate as running from October 1 through March 31), unpredictability of snowfall events and the difficult weather conditions under which our end-users operate, our

1

end-users have a fairly limited time frame in which to generate income. Accordingly, our end-users demand a high degree of quality, reliability and service. Over the last 50 years, we have engendered exceptional customer loyalty for our products because of our ability to satisfy the stringent demands of our customers. As a result, we believe our installed base is the largest in the industry with over 500,000 snowplows and sand and salt spreaders in service. Because sales of snowplows and sand and salt spreaders are primarily driven by the need of our core end-user base to replace worn existing equipment, we believe our substantial installed base provides us with a high degree of predictable sales over any extended period of time.

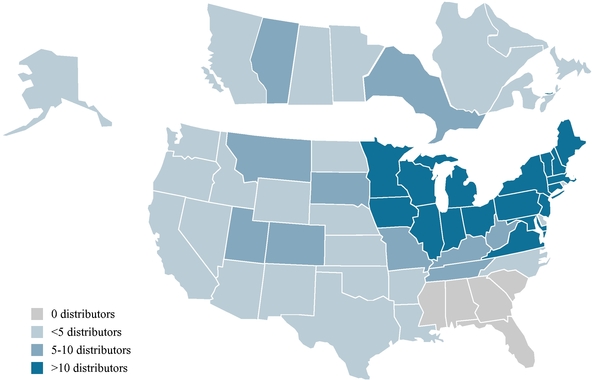

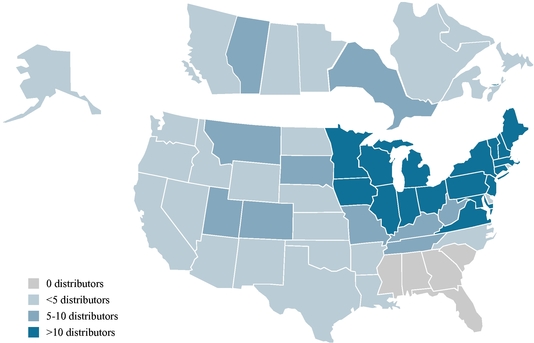

We believe we have the industry's most extensive North American distributor network, which primarily consists of over 720 truck equipment distributors who purchase directly from us located throughout the snowbelt regions in North America (primarily the Midwest, East and Northeast regions of the United States as well as all provinces of Canada). We have longstanding relationships with many of our distributors, with an average tenure of 15 years. Beginning in 2005, we began to extend our reach to international markets, establishing distribution relationships in Northern Europe and Asia, where we believe meaningful growth opportunities exist. A breakdown of our distributor base is reflected in the table below:

We believe we are the industry's most operationally efficient manufacturer due to our vertical integration, highly variable cost structure and intense focus on lean manufacturing. We continually seek to use lean principles to reduce costs and increase the efficiency of our manufacturing operations. From 2002 to 2008, we have increased our gross profit per unit by approximately 3.0% per annum, compounded annually. While we currently manufacture our products in three facilities that we own in Milwaukee, Wisconsin, Rockland, Maine and Johnson City, Tennessee, we have improved our manufacturing efficiency to the point that we will be closing our Johnson City, Tennessee facility effective mid-2010. We expect that the closing of this facility will yield estimated cost savings of approximately $4 million annually, with no anticipated reduction in production capacity. Furthermore, our manufacturing efficiency allows us to deliver desired products quickly to our customers during times of sudden and unpredictable snowfall events, when our customers need our products immediately.

2

Our ability to deliver products on a rapid and efficient basis through lean manufacturing allows us to both better serve our existing customer base and capture new customers from competitors who we believe cannot service their customers' needs with the same speed and reliability.

Our Industry

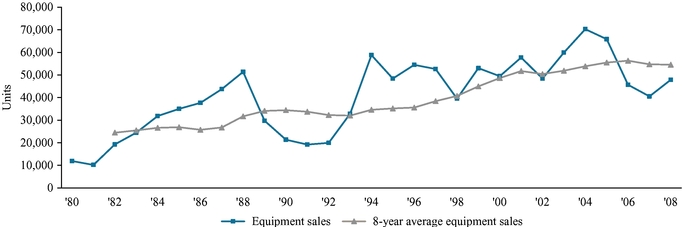

The light truck snow and ice control equipment industry in North America consists predominantly of domestic participants that manufacture their products in North America. Snowplow sales account for a significant portion of snow and ice control equipment sales for light trucks, with sand and salt spreader sales accounting for a lesser portion. The annual demand for snow and ice control equipment is driven primarily by the replacement cycle of the existing installed base, which is predominantly a function of the average life of a snowplow or spreader and is driven by usage and maintenance practices of the end-user. We believe actively-used snowplows are typically replaced, on average, every 7 to 8 years.

The primary factor influencing the replacement cycle for snow and ice control equipment is the level, timing and location of snowfall. Sales of snow and ice control equipment in any given year and region are most heavily influenced by local snowfall levels in the prior snow season. Heavy snowfall during a given winter causes equipment usage to increase, resulting in greater wear and tear and shortened life cycles, thereby creating a need for replacement equipment and additional parts and accessories. Moreover, in our experience, the timing of snowfall in a given winter also influences our end-users' decision-making process. Because an early snowfall can be viewed as a sign of a heavy upcoming snow season, our end-users may respond to an early snowfall by purchasing replacement snow and ice control equipment earlier than they otherwise might have. Alternatively, light snowfall during a given winter season may cause equipment usage to decrease, extending its useful life, and delaying replacement equipment purchases.

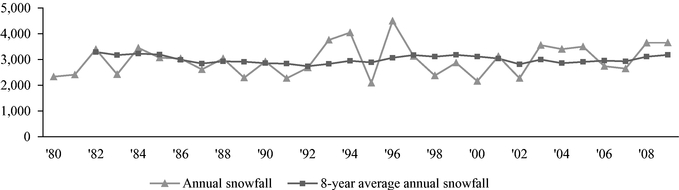

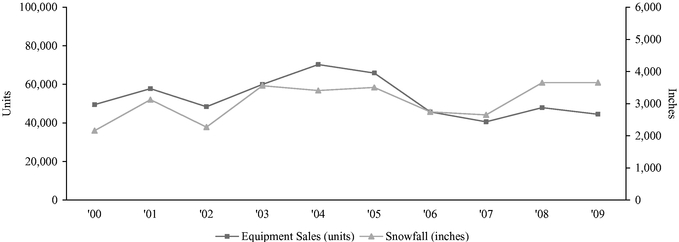

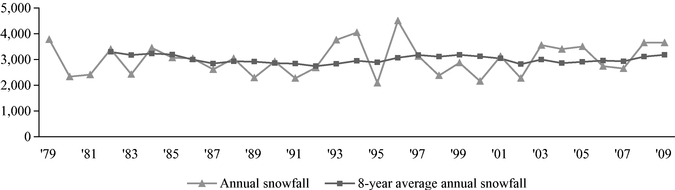

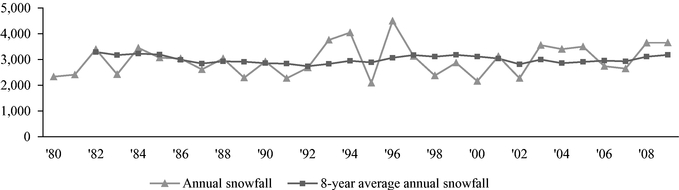

While snowfall levels vary within a given year and from year-to-year, snowfall, and the corresponding replacement cycle of snow and ice control equipment, is relatively consistent over multi-year periods. The following chart depicts aggregate annual and eight-year (based on the typical life of our snowplows) rolling average of the aggregate snowfall levels in 66 cities in 26 snowbelt states across the Northeast, East, Midwest and Western United States where we monitor snowfall levels) from 1980 to 2009. As the chart indicates, since 1982 aggregate snowfall levels in any given rolling eight-year period have been fairly consistent, ranging from 2,742 to 3,295 inches.

Snowfall in Snowbelt States (inches)

(for October 1 through March 31)

Note: The 8-year rolling average snowfall is not presented prior to 1982 for purposes of the calculation due to lack of snowfall data prior to 1975.

Source: National Oceanic and Atmospheric Administration's National Weather Service.

The demand for snow and ice control equipment can also be influenced by general economic conditions in the United States, as well as local economic conditions in the snowbelt regions in North America. In stronger economic conditions, our end-users may choose to replace or upgrade existing equipment before its useful life has ended, while in weak economic conditions, our end-users may seek

3

to extend the useful life of equipment, thereby increasing the sales of parts and accessories. However, since snow and ice control management is a non-discretionary service necessary to ensure public safety and continued personal and commercial mobility in populated areas that receive snowfall, end-users cannot extend the useful life of snow and ice control equipment indefinitely and must replace equipment that has become too worn, unsafe or unreliable, regardless of economic conditions.

Sales of parts and accessories for 2008 were approximately 85% higher than average annual parts and accessories sales over the preceding ten years, which management believes is a result of the deferral of new equipment purchases due to the recent economic downturn. Although sales of snow and ice control units increased in 2008 as compared to 2007, management believes that absent the recent economic downturn, equipment sales in 2008 would have been considerably higher due to the high levels of snowfall during the year, as equipment unit sales in 2008 remained below the ten-year average, while snowfall levels in 2008 were considerably above the ten-year average. Management believes this deferral of new equipment purchases could result in an elevated multi-year replacement cycle as the economy recovers.

Long-term growth in the overall snow and ice control equipment market also results from geographic expansion of developed areas in the snowbelt regions of North America, as well as consumer demand for technological enhancements in snow and ice control equipment and related parts and accessories that improves efficiency and reliability. Continued construction in the snowbelt regions in North America increases the aggregate area requiring snow and ice removal, thereby growing the market for snow and ice control equipment. In addition, the development and sale of more reliable, more efficient and more sophisticated product has contributed to an approximate 2% to 4% average unit price increase in each of the past five years.

Our Competitive Strengths

We are the North American market leader in snow and ice control equipment for light trucks with what we believe to be an industry leading installed base of over 500,000 snowplows and sand and salt spreaders in service. We compete solely with other North American manufacturers who do not benefit from our extensive distributor network, manufacturing efficiencies and depth and breadth of products. As the market leader, we enjoy a set of competitive advantages versus smaller, more regionally-focused equipment providers which allows us to generate robust cash flows in all snowfall environments and to support continued investment in our products, distribution capabilities and brand regardless of annual volume fluctuations. We believe this advantage is rooted in the following competitive strengths and reinforces our industry leadership over time.

Exceptional Customer Loyalty and Brand Equity. Our brands enjoy exceptional customer loyalty and brand equity in the snow and ice control equipment industry with both end-users and distributors. We have developed this exceptional loyalty through over 50 years of superior innovation, productivity, reliability and support, consistently delivered season after season. We believe many of our end-users are second and third generation owners of our snow and ice control equipment. Our surveys find that past brand experience, rather than price, is the key factor impacting snowplow purchasing decisions. Because a professional snowplower can typically recoup the cost of a plow within a very short period of time, and in some cases, as a result of one major snowfall event, we believe quality, reliability and functionality are more important factors in our end-users' purchasing decisions than price. For example, our end-user survey found that less than 10% of commercial end-users cite price as a key factor in their purchase decision.

Broadest and Most Innovative Product Offering. We provide the industry's broadest product offering with a full range of snowplows, sand and salt spreaders and related parts and accessories. We believe we maintain the industry's largest and most advanced in-house new product development program, historically introducing several new and redesigned products each year. Our broad product offering and

4

commitment to new product development is essential to maintaining and growing our leading market share position as well as continuing to increase the profitability of our business. We believe we have introduced or redesigned more efficient and productive products over the last five years (including the redesigned Fisher and Western V Plows in 2006 and the Fisher and Western Power Plows in 2007) than any of our competitors, driving increased value for our customers. Our products are covered by over 40 issued or pending U.S. and Canadian patents related to snow and ice control equipment technologies and other important product features and designs.

Extensive North American Distributor Network. We benefit from having the most extensive North American direct distributor network in the industry, providing a significant competitive advantage over our peers. We have over 720 direct distributor relationships which provide us with the ability to reach end-users throughout North America to achieve geographic diversification of sales that helps insulate us from annual variations in regional snowfall levels. Our distributors function not only as sales and support agents (providing access to parts and service), but also as industry partners providing real-time end-user information, such as retail inventory levels, changing consumer preferences or desired functionality enhancements, which we use as the basis for our product development efforts. We believe a majority of our distributors choose to sell our products exclusively, even though few are contractually required to do so. Despite the importance of our distributor network as a whole, no one distributor represents more than 5% of our net sales.

Leader in Operational Efficiency. We believe we are a leader in operational efficiency, resulting from our application of lean manufacturing principles and a highly variable cost structure. By utilizing lean principles, we are able to adjust production levels easily to meet fluctuating demand, while controlling costs in slower periods. This operational efficiency is supplemented by our highly variable cost structure, driven in part by our access to a sizable temporary workforce (comprising approximately 10-15% of our total workforce), which we can quickly adjust, as needed. As a result of our operational efficiency, we have increased our gross profit per unit by approximately 3.0% per annum, compounded annually, from 2002 to 2008. The upcoming closure of our Johnson City, Tennessee manufacturing facility, which we believe will save us approximately $4 million annually without a loss of production capacity, demonstrates the success of our lean initiatives. These manufacturing efficiencies enable us to respond rapidly to urgent customer demand during times of sudden and unpredictable snowfalls, allowing us to provide exceptional service to our existing customer base and capture new customers from competitors who we believe cannot service their customers' needs with the same speed and reliability.

Strong Cash Flow Generation. We are able to generate significant cash flow as a result of relatively consistent high profitability (Adjusted EBITDA margins averaged 27.3% from 2004 to 2008), low capital spending requirements and predictable timing of our working capital requirements. We have historically been able to pass through increases in raw material prices, including steel surcharges when necessary, to maintain our profitability. Our cash flow results will also benefit substantially from approximately $18 million of annual tax-deductible intangible and goodwill expense over the next ten years, which has the impact of reducing our corporate taxes owed by approximately $6.7 million on an annual basis. Our significant cash flow has allowed us to reinvest in our business, reduce indebtedness and pay substantial dividends to our stockholders.

Experienced Management Team. We believe our business benefits from an exceptional management team that is responsible for establishing our leadership in the snow and ice control equipment industry for light trucks. Our senior management team, consisting of four officers, has an average of approximately 19 years of weather-related industry experience and an average of approximately 10 years with our company. James Janik, our President and Chief Executive Officer, has been with us for over 17 years and in his current role since 2000, and through his strategic vision, we have been able to expand our distributor network and grow our market leading position.

5

Our Business Strategy

Our business strategy is to capitalize on our competitive strengths to maximize cash flow to pay dividends, reduce indebtedness and reinvest in our business to create stockholder value. The building blocks of our strategy are:

Continuous Product Innovation. We believe new product innovation plays an essential role in maintaining and growing our market-leading position in the snow and ice control equipment industry. We will continue to focus on developing innovative solutions to increase productivity, ease of use, reliability, durability and serviceability of our products. Our product development teams are guided by extensive market research, as well as real time feedback from our distributors who provide valuable insight into changing customer preferences, desired functionality or product features. In addition, we have and will continue to incorporate lean manufacturing concepts into our product development process, which has allowed us to reduce the overall cost of development and, more importantly, reduced our time-to-market by nearly one-half. As a result of these efforts, approximately 50% of our 2009 sales came from products introduced or redesigned in the last five years.

Distributor Network Optimization. We will continually seek opportunities to optimize our portfolio of over 720 direct distributors by opportunistically adding high-quality, well-capitalized distributors in select geographic areas and by cross-selling our industry-leading brands within our distribution network to ensure we maximize our ability to generate revenue while protecting our industry leading reputation, customer loyalty and brands. Prospective distributors are rigorously screened before they are allowed to sell our snow and ice control products, allowing us to maintain relationships with only those distributors we believe to be the most reputable in the industry. Once selected, we strive to maintain close working relationships with our distributors and actively monitor their performance, quality of service and support and credit profiles. We also focus on further optimizing this network by providing in-depth training, valuable distributor support and attractive promotional and incentive opportunities. As a result of these efforts, we believe a majority of our distributors choose to sell our products exclusively. Over the last ten years, we have grown our network by over 300 distributors. We believe this sizable high quality network is unique in the industry, providing us with valuable insight into purchasing trends and customer preferences, and would be very difficult to replicate.

Aggressive Asset Management and Profit Focus. We will continue to aggressively manage our assets in order to maximize our cash flow generation despite seasonal and annual variability in snowfall levels. We believe our ability is unique in our industry and enables us to achieve attractive margins in all snowfall environments. Key elements of our asset management and profit focus strategies include:

Additionally, although modest, our capital expenditure requirements and operating expenses can be temporarily reduced in response to anticipated or actual lower sales in a particular year to maximize cash flow.

6

Flexible, Lean Enterprise Platform. We intend to utilize lean principles to maximize the flexibility and efficiency of our manufacturing operations while reducing the associated costs. Implementation of these principles has allowed us to substantially improve the productivity of our manufacturing processes through waste elimination and improved space utilization, creating a flexible environment capable of efficiently responding to large variations in end-user demand and delivering best-in-class customer service and responsiveness, thereby enabling us to increase distributor and end-user satisfaction. Moreover, in an environment where shorter lead times and near-perfect order fulfillment are important to our distributors, our lean processes have helped us to build a reputation for providing industry leading shipping performance. In 2009, we fulfilled 98.2% of our orders on or before the requested ship date, without error in content, packaging or delivery.

Our cost reduction efforts also include the rationalization of our supply base and implementation of a global sourcing strategy, resulting in approximately $2.1 million of cumulative annualized cost savings from 2006 to 2008. Since 2006, we have reduced our supply base by 36% from over 450 suppliers to approximately 288 today. In January 2009, we opened a sourcing office in China, which will become our central focus for specific component purchases and will provide a majority of our procurement cost savings in the future.

Our Growth Opportunities

Increase Our Industry Leading Market Share. We plan to leverage our industry leading position, distribution network and new product innovation capabilities to capture market share in the North American snow and ice control equipment market, focusing our primary efforts on increasing penetration in those North American markets where we believe our overall market share is less than 50%. We also plan to continue growing our presence in the snow and ice control equipment market outside of North America, particularly in Asia and Europe, which we believe could provide significant growth opportunities in the future.

Opportunistically Seek New Products and New Markets. We will consider external growth opportunities within the snow and ice control industry and other equipment or component markets. We plan to continue to evaluate acquisition opportunities within our industry that can help us expand our distribution reach, enhance our technology and as a consequence improve the breadth and depth of our product lines. In November 2005, we purchased Blizzard Corporation and its highly-patented, groundbreaking hinged plow technology and have also incorporated this technology into our Western and Fisher snowplows. We also consider diversification opportunities in adjacent markets that complement our business model and could offer us the ability to leverage our core competencies to create stockholder value.

An investment in our common stock involves a high degree of risk. You should carefully consider the risks summarized below, the risks described under "Risk Factors," and the other information contained in this prospectus, including our consolidated financial statements and the related notes, before deciding to purchase any shares of our common stock:

7

The Aurora Entities are affiliates of Aurora Capital Group and control the vote with respect to approximately 67.0% of our common stock, prior to giving effect to this offering. Ares is an affiliate of Ares Management LLC, which we refer to as Ares Management, and controls the vote with respect to approximately 33.0% of our common stock, prior to giving effect to this offering. After giving effect to this offering, the Aurora Entities and Ares will control the vote with respect to approximately % and % of our common stock, respectively.

Aurora Capital Group is a Los Angeles-based private equity firm managing over $2.0 billion that utilizes two distinct investment strategies. Aurora Equity focuses principally on control-investments in middle-market industrial, manufacturing and selected service oriented businesses, each with a leading position in sustainable niches, a strong cash flow profile, and actionable opportunities for both operational and strategic enhancement. Aurora Resurgence invests in debt and equity securities of middle-market companies and targets complex situations that are created by operational or financial challenges either within a company or a broader industry.

Ares Management is a global alternative asset manager and SEC-registered investment adviser with total committed capital under management of approximately $33 billion as of December 31, 2009. With complementary pools of capital in private equity, private debt and capital markets, Ares Management has the ability to invest across all levels of a company's capital structure—from senior debt to common equity—in a variety of industries in a growing number of international markets. The Ares Private Equity Group manages over $6 billion of committed capital and has a proven track record of partnering with high quality, middle-market companies and creating value with its flexible capital. The firm is headquartered in Los Angeles with approximately 250 employees and professionals located across the United States and Europe.

Contemplated Financing Transactions in Connection with this Offering

In connection with this offering, we may increase our existing term loan facility by $ million. We plan to use the proceeds from this offering together with to redeem the outstanding 73/4% Senior Notes due 2012, which we refer to in this prospectus as our senior notes, issued by our direct wholly-owned subsidiaries, Douglas Dynamics, L.L.C. or Douglas LLC, and Douglas Finance Company or Douglas Finance, for a total of $ million, which amount includes accrued and unpaid interest and the associated redemption premium. Prior to the consummation of this offering, we also intend to amend our existing senior credit facilities to permit the redemption of our senior notes.

8

We are a holding corporation that was formed in connection with the acquisition of our business from AK Steel Corporation by affiliates of Aurora Capital Group in March 2004, which we refer to in this prospectus as the Acquisition. Douglas Holdings owns all of the issued and outstanding limited liability company interests of Douglas LLC, our operating company, together with its subsidiaries.

We maintain our principal executive offices at 7777 North 73rd Street, Milwaukee, Wisconsin 53223, and our telephone number is (414) 354-2310. We maintain a website at www. .com. Information contained on our website is not a part of, and is not incorporated by reference into, this prospectus.

9

Issuer |

Douglas Dynamics, Inc. | |

Common stock offered by us |

shares |

|

Common stock offered by the selling stockholders |

shares |

|

Over-allotment option |

We and the selling stockholders have granted the underwriters a 30-day option to purchase up to additional shares of our common stock from us and an aggregate of additional outstanding shares of common stock from the selling stockholders at the initial public offering price less underwriting discounts and commissions. The option may be exercised only to cover any over-allotments. |

|

Common stock outstanding after this offering |

shares (or shares if the underwriters exercise their over-allotment option in full). |

|

Use of proceeds |

We intend to use the net proceeds from this offering together with to redeem our senior notes, including accrued and unpaid interest and the related redemption premium, for a total of $ million. We intend to use any net proceeds we receive from any shares sold by us pursuant to the underwriters' over-allotment option to . We will not receive any proceeds from the sale of shares by the selling stockholders. See "Use of Proceeds." |

|

Dividend policy |

Our Board of Directors will adopt a dividend policy, effective upon the consummation of this offering, that reflects an intention to distribute to our stockholders a regular quarterly cash dividend, commencing with the first full fiscal quarter following the consummation of this offering, at an initial quarterly rate of $ per share. The declaration and payment of these dividends will be at the discretion of our Board of Directors and will depend upon many factors, including our financial condition and earnings, legal requirements, taxes, the terms of our indebtedness and other factors our Board of Directors may deem to be relevant. See "Dividend Policy and Restrictions." |

|

Risk factors |

See "Risk Factors" beginning on page of this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

|

Proposed NYSE symbol |

|

10

Unless otherwise noted, all information in this prospectus assumes:

11

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL AND OPERATING DATA

The following summary consolidated financial information as of and for the years ended December 31, 2006, 2007 and 2008 are derived from our audited consolidated financial statements and for the nine months ended September 30, 2008 and 2009 from our unaudited condensed consolidated financial statements, in each case, which are included elsewhere in this prospectus. In the opinion of management, the unaudited condensed consolidated financial statements have been prepared on the same basis as the audited consolidated financial statements and include all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of our operating results and financial position for those periods and as of such dates. The results for any interim period are not necessarily indicative of the results that may be expected for a full year.

The results indicated below and elsewhere in this prospectus are not necessarily indicative of our future performance. You should read this information together with "Selected Consolidated Financial Data," "Capitalization," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and related notes included elsewhere in this prospectus.

| |

For the year ended December 31, | For the nine months ended September 30 |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2006 | 2007 | 2008 | 2008 | 2009 | |||||||||||

| |

(in thousands) |

|||||||||||||||

Consolidated Statement of Operations Data |

||||||||||||||||

Equipment sales |

$ | 131,474 | $ | 122,091 | $ | 151,450 | $ | 113,882 | $ | 106,700 | ||||||

Parts and accessories sales |

14,305 | 17,974 | 28,658 | 18,706 | 18,506 | |||||||||||

Net sales |

145,779 | 140,065 | 180,108 | 132,588 | 125,206 | |||||||||||

Cost of sales |

100,547 | 97,249 | 117,911 | 89,084 | 87,523 | |||||||||||

Gross profit |

45,232 | 42,816 | 62,197 | 43,504 | 37,683 | |||||||||||

Selling, general and administrative expense |

24,773 | 22,180 | 26,561 | 20,368 | 21,130 | |||||||||||

Income from operations |

20,459 | 20,636 | 35,636 | 23,136 | 16,553 | |||||||||||

Interest expense, net |

(20,095 | ) | (19,622 | ) | (17,299 | ) | (12,765 | ) | (11,756 | ) | ||||||

Loss on extinguishment of debt |

— | (2,733 | ) | — | — | — | ||||||||||

Other income (expense), net |

276 | (87 | ) | (73 | ) | (70 | ) | (105 | ) | |||||||

Income (loss) before taxes |

640 | (1,806 | ) | 18,264 | 10,301 | 4,692 | ||||||||||

Income tax expense (benefit) |

443 | (749 | ) | 6,793 | 3,926 | 1,964 | ||||||||||

Net income (loss) |

$ | 197 | $ | (1,057 | ) | $ | 11,471 | $ | 6,375 | $ | 2,728 | |||||

Cash Flow |

||||||||||||||||

Net cash provided by (used in) operating activities |

$ | 4,763 | $ | 20,040 | $ | 23,411 | $ | (33,377 | ) | $ | (39,883 | ) | ||||

Net cash used in investing activities |

(3,471 | ) | (1,045 | ) | (3,113 | ) | (1,932 | ) | (4,821 | ) | ||||||

Net cash provided by (used in) financing activities |

$ | (25,753 | ) | $ | 4,083 | $ | (2,265 | ) | $ | 2,261 | $ | 8,362 | ||||

Other Data |

||||||||||||||||

Adjusted EBITDA |

$ | 32,564 | $ | 32,745 | $ | 47,742 | $ | 32,385 | $ | 28,036 | ||||||

Capital expenditures(1) |

$ | 3,449 | $ | 1,049 | $ | 3,160 | $ | 1,979 | $ | 4,821 | ||||||

| |

As of December 31, | |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

As of September 30, 2009 |

||||||||||||

| |

2006 | 2007 | 2008 | ||||||||||

| |

(in thousands) |

||||||||||||

Selected Balance Sheet Data |

|||||||||||||

Cash and cash equivalents |

$ | 12,441 | $ | 35,519 | $ | 53,552 | $ | 17,210 | |||||

Total assets |

365,168 | 375,649 | 391,264 | 404,420 | |||||||||

Total debt |

227,608 | 234,363 | 233,513 | 242,875 | |||||||||

Total liabilities |

271,447 | 283,705 | 293,203 | 303,924 | |||||||||

Total redeemable stock and stockholders' equity |

93,721 | 91,944 | 98,061 | 100,496 | |||||||||

12

Discussion of Adjusted EBITDA

In addition to our results under United States generally accepted accounting principles, which we refer to as GAAP, we also use Adjusted EBITDA, a non-GAAP financial measure, which we consider to be an important and supplemental measure of our performance. Adjusted EBITDA represents net income before interest, taxes, depreciation and amortization, as further adjusted for certain non-recurring charges related to the closure of our Johnson City, Tennessee manufacturing facility, certain legal expenses and a one-time stock repurchase, as well as management fees paid by us to Aurora and an affiliate of Ares. We use, and we believe our investors, and in particular, our principal stockholders, benefit from the presentation of Adjusted EBITDA in evaluating our operating performance because it provides us and our investors with an additional tool to compare our operating performance on a consistent basis by removing the impact of certain items that management believes do not directly reflect our core operations. In addition, we believe that Adjusted EBITDA is useful to investors and other external users of our consolidated financial statements in evaluating our operating performance as compared to that of other companies, because it allows them to measure a company's operating performance without regard to items such as interest expense, taxes, depreciation and depletion, and amortization and accretion, which can vary substantially from company to company depending upon accounting methods and book value of assets and liabilities, capital structure and the method by which assets were acquired. Our management also uses Adjusted EBITDA for planning purposes, including the preparation of our annual operating budget and financial projections. Note, however that the calculation of Adjusted EBITDA as included in this prospectus is different than the calculation of Consolidated Adjusted EBITDA used for purposes of certain covenants in our senior credit facilities, including as a component of Restricted Payment EBITDA, which is used in the calculation governing our ability to pay dividends as described in the section entitled "Restrictions on Payment of Dividends—Senior Credit Facilities."

Adjusted EBITDA has limitations as an analytical tool. As a result, you should not consider it in isolation, or as a substitute for net income, operating income, cash flow from operating activities or any other measure of financial performance or liquidity presented in accordance with U.S. GAAP. Some of these limitations are:

The Securities and Exchange Commission, which we refer to in this prospectus as the SEC, has adopted rules to regulate the use in filings with the SEC and public disclosures and press releases of non-GAAP financial measures, such as Adjusted EBITDA, that are derived on the basis of methodologies other than in accordance with GAAP. These rules require, among other things:

13

The rules prohibit, among other things:

The following table presents a reconciliation of net income (loss), the most comparable GAAP financial measure, to Adjusted EBITDA, for each of the periods indicated:

| |

For the year ended December 31, | For the nine months ended September 30, |

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2006 | 2007 | 2008 | 2008 | 2009 | ||||||||||||

| |

(in thousands) |

||||||||||||||||

Net income (loss) |

$ | 197 | $ | (1,057 | ) | $ | 11,471 | $ | 6,375 | $ | 2,728 | ||||||

Interest expense—net |

20,095 | 19,622 | 17,299 | 12,765 | 11,756 | ||||||||||||

Loss on extinguishment of debt |

— | 2,733 | — | — | — | ||||||||||||

Income taxes |

443 | (749 | ) | 6,793 | 3,926 | 1,964 | |||||||||||

Depreciation expense |

4,284 | 4,632 | 4,650 | 3,715 | 3,877 | ||||||||||||

Amortization |

6,166 | 6,164 | 6,160 | 4,620 | 4,621 | ||||||||||||

EBITDA |

31,185 | 31,345 | 46,373 | 31,401 | 24,946 | ||||||||||||

Management fees |

1,379 | 1,400 | 1,369 | 984 | 1,066 | ||||||||||||

Stock repurchase(1) |

— | — | — | — | 738 | ||||||||||||

Other non-recurring charges(2) |

— | — | — | — | 1,286 | ||||||||||||

Adjusted EBITDA |

$ | 32,564 | $ | 32,745 | $ | 47,742 | $ | 32,385 | $ | 28,036 | |||||||

14

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and all of the other information contained in this prospectus before deciding whether to purchase our common stock. Our business, prospects, financial condition and operating results could be materially adversely affected by any of these risks, as well as other risks not currently known to us or that we currently consider immaterial. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment. In assessing the risks described below, you should also refer to the other information contained in this prospectus, including our consolidated financial statements and the related notes, before deciding to purchase any shares of our common stock.

Risks Related to Our Business and Industry

Our results of operations depend primarily on the level, timing and location of snowfall. As a result, a decline in snowfall levels in multiple regions for an extended time could cause our results of operations to decline and adversely affect our ability to pay dividends.

As a manufacturer of snow and ice control equipment for light trucks, and related parts and accessories, our sales depend primarily on the level, timing and location of snowfall in the regions in which we offer our products. A low level or lack of snowfall in any given year in any of the snowbelt regions in North America (primarily the Midwest, East and Northeast regions of the United States as well as all provinces of Canada) will likely cause sales of our products to decline in such year as well as the subsequent year, which in turn may adversely affect our results of operations and ability to pay dividends. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Seasonality and Year-to-Year Variability." A sustained period of reduced snowfall events in one or more of the geographic regions in which we offer our products could cause our results of operations to decline and adversely affect our ability to pay dividends.

The year-to-year variability of our business can cause our results of operations and financial condition to be materially different from year-to-year; whereas the seasonality of our business can cause our results of operations and financial condition to be materially different from quarter-to-quarter.

Because our business depends on the level, timing and location of snowfall, our results of operations vary from year-to-year. Additionally, because the annual snow season only runs from October 1 through March 31, our distributors typically purchase our products during the second and third quarters. As a result, we operate in a seasonal business. We not only experience seasonality in our sales, but also experience seasonality in our working capital needs. Consequently, our results of operations and financial condition can vary from year-to-year, as well from quarter-to-quarter, which could affect our ability to pay dividends. If we are unable to effectively manage the seasonality and year-to-year variability of our business, our results of operations, financial condition and ability to pay dividends may suffer.

If economic conditions in the United States continue to remain weak or deteriorate further, our results of operations, financial condition and ability to pay dividends may be adversely affected.

Historically, demand for snow and ice control equipment for light trucks has been influenced by general economic conditions in the United States, as well as local economic conditions in the snowbelt regions in North America. During the last few years, economic conditions throughout the United States have been extremely weak, and may not improve in the foreseeable future. Weakened economic conditions may cause our end-users to delay purchases of replacement snow and ice control equipment and instead repair their existing equipment, leading to a decrease in our sales of new equipment. Weakened economic conditions may also cause our end-users to delay their purchases of new light trucks. Because our end-users tend to purchase new snow and ice control equipment concurrent with their purchase of new light trucks, their delay in purchasing new light trucks can also result in the

15

deferral of their purchases of new snow and ice control equipment. The deferral of new equipment purchases during periods of weak economic conditions may negatively affect our results of operations, financial condition and ability to pay dividends.

Weakened economic conditions may also cause our end-users to consider price more carefully in selecting new snow and ice control equipment. Historically, considerations of quality and service have outweighed considerations of price, but in a weak economy, price may become a more important factor. Any refocus away from quality in favor of cheaper equipment could cause end-users to shift away from our products to less expensive products, which in turn would adversely affect our results of operations and our ability to pay dividends.

Our failure to maintain good relationships with our distributors, the loss or consolidation of our distributor base or the actions or inactions of our distributors could have an adverse effect on our results of operations and our ability to pay dividends.

We depend on a network of truck equipment distributors to sell, install and service our products. Nearly all of these sales and service relationships are at will, and less than 1% of our distributors have agreed not to offer products that compete with our products. As a result, almost all of our distributors could discontinue the sale and service of our products at any time, and those distributors that primarily sell our products may choose to sell competing products at any time. Further, difficult economic or other circumstances could cause any of our distributors to discontinue their businesses. Moreover, if our distributor base were to consolidate or if any of our distributors were to discontinue their business, competition for the business of fewer distributors would intensify. If we do not maintain good relationships with our distributors, or if we do not provide product offerings and pricing that meet the needs of our distributors, we could lose a substantial amount of our distributor base. A loss of a substantial portion of our distributor base could cause our sales to decline significantly, which would have an adverse effect on our results of operations and ability to pay dividends.

In addition, our distributors may not provide timely or adequate service to our end-users. If this occurs, our brand identity and reputation may be damaged, which would have an adverse effect on our results of operations and ability to pay dividends.

Lack of available financing options for our end-users or distributors may adversely affect our sales volumes.

Our end-user base is highly concentrated among professional snowplowers, who comprise over 50% of our end-users, many of whom are individual landscapers who remove snow during the winter and landscape during the rest of the year, rather than large, well-capitalized corporations. These end-users often depend upon credit to purchase our products. If credit is unavailable on favorable terms or at all, our end-users may not be able to purchase our products from our distributors, which would in turn reduce sales and adversely affect our results of operations and ability to pay dividends.

In addition, because our distributors, like our end-users, rely on credit to purchase our products, if our distributors are not able to obtain credit, or access credit on favorable terms, we may experience delays in payment or nonpayment for delivered products. Further, if our distributors are unable to obtain credit or access credit on favorable terms, they could experience financial difficulties or bankruptcy and cease purchases of our products altogether. Thus, if financing is unavailable on favorable terms or at all, our results of operations and ability to pay dividends would be adversely affected.

The price of steel, a commodity necessary to manufacture our products, is highly variable. If the price of steel increases, our gross margins could decline.

Steel is a significant raw material used to manufacture our products. During the first nine months of 2009, our steel purchases were approximately 18% of our revenue. The steel industry is highly

16

cyclical in nature, and steel prices have been volatile in recent years and may remain volatile in the future. Steel prices are influenced by numerous factors beyond our control, including general economic conditions domestically and internationally, the availability of raw materials, competition, labor costs, freight and transportation costs, production costs, import duties and other trade restrictions. After experiencing a downward trend in steel prices throughout most of 2009, steel prices may increase as a result of increased demand from the automobile and consumer durable sectors. If the price of steel increases, our variable costs may increase. We may not be able to mitigate these increased costs through the implementation of permanent price increases or temporary invoice surcharges, especially if economic conditions remain weak and our distributors and end-users become more price sensitive. If we are unable to successfully mitigate such cost increases in the future, our gross margins could decline.

We depend on outside suppliers who may be unable to meet our volume and quality requirements, and we may be unable to obtain alternative sources.

We purchase certain components essential to our snowplows and sand and salt spreaders from outside suppliers, including off-shore sources. Most of our key supply arrangements can be discontinued at any time. A supplier may encounter delays in the production and delivery of such products and components or may supply us with products and components that do not meet our quality, quantity or cost requirements. Additionally, a supplier may be forced to discontinue operations. Any discontinuation or interruption in the availability of quality products and components from one or more of our suppliers may result in increased production costs, delays in the delivery of our products and lost end-user sales, which could have an adverse effect on our business and financial condition.

In addition, we have begun to increase the number of our off-shore suppliers. Our increased reliance on off-shore sourcing may cause our business to be more susceptible to the impact of natural disasters, war and other factors that may disrupt the transportation systems or shipping lines used by our suppliers, a weakening of the dollar over an extended period of time and other uncontrollable factors such as changes in foreign regulation or economic conditions. In addition, reliance on off-shore suppliers may make it more difficult for us to respond to sudden changes in demand because of the longer lead time to obtain components from off-shore sources. We may be unable to mitigate this risk by stocking sufficient materials to satisfy any sudden or prolonged surges in demand for our products. If we cannot satisfy demand for our products in a timely manner, our sales could suffer as distributors can cancel purchase orders without penalty until shipment.

We do not sell our products under long-term purchase contracts, and sales of our products are significantly impacted by factors outside of our control; therefore, our ability to estimate demand is limited.

We do not enter into long-term purchase contracts with our distributors and the purchase orders we receive may be cancelled without penalty until shipment. Therefore, our ability to accurately predict future demand for our products is limited. Nonetheless, we attempt to estimate demand for our products for purposes of planning our annual production levels and our long-term product development and new product introductions. We base our estimates of demand on our own market assessment, snowfall figures, quarterly field inventory surveys and regular communications with our distributors. Because wide fluctuations in the level, timing and location of snowfall, economic conditions and other factors may occur, each of which is out of our control, our estimates of demand may not be accurate. Underestimating demand could result in procuring an insufficient amount of materials necessary for the production of our products, which may result in increased production costs, delays in product delivery, missed sale opportunities and a decrease in customer satisfaction. Overestimating demand could result in the procurement of excessive supplies, which could result in increased inventory and associated carrying costs.

17

If we are unable to enforce, maintain or continue to build our intellectual property portfolio, or if others invalidate our intellectual property rights, our competitive position may be harmed.

We rely on a combination of patents, trade secrets and trademarks to protect certain of the proprietary aspects of our business and technology. We hold approximately 20 U.S. registered trademarks (including the trademarks WESTERN®, FISHER® and BLIZZARD®), 5 Canadian registered trademarks, 28 U.S. issued and pending patents and patent applications and 15 Canadian patents. Although we work diligently to protect our intellectual property rights, monitoring the unauthorized use of our intellectual property is difficult, and the steps we have taken may not prevent unauthorized use by others. In addition, our intellectual property rights may not be valid or enforceable. Third parties may design around our patents or may independently develop technology similar to our trade secrets. The failure to adequately build, maintain and enforce our intellectual property portfolio could impair the strength of our technology and our brands, and harm our competitive position.

If we are unable to develop new products or improve upon our existing products on a timely basis, it could have an adverse effect on our business and financial condition.

We believe that our future success depends, in part, on our ability to develop on a timely basis new technologically advanced products or improve upon our existing products in innovative ways that meet or exceed our competitors' product offerings. Continuous product innovation ensures that our consumers have access to the latest products and features when they consider buying snow and ice control equipment. Maintaining our market position will require us to continue to invest in research and development and sales and marketing. Product development requires significant financial, technological and other resources. We may be unsuccessful in making the technological advances necessary to develop new products or improve our existing products to maintain our market position. Industry standards, end-user expectations or other products may emerge that could render one or more of our products less desirable or obsolete. If any of these events occur, it could cause decreases in sales, a failure to realize premium pricing and an adverse effect on our business and financial condition.

We face competition from other companies in our industry, and if we are unable to compete effectively with these companies, it could have an adverse effect on our sales and profitability.

We primarily compete with regional manufacturers of snow and ice control equipment for light trucks. While we are the most geographically diverse company in our industry, we may face increasing competition in the markets in which we operate. Moreover, some of our competitors may have or may develop greater financial resources, lower costs, superior service or technology or more favorable operating conditions than we maintain. As a result, competitive pressures we face may cause price reductions for our products, which would affect our profitability or result in decreased sales and operating income.

We are subject to complex laws and regulations, including environmental and safety regulations, that can adversely affect the cost, manner or feasibility of doing business.

Our operations are subject to certain federal, state and local laws and regulations relating to, among other things, the generation, storage, handling, emission, transportation, disposal and discharge of hazardous and non-hazardous substances and materials into the environment, the manufacturing of motor vehicle accessories and employee health and safety. We cannot be certain that existing and future laws and regulations and their interpretations will not harm our business or financial condition.

18

We may be required to make large and unanticipated capital expenditures to comply with environmental and other regulations, such as:

Under these laws and regulations, we could be liable for:

Our operations could be significantly delayed or curtailed and our costs of operations could significantly increase as a result of regulatory requirements, restrictions or claims. We are unable to predict the ultimate cost of compliance with these requirements or their effect on our operations.

Financial market conditions have had a negative impact on the return on plan assets for our pension plans, which may require additional funding and negatively impact our cash flows.

Our pension expense and required contributions to our pension plan are directly affected by the value of plan assets, the projected rate of return on plan assets, the actual rate of return on plan assets and the actuarial assumptions we use to measure the defined benefit pension plan obligations. Due to the significant financial market downturn during 2008, the funded status of our pension plans has declined. As of December 31, 2008, our pension plans were underfunded by approximately $10.4 million. In 2008, contributions to our defined benefit pension plans were approximately $1.2 million. If plan assets continue to perform below expectations, future pension expense and funding obligations will increase, which would have a negative impact on our cash flows. Moreover, under the Pension Protection Act of 2006, it is possible that continued losses of asset values may necessitate accelerated funding of our pension plans in the future to meet minimum federal government requirements.

The statements regarding our industry, market positions and market share in this prospectus are based on our management's estimates and assumptions. While we believe such statements are reasonable, such statements have not been independently verified.

Information contained in this prospectus concerning the snow and ice control equipment industry for light trucks, our general expectations concerning this industry and our market positions and other market share data regarding the industry are based on estimates our management prepared using end-user surveys, anecdotal data from our distributors and distributors that carry our competitors' products, our results of operations and management's past experience, and on assumptions made, based on our management's knowledge of this industry, all of which we believe to be reasonable. These estimates and assumptions are inherently subject to uncertainties, especially given the year-to-year variability of snowfall and the difficulty of obtaining precise information about our competitors, and may prove to be inaccurate. In addition, we have not independently verified the information from any third-party source and thus cannot guarantee its accuracy or completeness, although management also believes such information to be reasonable. Our actual operating results may vary significantly if our

19

estimates and outlook concerning the industry, snowfall patterns, our market positions or our market shares turn out to be incorrect.

We are subject to product liability claims, product quality issues, and other litigation from time to time that could adversely affect our operating results or financial condition.

The manufacture, sale and usage of our products expose us to a risk of product liability claims. If our products are defective or used incorrectly by our end-users, injury may result, giving rise to product liability claims against us. If a product liability claim or series of claims is brought against us for uninsured liabilities or in excess of our insurance coverage, and it is ultimately determined that we are liable, our business and financial condition could suffer. Any losses that we may suffer from any liability claims, and the effect that any product liability litigation may have upon the reputation and marketability of our products, may divert management's attention from other matters and may have a negative impact on our business and operating results. Additionally, we could experience a material design or manufacturing failure in our products, a quality system failure or other safety issues, or heightened regulatory scrutiny that could warrant a recall of some of our products. A recall of some of our products could also result in increased product liability claims. Any of these issues could also result in loss of market share, reduced sales, and higher warranty expense.

We are heavily dependent on our Chief Executive Officer and management team.

Our continued success depends on the retention, recruitment and continued contributions of key management, finance, sale and marketing personnel, some of whom would be difficult to replace. Our success is largely dependent upon our senior management team, led by our Chief Executive Officer and other key managers. The loss of any one or more of such persons could have an adverse effect on our business and financial condition.

Our indebtedness could adversely affect our operations, including our ability to perform our obligations and pay dividends.

As of , as adjusted to give effect to this offering and the application of the proceeds therefrom (including the redemption of our senior notes), we would have had approximately $ million of senior secured indebtedness and $ million of available borrowings under our revolving credit facility. We may also be able to incur substantial indebtedness in the future, including senior indebtedness, which may or may not be secured. For example, concurrent with this offering, we may increase our existing term loan facility by million. Further, if this offering is completed and all our senior notes are redeemed, our revolving credit facility and term loan facility will mature in May 2012 and May 2013, respectively. See "Description of Indebtedness—Senior Credit Facilities."

Our indebtedness could have important consequences to you, including the following:

20

If any of these consequences occur, our financial condition, results of operations and ability to pay dividends could be adversely affected. This, in turn, could negatively affect the market price of our common stock, and we may need to undertake alternative financing plans, such as refinancing or restructuring our debt, selling assets, reducing or delaying capital investments or seeking to raise additional capital. We cannot assure you that any refinancing would be possible, that any assets could be sold, or, if sold, of the timing of the sales and the amount of proceeds that may be realized from those sales, or that additional financing could be obtained on acceptable terms, if at all.

Our variable rate indebtedness subjects us to interest rate risk, which could cause our debt service obligations to increase significantly and could impose adverse consequences.

Certain of our borrowings, including our term loan and any revolving borrowings under our senior credit facilities, are at variable rates of interest and expose us to interest rate risk. In addition, the interest rate on any revolving borrowings is subject to an increase in the interest rate if the average daily availability under our revolving credit facility falls below a certain threshold. If interest rates increase, our debt service obligations on the variable rate indebtedness would increase even though the amount borrowed remained the same, and our net income and cash flows would correspondingly decrease.

Our senior credit facilities impose restrictions on us, which may also prevent us from capitalizing on business opportunities and taking certain corporate actions. One of these facilities also includes minimum availability requirements, which if unsatisfied, could result in liquidity events that may jeopardize our business.

Our senior credit facilities contain, and future debt instruments to which we may become subject may contain, covenants governing our activities, including, covenants that limit our ability to engage in activities that could otherwise benefit our company, including restrictions on our ability to:

Our revolving credit facility also includes limitations on capital expenditures and requires us to maintain at least $6.0 million of borrowing availability. Failure to maintain such availability shall constitute a "liquidity event" under our revolving credit facility, and as a result we will be required to

21

comply with a fixed charge coverage ratio test. In addition, if such a liquidity event (or an event of default) occurs and is continuing, subject to certain limited cure rights, all proceeds of our accounts receivable and other collateral will be applied to reduce obligations under our revolving credit facility, jeopardizing our ability to meet other obligations. Our ability to comply with the covenants contained in our senior credit facilities or in the agreements governing our future indebtedness, and our ability to avoid liquidity events, may be affected by events, or our future performance, which are subject to factors beyond our control, including prevailing economic, financial, industry and weather conditions, such as the level, timing and location of snowfall and general economic conditions in the snowbelt regions of North America. A failure to comply with these covenants could result in a default under our senior credit facilities, which could prevent us from paying dividends, borrowing additional amounts and using proceeds of our inventory and accounts receivable, and also permit the lenders to accelerate the payment of such debt. If any of our debt is accelerated or if a liquidity event (or event of default) occurs which results in collateral proceeds being applied to reduce such debt, we may not have sufficient funds available to repay such debt and our other obligations, in which case, our business could be halted and such lenders could proceed against any collateral securing that debt. Further, if the lenders accelerate the payment of the indebtedness under our senior credit facilities, our assets may not be sufficient to repay in full the indebtedness under our senior credit facilities and our other indebtedness, if any. We cannot assure you that these covenants will not adversely affect our ability to finance our future operations or capital needs to pursue available business opportunities or react to changes in our business and the industry in which we operate.

The closure of our Johnson City, Tennessee manufacturing facility may entail risks to our business.

As part of our lean manufacturing strategy to lower our fixed costs, in mid-2010 we plan to close our Johnson City, Tennessee manufacturing facility, reducing our manufacturing facilities from three to two. In connection with this closure, we plan to relocate our Johnson City operations and equipment into our remaining two facilities. We cannot assure you that we will realize contemplated cost savings from the closure of this facility. In addition, there may be risks associated with this closure for which we are unprepared, such as labor and employment litigation, difficulties implementing a smooth transition and the possibility that this closure leaves us with insufficient manufacturing capacity. It is therefore possible that our business could be negatively affected by the closure of this facility.

Risks Related to this Offering of Our Common Stock

An active, liquid and orderly trading market for our common stock may not develop or be maintained, which could limit your ability to sell shares of our common stock.

Prior to the consummation of this offering, there has not have been a public market for our common stock. Although we intend to apply to list our common stock on The New York Stock Exchange, which we refer to in this prospectus as the NYSE, an active public market for our shares may not develop or be sustained after this offering. The initial public offering price for our shares will be determined by negotiations between us and representatives of the underwriters, and may not be indicative of the market price at which shares of our common stock will trade after this offering. In particular, we cannot assure you that you will be able to resell your shares of our common stock at or above the initial public offering price.

22

The market price of our common stock may be volatile, which could cause the value of your investment to decline or could subject us to securities class action litigation.

Even if a trading market develops, the market price of shares of our common stock could be subject to wide fluctuations in response to the many risk factors listed in this section and others beyond our control, including:

Furthermore, the stock markets recently have experienced extreme price and volume fluctuations that have affected and continue to affect the market prices of equity securities of many companies. These fluctuations often have been unrelated or disproportionate to the operating performance of those companies. These broad market and industry fluctuations, as well as general economic, political and market conditions such as recessions or interest rate changes may cause the market price of shares of our common stock to decline. If the market price of a share our common stock after this offering does not exceed the initial public offering price, you may not realize any return on your investment in us and may lose some or all of your investment.

In addition, in the past, companies that have experienced volatility in the market price of their stock have been subject to securities class action litigation. We may be the target of this type of litigation in the future. Securities litigation against us could result in substantial costs and divert our management's attention from other business concerns, which could seriously harm our business.

If securities or industry analysts do not publish research or reports about our business, or if they change their recommendations regarding our stock adversely, our stock price and trading volume could decline.