Use these links to rapidly review the document

TABLE OF CONTENTS

As filed with the Securities and Exchange Commission on May 13, 2011

Registration No. 333-173860

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Amendment No. 1

to

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

DOUGLAS DYNAMICS, INC.

(Exact name of registrant as specified in its charter)

| DELAWARE | 3531 | 134275891 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

7777 North 73rd Street

Milwaukee, Wisconsin 53223

(414) 354-2310

(Address, including zip code, and telephone number, including

area code, of registrant's principal executive offices)

James L. Janik

President and Chief Executive Officer

7777 North 73rd Street

Milwaukee, Wisconsin 53223

(414) 354-2310

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Bruce D. Meyer Ari B. Lanin Gibson, Dunn & Crutcher LLP 333 South Grand Avenue Los Angeles, CA 90071 (213) 229-7000 |

Gregg A. Noel Skadden, Arps, Slate, Meagher & Flom LLP 300 South Grand Avenue Los Angeles, CA 90071 (213) 687-5000 |

Approximate

date of commencement of proposed sale to the public:

As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

|

||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Aggregate Offering Price(2) |

Amount of Registration Fee |

|||

|---|---|---|---|---|---|---|

Common Stock, $0.01 par value per share |

5,750,000 | $87,026,250 | $10,104(3) | |||

|

||||||

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission acting pursuant to such Section 8(a) may determine.

The information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and the selling stockholders are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 13, 2011

5,000,000 Shares

Douglas Dynamics, Inc.

Common Stock

The shares of common stock are being sold by the selling stockholders. We will not receive any proceeds from the sale of these shares.

Our common stock is listed on the New York Stock Exchange under the symbol "PLOW." On May 12, 2011, the last sale price of our common stock on the New York Stock Exchange was $16.17 per share.

The underwriters have a 30-day option to purchase on a pro rata basis an aggregate of 750,000 additional outstanding shares from the selling stockholders to cover over-allotments of shares.

Investing in our common stock involves risks. See "Risk Factors" beginning on page 17.

| |

Price to Public |

Underwriting Discounts and Commissions |

Proceeds to Selling Stockholders |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Per Share | $ | $ | $ | |||||||

| Total | $ | $ | $ | |||||||

Delivery of the shares of our common stock will be made on or about , 2011.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Joint Book-Running Managers

Credit Suisse |

Oppenheimer & Co. |

Baird |

||

Co-Manager |

||||

Piper Jaffray |

||||

The date of this prospectus is , 2011.

You should rely only on the information contained in this prospectus or in any free-writing prospectus we may authorize. We have not, the selling stockholders have not, and the underwriters have not, authorized anyone to provide you with additional or different information. The information in this prospectus or any free-writing prospectus may only be accurate as of its date, regardless of its time of delivery or of any sale of shares of common stock. This prospectus does not constitute an offer to sell, or a solicitation of an offer to buy, any securities offered hereby in any jurisdiction where, or to any person to whom, it is unlawful to make such offer or solicitation.

This summary highlights certain significant aspects of our business and this offering, but it is not complete and does not contain all of the information that you should consider before making your investment decision. You should carefully read the entire prospectus and the information incorporated by reference into this prospectus, including the information presented under the section entitled "Risk Factors" and the financial data and related notes, before making an investment decision. This summary contains forward-looking statements that involve risks and uncertainties. Our actual results may differ significantly from future results contemplated in the forward-looking statements as a result of factors such as those set forth in "Risk Factors" and "Cautionary Statement Regarding Forward-Looking Statements." Certain historical information in this prospectus has been adjusted to reflect the 23.75-for-one stock split of our common stock that occurred immediately prior to the consummation of our initial public offering.

In this prospectus, unless the context indicates otherwise: "Douglas Dynamics," the "Company," "we," "our," "ours" or "us" refer to Douglas Dynamics, Inc. (formerly known as Douglas Dynamics Holdings, Inc.) and its subsidiaries and "Douglas Holdings" refers to Douglas Dynamics, Inc. exclusive of its subsidiaries. Douglas Dynamics, Inc. is a Delaware corporation and the issuer of the common stock offered hereby.

Our Company

We are the North American leader in the design, manufacture and sale of snow and ice control equipment for light trucks, which consists of snowplows and sand and salt spreaders, and related parts and accessories. We sell our products under the WESTERN®, FISHER® and BLIZZARD® brands which are among the most established and recognized in the industry. We believe that in 2010 our share of the light truck snow and ice control equipment market was greater than 50%. In 2010, we generated net sales, Adjusted EBITDA (as defined in "Summary Historical Consolidated Financial and Operating Data"), net income, and Adjusted Net Income (as defined in "Summary Historical Consolidated Financial and Operating Data") of $176.8 million, $47.3 million, $1.7 million and $12.7 million, respectively, as compared to net sales, Adjusted EBITDA, net income, and Adjusted Net Income of $174.3 million, $45.2 million, $9.8 million, and $9.8 million, respectively, for 2009. In the first three months of 2011, we generated net sales, Adjusted EBITDA, and net loss of $23.5 million, $4.1 million, and $0.8 million, respectively, as compared to net sales, Adjusted negative EBITDA, and net loss of $14.6 million, $1.2 million, and $5.7 million, respectively, for the first three months of 2010. See "Summary Historical Consolidated Financial and Operating Data" for a discussion of why management uses Adjusted EBITDA and Adjusted Net Income to measure our financial performance, and a reconciliation of net income to Adjusted EBITDA and Adjusted Net Income.

We offer the broadest and most complete product line of snowplows and sand and salt spreaders for light trucks in the U.S. and Canadian markets. We also provide a full range of related parts and accessories, which generates an ancillary revenue stream throughout the lifecycle of our snow and ice control equipment. For the year ended December 31, 2010, 86% of our net sales were generated from sales of snow and ice control equipment, and 14% of our net sales were generated from sales of parts and accessories.

We sell our products through a distributor network primarily to professional snowplowers who are contracted to remove snow and ice from commercial, municipal and residential areas. Over the last 50 years, we have engendered exceptional customer loyalty for our products because of our ability to satisfy the stringent demands of our customers for a high degree of quality, reliability and service. As a result, we believe our installed base is the largest in the industry with over 500,000 snowplows and sand and salt spreaders in service. Because sales of snowplows and sand and salt spreaders are primarily driven by the need of our core end-user base to replace worn existing equipment, we believe our

1

substantial installed base provides us with a high degree of predictable sales over any extended period of time.

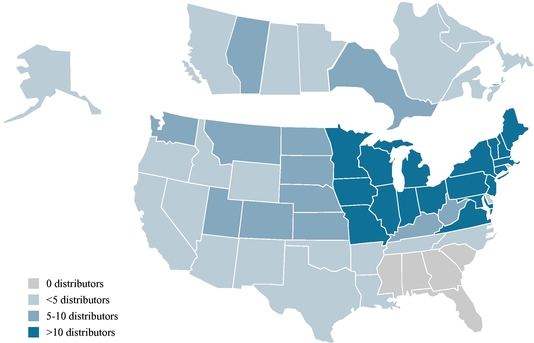

We believe we have the industry's most extensive North American distributor network, which primarily consists of over 710 truck equipment distributors who purchase directly from us and are located throughout the snowbelt regions in North America (primarily the Midwest, East and Northeast regions of the United States as well as all provinces of Canada). Beginning in 2005, we began to extend our reach to international markets, establishing distribution relationships in Northern Europe and Asia, where we believe meaningful growth opportunities exist.

We believe we are the industry's most operationally efficient manufacturer due to our vertical integration, highly variable cost structure and intense focus on lean manufacturing. We continually seek to use lean principles to reduce costs and increase the efficiency of our manufacturing operations. Our manufacturing efficiencies have contributed to the increase of our gross profit per unit by approximately 3.2% per annum, compounded annually, from 2000 to 2010. In addition, as a result of improvements in our manufacturing efficiency, we closed our Johnson City, Tennessee facility in August 2010 (which is still owned by the Company, but is held for sale), reducing our manufacturing facilities from three to two. We now manufacture our products in two facilities that we own in Milwaukee, Wisconsin and Rockland, Maine. Furthermore, our manufacturing efficiency allows us to deliver desired products quickly to our customers during times of sudden and unpredictable snowfall events when our customers need our products immediately.

Our Industry

The light truck snow and ice control equipment industry in North America consists predominantly of domestic participants that manufacture their products in North America. The annual demand for snow and ice control equipment is driven primarily by the replacement cycle of the existing installed base, which is predominantly a function of the average life of a snowplow or spreader and is driven by usage and maintenance practices of the end-user. We believe actively-used snowplows are typically replaced, on average, every seven to eight years.

The primary factor influencing the replacement cycle for snow and ice control equipment is the level, timing and location of snowfall. Sales of snow and ice control equipment in any given year and region are most heavily influenced by local snowfall levels in the prior snow season. Heavy snowfall during a given winter causes equipment usage to increase, resulting in greater wear and tear and shortened life cycles, thereby creating a need for replacement equipment and additional parts and accessories.

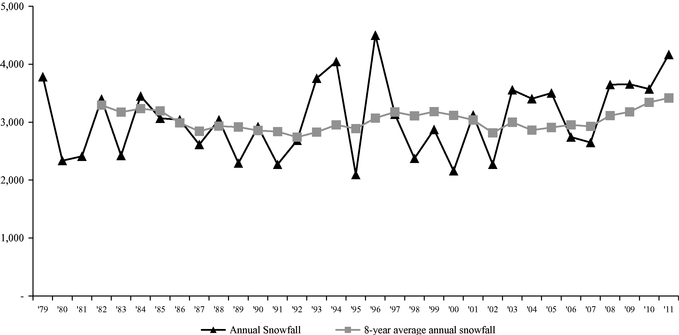

While snowfall levels vary within a given year and from year-to-year, snowfall, and the corresponding replacement cycle of snow and ice control equipment, is relatively consistent over multi-year periods. The following chart depicts an aggregate annual and eight-year (based on the typical life of our snowplows) rolling average of the aggregate snowfall levels in 66 cities in 26 snowbelt states across the Northeast, East, Midwest and Western United States where we monitor snowfall levels from 1980 to 2011. As the chart indicates, since 1982, aggregate snowfall levels in any given rolling eight-year period have been fairly consistent, ranging from 2,742 to 3,419 inches.

2

Snowfall in Snowbelt States (inches)

(for October 1 through March 31)

Source: National Oceanic and Atmospheric Administration's National Weather Service.

The demand for snow and ice control equipment can also be influenced by general economic conditions in the United States, as well as local economic conditions in the snowbelt regions in North America. In stronger economic conditions, our end-users may choose to replace or upgrade existing equipment before its useful life has ended, while in weak economic conditions, our end-users may seek to extend the useful life of equipment, thereby increasing the sales of parts and accessories. However, since snow and ice control management is a non-discretionary service necessary to ensure public safety and continued personal and commercial mobility in populated areas that receive snowfall, end-users cannot extend the useful life of snow and ice control equipment indefinitely and must replace equipment that has become too worn, unsafe or unreliable, regardless of economic conditions.

3

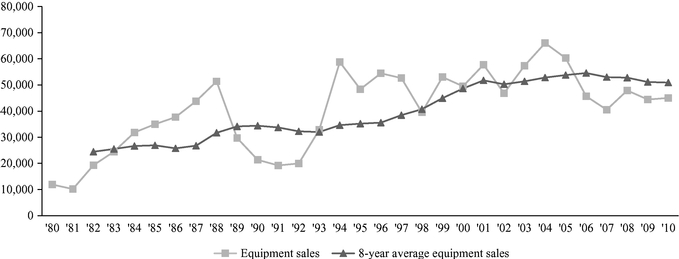

The next chart depicts annual unit sales of snow and ice control equipment since 1980 and an eight-year (based on the typical life of our snowplows) rolling average since 1982. As the chart reveals, sales of our snow and ice control equipment have been relatively consistent over any eight year period.

Although sales of snow and ice control units increased in 2010 as compared to 2009, management believes that absent the continued economic downturn, equipment sales in 2009 and 2010 would have been considerably higher due to the high levels of snowfall during these years, as equipment unit sales in 2009 and 2010 remained below the rolling ten-year average, while snowfall levels in 2009 and 2010 were considerably above the rolling ten-year average. Further to this point, sales of parts and accessories for 2009 and 2010, respectively, were approximately 58.3% and 34.4% higher than the applicable rolling ten-year average, which management believes is largely a result of the deferral of new equipment purchases due to the economic downturn. Management believes this deferral of new equipment purchases could result in an elevated multi-year replacement cycle as the economy recovers.

Long-term growth in the overall snow and ice control equipment market also results from geographic expansion of developed areas in the snowbelt regions of North America, as well as consumer demand for technological enhancements in snow and ice control equipment and related parts and accessories that improves efficiency and reliability. Continued construction in the snowbelt regions in North America increases the aggregate area requiring snow and ice removal, thereby growing the market for snow and ice control equipment. In addition, the development and sale of more reliable, more efficient and more sophisticated products have contributed to an approximate 2-4% average unit price increase in each of the past five years.

Our Competitive Strengths

We compete solely with other North American manufacturers who do not benefit from our extensive distributor network, manufacturing efficiencies and depth and breadth of products. We compete against these companies to provide the broadest, highest quality, most reliable product offering at competitive prices; however, because of our reputation for reliable and durable product performance, we can often demand a premium price in the marketplace. Further, as the market leader in snow and ice control equipment for light trucks, we enjoy a set of competitive advantages versus smaller equipment providers, which allows us to generate robust cash flows in all snowfall environments and to support continued investment in our products, distribution capabilities and brand regardless of

4

annual volume fluctuations. We believe these competitive advantages are rooted in the following competitive strengths and reinforces our industry leadership over time.

Exceptional Customer Loyalty and Brand Equity. Our brands enjoy exceptional customer loyalty and brand equity in the snow and ice control equipment industry with both end-users and distributors which have been developed through over 50 years of superior innovation, productivity, reliability and support, consistently delivered season after season. We believe past brand experience, rather than price, is the key factor impacting snowplow purchasing decisions.

Broadest and Most Innovative Product Offering. We provide the industry's broadest product offering with a full range of snowplows, sand and salt spreaders and related parts and accessories. Through our acquisition of Blizzard Corporation in November 2005, we acquired the highly-patented, groundbreaking BLIZZARD® technology that represents one of the most significant innovations in our industry. More specifically, we acquired industry-leading hinged plow technology, which has significant advantages over competing products because it utilizes expandable wings for more effective snow removal.

We also believe we maintain the industry's largest and most advanced in-house new product development program, and that our market leadership position permits us the flexibility to devote more resources to research and development than any of our competitors. We historically introduce several new and redesigned products each year, as research and development is a major focus of our management. New product development projects are typically the result of end-user feedback, plow productivity improvements, quality and reliability improvements and vehicle application expansion. Our broad product offering and commitment to new product development is essential to maintaining and growing our leading market share position as well as continuing to increase the profitability of our business.

Extensive North American Distributor Network. With over 710 direct distributors, we benefit from having the most extensive North American direct distributor network in the industry, providing a significant competitive advantage over our peers. Our distributors function not only as sales and support agents (providing access to parts and service), but also as industry partners providing real-time end-user information, such as retail inventory levels, changing consumer preferences or desired functionality enhancements, which we use as the basis for our product development efforts.

Leader in Operational Efficiency. We believe we are a leader in operational efficiency in our industry, resulting from our application of lean manufacturing principles and a highly variable cost structure. By utilizing lean principles, we are able to adjust production levels easily to meet fluctuating demand, while controlling costs in slower periods. This operational efficiency is supplemented by our highly variable cost structure, driven in part by our access to a sizable temporary workforce (comprising approximately 10-15% of our total workforce), which we can quickly adjust, as needed. These manufacturing efficiencies enable us to respond rapidly to urgent customer demand during times of sudden and unpredictable snowfalls, allowing us to provide exceptional service to our existing customer base and capture new customers from competitors that we believe cannot service their customers' needs with the same speed and reliability.

Strong Cash Flow Generation. We are able to generate significant cash flow as a result of relatively consistent high profitability (Adjusted EBITDA Margins averaged 26.4% for the three-year period from 2008 to 2010), low capital spending requirements and predictable timing of our working capital requirements. Our cash flow results will also benefit substantially from approximately $18 million of annual tax-deductible intangible and goodwill expense over the next nine years, which has the impact of reducing our corporate taxes owed by approximately $6.7 million on an annual basis during this period, in the event we have sufficient taxable income to utilize such benefit. Our significant cash flow has allowed us to reinvest in our business, pay down long term debt, and pay substantial dividends to our

5

stockholders. Effective upon the consummation of our initial public offering, our Board of Directors adopted a regular quarterly cash dividend of $0.1825 per share, which was first paid on September 30, 2010. In November 2010, we increased our quarterly dividend, effective as of the fourth quarter of 2010, by $0.0175 to $0.20 per share, an increase of 9.6%, and on March 31, 2011, we paid an additional special cash dividend of $0.37 per share. This dividend program has resulted in an aggregate of $20.7 million being paid to our stockholders in the form of cash dividends since our initial public offering.

Experienced Management Team. We believe our business benefits from an exceptional management team that is responsible for establishing our leadership in the snow and ice control equipment industry for light trucks. Our senior management team, consisting of four officers, has an average of approximately 20 years of weather-related industry experience and an average of over ten years with our company. James Janik, our President and Chief Executive Officer, has been with us for over 18 years and in his current role since 2000, and through his strategic vision, we have been able to expand our distributor network and grow our market leading position.

Our Business Strategy

Our business strategy is to capitalize on our competitive strengths to maximize cash flow to pay dividends, reduce indebtedness and reinvest in our business to create stockholder value. The building blocks of our strategy are:

Continuous Product Innovation. We believe new product innovation is critical to maintaining and growing our market-leading position in the snow and ice control equipment industry. We will continue to focus on developing innovative solutions to increase productivity, ease of use, reliability, durability and serviceability of our products and on incorporating lean manufacturing concepts into our product development process, which has allowed us to reduce the overall cost of development and, more importantly, to reduce our time-to-market by nearly one-half. As a result of these efforts, approximately $87 million, or 49.5%, of our 2010 net sales came from products introduced or redesigned in the last five years.

Distributor Network Optimization. Over the last ten years, we have grown our network by over 250 distributors. We will continually seek opportunities to continue to expand our extensive distribution network by adding high-quality, well-capitalized distributors in select geographic areas and by cross-selling our industry-leading brands within our distribution network to ensure we maximize our ability to generate revenue while protecting our industry leading reputation, customer loyalty and brands. We will also focus on optimizing this network by providing in-depth training, valuable distributor support and attractive promotional and incentive opportunities. As a result of these efforts, we believe a majority of our distributors choose to sell our products exclusively. We believe this sizable high quality network is unique in the industry, providing us with valuable insight into purchasing trends and customer preferences, and would be very difficult to replicate.

Aggressive Asset Management and Profit Focus. We will continue to aggressively manage our assets in order to maximize our cash flow generation despite seasonal and annual variability in snowfall levels. We believe our ability is unique in our industry and enables us to achieve attractive margins in all snowfall environments. Key elements of our asset management and profit focus strategies include:

6

These asset management and profit focus strategies, among other management tools, allow us to adjust fixed overhead and sales, general and administrative expenditures to account for the year-to-year variability of our sales volumes. Management currently estimates that annual fixed overhead expenses generally range from approximately $15.3 million in low sales volume years to approximately $18.3 million in high sales volume years. Further, management currently estimates that annual sales, general and administrative expenses other than amortization generally approximate $21.5 million, but can be reduced to approximately $20.5 million to maximize cash flow in low sales volume years, and can increase to approximately $25.5 million to maintain customer service and responsiveness in high sales volume years.

Additionally, although modest, our capital expenditure requirements, which are normally budgeted at $3.5 million, can be temporarily reduced by up to approximately 60% in response to actual or anticipated decreases in sales volumes in a particular year to maximize cash flow.

Flexible, Lean Enterprise Platform. We will continue to utilize lean principles to maximize the flexibility, efficiency and productivity of our manufacturing operations while reducing the associated costs, enabling us to increase distributor and end-user satisfaction. For example, in an environment where shorter lead times and near-perfect order fulfillment are important to our distributors, we believe our lean processes have helped us to improve our shipping performance and build a reputation for providing industry leading shipping performance. In 2010, we fulfilled 96.1% of our orders on or before the requested ship date, without error in content, packaging or delivery, continuing the strength of our performance in 2009 in which we filled 98.2% of our orders on or before the requested ship date without such errors, and representing a significant improvement from our 81.5% error-free performance in 2008.

Our cost reduction efforts also include the rationalization of our supply base and implementation of a global sourcing strategy, resulting in approximately $3.9 million of cumulative annualized cost savings from 2006 to 2010 with the goal of an additional $1 million in annualized cost savings in 2011. In January 2009, we opened a sourcing office in China, which we expect to become our central focus for specific component purchases and provide a majority of our procurement cost savings in the future.

Our Growth Opportunities

Increase Our Industry Leading Market Share. We plan to leverage our industry leading position, distribution network and new product innovation capabilities to capture market share in the North American snow and ice control equipment market, focusing our primary efforts on increasing penetration in those North American markets where we believe our overall market share is less than 50%. We also plan to continue growing our presence in the snow and ice control equipment market outside of North America, particularly in Asia and Europe, which we believe could provide significant growth opportunities in the future.

Opportunistically Seek New Products and New Markets. We will consider external growth opportunities within the snow and ice control industry and other equipment or component markets. We plan to continue to evaluate acquisition opportunities within our industry and in complementary industries that can help us expand our distribution reach, enhance our technology and improve the breadth and depth of our product lines. We also consider diversification opportunities in adjacent markets that complement our business model and could offer us the ability to leverage our core competencies to create stockholder value.

7

Summary Risk Factors

An investment in our common stock involves a high degree of risk. You should carefully consider the risks summarized below, the risks described under "Risk Factors" beginning on page 16 and the other information contained in, or incorporated by reference into, this prospectus, before deciding to purchase any shares of our common stock:

Principal Stockholders

Aurora Equity Partners II L.P., a Delaware limited partnership, and Aurora Overseas Equity Partners II, L.P., a Cayman Islands exempt limited partnership, which we refer collectively to in this prospectus as the Aurora Entities, collectively beneficially own approximately 29.8% of our common stock, prior to giving effect to this offering. The Aurora Entities are affiliates of Aurora Capital Group. Ares Corporate Opportunities Fund, L.P., a Delaware limited partnership, which we refer to in this prospectus as Ares, beneficially owns approximately 10.7% of our common stock, prior to giving effect to this offering. Ares is an affiliate of Ares Management LLC, which we refer to in this prospectus as Ares Management. After giving effect to this offering, the Aurora Entities and Ares will beneficially own approximately 13.2% and 4.5% of our common stock, respectively.

Aurora Capital Group is a Los Angeles-based private equity firm managing over $2 billion that utilizes two distinct investment strategies. Aurora's traditional private equity vehicles focus principally on control-investments in middle-market businesses in a diverse set of industries, each with a leading market position, a strong cash flow profile, and actionable opportunities for both operational and strategic enhancement. Aurora's Resurgence fund invests in debt and equity securities of middle-market companies and targets complex situations that are created by operational or financial challenges either within a company or a broader industry.

Ares Management is a global alternative asset manager and SEC-registered investment adviser with total committed capital under management of approximately $40 billion as of March 31, 2011. With complementary pools of capital in private equity, private debt and capital markets, Ares

8

Management has the ability to invest across all levels of a company's capital structure—from senior debt to common equity—in a variety of industries in a growing number of international markets. The Ares Private Equity Group manages over $6 billion of committed capital and has a track record of partnering with high quality, middle-market companies and creating value with its flexible capital. The firm is headquartered in Los Angeles with over 380 employees and professionals located across the United States, Europe and Asia.

Interests of Certain Affiliates in this Offering

Certain of our executive officers and other affiliates may stand to benefit as a result of this offering. Specifically, certain of our executive officers will sell shares of common stock in this offering, including through the exercise and sale of shares underlying stock options. In addition, our principal stockholders, the Aurora Entities and Ares, together with certain of our other stockholders, will also sell a portion of their shares of our common stock in this offering. For a description of the interests of these parties in this offering, see "Interests of Certain Affiliates in this Offering."

Company Information

We maintain our principal executive offices at 7777 North 73rd Street, Milwaukee, Wisconsin 53223, and our telephone number is (414) 354-2310. We maintain a website at www.DouglasDynamics.com. Information contained on our website is not a part of, and is not incorporated by reference into, this prospectus.

"WESTERN," "FISHER" and "BLIZZARD" and their respective logos are trademarks. Solely for convenience, from time to time we refer to our trademarks in this prospectus without the ® symbols, but such references are not intended to indicate that we will not assert, to the fullest extent under applicable law, our rights to our trademarks.

9

Issuer |

Douglas Dynamics, Inc. | |

Common stock offered by the selling stockholders |

5,000,000 shares |

|

Over-allotment option |

The selling stockholders have granted the underwriters a 30-day option to purchase up to 750,000 additional outstanding shares of common stock from the selling stockholders. |

|

Common stock outstanding after this offering |

21,996,251 shares |

|

Use of proceeds |

The selling stockholders will receive all of the proceeds from this offering and we will not receive any proceeds from the sale of shares in this offering. Any proceeds received by us in connection with the exercise of options to purchase shares of our common stock by the selling stockholders in connection with this offering will be used for general corporate purposes. See "Use of Proceeds." |

|

Dividend policy |

Our Board of Directors has adopted a dividend policy that reflects an intention to distribute to our stockholders a regular quarterly cash dividend of $0.20 per share. The declaration and payment of this quarterly dividend will be at the discretion of our Board of Directors and will depend upon many factors, including our financial condition and earnings, legal requirements, taxes, the terms of our indebtedness and other factors our Board of Directors may deem to be relevant. See "Dividend Policy and Restrictions." |

|

Risk factors |

See "Risk Factors" beginning on page 16 of this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

|

NYSE symbol |

PLOW |

The number of shares of our common stock outstanding after this offering is based on 21,848,947 shares outstanding as of May 12, 2011, plus an aggregate of 147,304 shares of common stock subject to outstanding options being exercised by certain selling stockholders for the purpose of selling shares in this offering.

Unless otherwise noted, all information in this prospectus assumes no exercise of the underwriters' over-allotment option to purchase up to 750,000 additional shares of our common stock from the selling stockholders. Certain historical information in this prospectus has been adjusted to reflect the 23.75-for-one stock split of our common stock that occurred immediately prior to the consummation of our initial public offering.

10

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL AND OPERATING DATA

The following tables set forth our summary historical consolidated financial data for and at the end of each of the years in the three-year period ended December 31, 2010 and for and at the end of the three months ended March 31, 2010 and 2011 and the twelve months ended March 31, 2011. The summary consolidated statement of operations data and consolidated cash flows data for the years ended December 31, 2008, 2009 and 2010 and the summary consolidated balance sheet data as of December 31, 2009 and 2010 have been derived from our audited consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2010, and incorporated herein by reference. The summary consolidated statement of operations data and consolidated cash flows data for the three months ended March 31, 2010 and 2011 and the summary consolidated balance sheet data at March 31, 2011 have been derived from our unaudited consolidated financial statements included in our Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2011, and incorporated herein by reference. The summary consolidated statement of operations data and consolidated cash flows data for the twelve months ended March 31, 2011 was derived by subtracting (1) our unaudited consolidated statement of operations and cash flows data, respectively, for the three months ended March 31, 2010 from (2) our audited consolidated statement of operations and cash flows data, respectively, for the twelve months ended December 31, 2010, and adding (3) our unaudited consolidated statement of operations and cash flows data, respectively, for the three months ended March 31, 2011. The summary consolidated balance sheet data as of December 31, 2008 and March 31, 2010 has been derived from our audited and unaudited consolidated financial statements, respectively, not incorporated herein by reference.

11

The following tables are qualified in their entirety by, and should be read in conjunction with, the information under "Management's Discussion and Analysis of Financial Condition and Results of Operations," "Selected Consolidated Financial Data," and our consolidated financial statements and related notes included in our Annual Report on Form 10-K for the year ended December 31, 2010 and our Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2011, which are incorporated herein by reference.

| |

For the year ended December 31, | For the three months ended March 31, |

For the twelve months ended March 31, |

||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2008 | 2009 | 2010 | 2010 | 2011 | 2011 | |||||||||||||

| |

(in thousands) |

||||||||||||||||||

Consolidated Statement of Operations Data |

|||||||||||||||||||

Equipment sales |

$ | 151,450 | $ | 147,478 | $ | 151,808 | $ | 8,687 | $ | 14,118 | $ | 157,239 | |||||||

Parts and accessories sales |

28,658 | 26,864 | 24,987 | 5,960 | 9,372 | 28,399 | |||||||||||||

Net sales |

180,108 | 174,342 | 176,795 | 14,647 | 23,490 | 185,638 | |||||||||||||

Cost of sales |

117,911 | 117,264 | 116,494 | 12,667 | 14,419 | 118,246 | |||||||||||||

Gross profit |

62,197 | 57,078 | 60,301 | 1,980 | 9,071 | 67,392 | |||||||||||||

Selling, general and administrative expense(1) |

26,561 | 27,639 | 38,893 | 7,695 | 7,227 | 38,425 | |||||||||||||

Income from operations |

35,636 | 29,439 | 21,408 | (5,715 | ) | 1,844 | 28,967 | ||||||||||||

Interest expense, net |

(17,299 | ) | (15,520 | ) | (10,943 | ) | (3,715 | ) | (2,204 | ) | (9,432 | ) | |||||||

Loss on extinguishment of debt |

— | — | (7,967 | ) | — | — | (7,967 | ) | |||||||||||

Other income (expense), net |

(73 | ) | (90 | ) | 36 | 6 | (115 | ) | (85 | ) | |||||||||

Income (loss) before taxes |

18,264 | 13,829 | 2,534 | (9,424 | ) | (475 | ) | 11,483 | |||||||||||

Income tax expense (benefit) |

6,793 | 3,986 | 872 | (3,705 | ) | 325 | 4,902 | ||||||||||||

Net income (loss) |

$ | 11,471 | $ | 9,843 | $ | 1,662 | $ | (5,719 | ) | $ | (800 | ) | $ | 6,581 | |||||

Cash Flow |

|||||||||||||||||||

Net cash provided by (used in) operating activities |

$ | 23,411 | $ | 25,571 | $ | 15,777 | $ | (4,243 | ) | $ | 11,765 | $ | 31,785 | ||||||

Net cash used in investing activities |

(3,113 | ) | (8,200 | ) | (2,783 | ) | (1,240 | ) | (220 | ) | (1,763 | ) | |||||||

Net cash provided by (used in) financing activities |

$ | (2,265 | ) | $ | (1,850 | ) | $ | (61,918 | ) | $ | 5,787 | $ | (12,160 | ) | $ | (79,865 | ) | ||

Other Data |

|||||||||||||||||||

Adjusted EBITDA |

$ | 47,742 | $ | 45,180 | $ | 47,345 | $ | (1,186 | ) | $ | 4,061 | $ | 52,592 | ||||||

Adjusted Net Income (Loss) |

11,471 | 9,843 | 12,665 | (5,719 | ) | (800 | ) | 17,584 | |||||||||||

Capital expenditures(2) |

$ | 3,160 | $ | 8,200 | $ | 3,009 | $ | 1,240 | $ | 267 | $ | 2,036 | |||||||

| |

As of December 31, | As of March 31, |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2008 | 2009 | 2010 | 2010 | 2011 | |||||||||||

| |

(in thousands) |

|||||||||||||||

Selected Balance Sheet Data |

||||||||||||||||

Cash and cash equivalents |

$ | 53,552 | $ | 69,073 | $ | 20,149 | $ | 69,377 | $ | 19,534 | ||||||

Total assets |

391,264 | 404,619 | 348,043 | 397,522 | 334,942 | |||||||||||

Total debt |

233,513 | 232,663 | 121,154 | 238,450 | 120,858 | |||||||||||

Total liabilities |

293,203 | 296,395 | 178,550 | 295,019 | 177,780 | |||||||||||

Total redeemable stock and stockholders' equity |

98,061 | 108,224 | 169,493 | 102,505 | 157,162 | |||||||||||

12

Discussion of Adjusted EBITDA, Adjusted EBITDA Margin and Adjusted Net Income

In addition to our results under United States generally accepted accounting principles, which we refer to in this prospectus as GAAP, we also use Adjusted EBITDA, Adjusted EBITDA Margin and Adjusted Net Income, non-GAAP financial measures, which we consider to be important and supplemental measures of our performance.

Adjusted EBITDA and Adjusted EBITDA Margin

Adjusted EBITDA represents net income before interest, taxes, depreciation and amortization, as further adjusted for certain non-recurring charges related to the closure of our Johnson City, Tennessee manufacturing facility, certain unrelated legal expenses, stock-based compensation and a one-time stock option repurchase, as well as management fees paid by us to Aurora Management Partners LLC, a Delaware limited liability company and an affiliate of the Aurora Entities, and ACOF Management, L.P., a Delaware limited partnership and an affiliate of Ares. Adjusted EBITDA Margin is defined as Adjusted EBITDA as a percentage of net sales. We use, and we believe our investors, and in particular, the Aurora Entities and Ares, which we collectively refer to as our principal stockholders in this prospectus, benefit from the presentation of Adjusted EBITDA and Adjusted EBITDA Margin in evaluating our operating performance because they provide us and our investors with additional tools to compare our operating performance on a consistent basis by removing the impact of certain items that management believes do not directly reflect our core operations. In addition, we believe that Adjusted EBITDA and Adjusted EBITDA Margin are useful to investors and other external users of our consolidated financial statements in evaluating our operating performance as compared to that of other companies, because they allow them to measure a company's operating performance without regard to items such as interest expense, taxes, depreciation and depletion, and amortization and accretion, which can vary substantially from company to company depending upon accounting methods and book value of assets and liabilities, capital structure and the method by which assets were acquired. Our management also uses Adjusted EBITDA and Adjusted EBITDA Margin for planning purposes, including the preparation of our annual operating budget and financial projections and believes Adjusted EBITDA Margin is useful in assessing the profitability of our core businesses.

Management also uses Adjusted EBITDA to evaluate our ability to make certain payments, including dividends, in compliance with our new senior credit facilities (comprised of our amended revolving credit facility and new term loan, entered into on April 18, 2011), which is determined based on a calculation of "Consolidated Adjusted EBITDA" that is substantially similar to Adjusted EBITDA. The definition of Consolidated Adjusted EBITDA under our new senior credit facilities differs from our definition of Adjusted EBITDA in this prospectus primarily because the definition in our new senior credit facilities excludes additional non-cash charges and non-recurring expenses, which we have not incurred during the periods presented. Specifically, Consolidated Adjusted EBITDA under our new senior credit facilities is comprised of net income of the Company and its subsidiaries before interest, taxes, depreciation and amortization as further adjusted to exclude the effect of:

13

and to include as a deduction in calculating Consolidated Adjusted EBITDA:

Adjusted EBITDA and Adjusted EBITDA Margin have limitations as analytical tools. As a result, you should not consider them in isolation, or as substitutes for net income, operating income, operating income margin, cash flow from operating activities or any other measure of financial performance or liquidity presented in accordance with GAAP. Some of these limitations are:

14

The Securities and Exchange Commission, which we refer to in this prospectus as the SEC, has adopted rules to regulate the use in filings with the SEC and public disclosures and press releases of non-GAAP financial measures, such as Adjusted EBITDA and Adjusted EBITDA Margin, that are derived on the basis of methodologies other than in accordance with GAAP. These rules require, among other things:

The rules prohibit, among other things:

The following table presents a reconciliation of net income, the most comparable GAAP financial measure, to Adjusted EBITDA as well as the resulting calculation of Adjusted EBITDA Margin, for each of the periods indicated:

| |

For the year ended December 31, | For the three months ended March 31, |

For the twelve months ended March 31, |

|||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2008 | 2009 | 2010 | 2010 | 2011 | 2011 | ||||||||||||||

| |

(in thousands) |

|||||||||||||||||||

Net income (loss) |

$ | 11,471 | $ | 9,843 | $ | 1,662 | $ | (5,719 | ) | $ | (800 | ) | $ | 6,581 | ||||||

Interest expense—net |

17,299 | 15,520 | 10,943 | 3,715 | 2,204 | 9,432 | ||||||||||||||

Income taxes |

6,793 | 3,986 | 872 | (3,705 | ) | 325 | 4,902 | |||||||||||||

Depreciation expense |

4,650 | 5,797 | 5,704 | 2,017 | 747 | 4,434 | ||||||||||||||

Amortization |

6,160 | 6,161 | 6,001 | 1,540 | 1,300 | 5,761 | ||||||||||||||

EBITDA |

46,373 | 41,307 | 25,182 | (2,152 | ) | 3,776 | 31,110 | |||||||||||||

Management fees |

1,369 | 1,393 | 6,383 | 347 | 16 | 6,052 | ||||||||||||||

Stock-based compensation |

— | 732 | 4,029 | — | 265 | 4,294 | ||||||||||||||

Loss on extinguishment of debt |

— | — | 7,967 | — | — | 7,967 | ||||||||||||||

Management Liquidity Bonus |

— | — | 1,003 | — | — | 1,003 | ||||||||||||||

Other non-recurring charges(1) |

— | 1,748 | 2,781 | 619 | 4 | 2,166 | ||||||||||||||

Adjusted EBITDA |

$ | 47,742 | $ | 45,180 | $ | 47,345 | $ | (1,186 | ) | $ | 4,061 | $ | 52,592 | |||||||

Adjusted EBITDA Margin(2) |

26.5% | 25.9% | 26.8% | (8.1)% | 17.3% | 28.3% | ||||||||||||||

15

2010, the three months ended March 31, 2010, and the twelve months ended March 31, 2011, respectively, $694, $2,013, $179, $4 and $1,838 of unrelated legal fees for the years ended December 31, 2009 and 2010, the three months ended March 31, 2010 and 2011, and the twelve months ended March 31, 2011, respectively, and $667 of gain on other post employment benefit plan curtailment related to the Johnson City plant closure for the year ended December 31, 2010 and the twelve months ended March 31, 2011.

Adjusted Net Income

Adjusted Net Income represents net income as determined under GAAP, excluding non-recurring expenses incurred at the time of our initial public offering, namely the buyout of our management services agreement, the loss on extinguishment of debt, stock-based compensation expense associated with the net exercise of stock options and the payment of cash bonuses under our liquidity bonus plan. We believe that the presentation of Adjusted Net Income for the year ended December 31, 2010 and the twelve months ended March 31, 2011 provides useful information to investors by facilitating comparisons to our historical performance by removing the effect of the non-recurring expenses incurred at the time of our initial public offering in May 2010.

The following table presents a reconciliation of net income, the most comparable GAAP financial measure, to Adjusted Net Income for the year ending December 31, 2010 and the twelve months ended March 31, 2011. There were no such adjustments during the years ended December 31, 2008 and 2009 or the three months ended March 31, 2010 and 2011.

| |

Year Ended | Twelve Months Ended |

||||||

|---|---|---|---|---|---|---|---|---|

| |

December 31, 2010 |

March 31, 2011 |

||||||

| |

(in thousands) |

|||||||

Net Income—(GAAP) |

$ | 1,662 | $ | 6,581 | ||||

Add back non-recurring expenses, net of tax at 38.0%, incurred at the time of the IPO: |

||||||||

—Buyout of the Management Services Agreement |

3,596 | 3,596 | ||||||

—Loss on extinguishment of debt |

4,940 | 4,940 | ||||||

—Liquidity bonus payment |

622 | 622 | ||||||

—Non-recurring stock-based compensation expense |

1,845 | 1,845 | ||||||

Adjusted Net Income—(non-GAAP) |

$ | 12,665 | $ | 17,584 | ||||

16

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and all of the other information contained in this prospectus or incorporated herein by reference, including "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and related notes included in our Annual Report on Form 10-K for the year ended December 31, 2010 and our Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2011, before deciding whether to purchase our common stock. Our business, prospects, financial condition and operating results could be materially adversely affected by any of these risks, as well as other risks not currently known to us or that we currently consider immaterial. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

Risks Related to Our Business and Industry

Our results of operations depend primarily on the level, timing and location of snowfall. As a result, a decline in snowfall levels in multiple regions for an extended time could cause our results of operations to decline and adversely affect our ability to pay dividends.

As a manufacturer of snow and ice control equipment for light trucks, and related parts and accessories, our sales depend primarily on the level, timing and location of snowfall in the regions in which we offer our products. A low level or lack of snowfall in any given year in any of the snowbelt regions in North America (primarily the Midwest, East and Northeast regions of the United States as well as all provinces of Canada) will likely cause sales of our products to decline in such year as well as the subsequent year, which in turn may adversely affect our results of operations and ability to pay dividends. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Seasonality and Year-to-Year Variability" in our Annual Report on Form 10-K for the year ended December 31, 2010. A sustained period of reduced snowfall events in one or more of the geographic regions in which we offer our products could cause our results of operations to decline and adversely affect our ability to pay dividends.

The year-to-year variability of our business can cause our results of operations and financial condition to be materially different from year-to-year; whereas the seasonality of our business can cause our results of operations and financial condition to be materially different from quarter-to-quarter.

Because our business depends on the level, timing and location of snowfall, our results of operations vary from year-to-year. Additionally, because the annual snow season typically only runs from October 1 through March 31, our distributors typically purchase our products during the second and third quarters. As a result, we operate in a seasonal business. We not only experience seasonality in our sales, but also experience seasonality in our working capital needs. For example, our average monthly working capital net of cash, accrued interest, income taxes payable, deferred tax assets and prepaid management fees was approximately $58.9 million from 2008 to 2010 with an average monthly peak in the third quarter of approximately $90 million. Excluding such adjustments, our average monthly working capital during this period was approximately $84.4 million. Consequently, our results of operations and financial condition can vary from year-to-year, as well as from quarter-to-quarter, which could affect our ability to pay dividends. If we are unable to effectively manage the seasonality and year-to-year variability of our business, our results of operations, financial condition and ability to pay dividends may suffer.

17

If economic conditions in the United States continue to remain weak or deteriorate further, our results of operations, financial condition and ability to pay dividends may be adversely affected.

Historically, demand for snow and ice control equipment for light trucks has been influenced by general economic conditions in the United States, as well as local economic conditions in the snowbelt regions in North America. During the last few years, economic conditions throughout the United States have been extremely weak. Weakened economic conditions may cause our end-users to delay purchases of replacement snow and ice control equipment and instead repair their existing equipment, leading to a decrease in our sales of new equipment. Weakened economic conditions may also cause our end-users to delay their purchases of new light trucks. Because our end-users tend to purchase new snow and ice control equipment concurrent with their purchase of new light trucks, their delay in purchasing new light trucks can also result in the deferral of their purchases of new snow and ice control equipment. The deferral of new equipment purchases during periods of weak economic conditions may negatively affect our results of operations, financial condition and ability to pay dividends.

Weakened economic conditions may also cause our end-users to consider price more carefully in selecting new snow and ice control equipment. Historically, considerations of quality and service have outweighed considerations of price, but in a weak economy, price may be a more important factor. Any refocus away from quality in favor of cheaper equipment could cause end-users to shift away from our products to less expensive competitor products, or to shift away from our more profitable products to our less profitable products, which in turn would adversely affect our results of operations and our ability to pay dividends.

Our failure to maintain good relationships with our distributors, the loss or consolidation of our distributor base or the actions or inactions of our distributors could have an adverse effect on our results of operations and our ability to pay dividends.

We depend on a network of truck equipment distributors to sell, install and service our products. Nearly all of these sales and service relationships are at will, and less than 1% of our distributors have agreed not to offer products that compete with our products. As a result, almost all of our distributors could discontinue the sale and service of our products at any time, and those distributors that primarily sell our products may choose to sell competing products at any time. Further, difficult economic or other circumstances could cause any of our distributors to discontinue their businesses. Moreover, if our distributor base were to consolidate or if any of our distributors were to discontinue their business, competition for the business of fewer distributors would intensify. If we do not maintain good relationships with our distributors, or if we do not provide product offerings and pricing that meet the needs of our distributors, we could lose a substantial amount of our distributor base. A loss of a substantial portion of our distributor base could cause our sales to decline significantly, which would have an adverse effect on our results of operations and ability to pay dividends.

In addition, our distributors may not provide timely or adequate service to our end-users. If this occurs, our brand identity and reputation may be damaged, which would have an adverse effect on our results of operations and ability to pay dividends.

Lack of available financing options for our end-users or distributors may adversely affect our sales volumes.

Our end-user base is highly concentrated among professional snowplowers, who comprise over 50% of our end-users, many of whom are individual landscapers who remove snow during the winter and landscape during the rest of the year, rather than large, well-capitalized corporations. These end-users often depend upon credit to purchase our products. If credit is unavailable on favorable terms or at all, our end-users may not be able to purchase our products from our distributors, which would in turn reduce sales and adversely affect our results of operations and ability to pay dividends.

18

In addition, because our distributors, like our end-users, rely on credit to purchase our products, if our distributors are not able to obtain credit, or access credit on favorable terms, we may experience delays in payment or nonpayment for delivered products. Further, if our distributors are unable to obtain credit or access credit on favorable terms, they could experience financial difficulties or bankruptcy and cease purchases of our products altogether. Thus, if financing is unavailable on favorable terms or at all, our results of operations and ability to pay dividends would be adversely affected.

The price of steel, a commodity necessary to manufacture our products, is highly variable. If the price of steel increases, our gross margins could decline.

Steel is a significant raw material used to manufacture our products. During 2008, 2009, and 2010, our steel purchases were approximately 15%, 18% and 13% of our revenue, respectively. The steel industry is highly cyclical in nature, and steel prices have been volatile in recent years and may remain volatile in the future. Steel prices are influenced by numerous factors beyond our control, including general economic conditions domestically and internationally, the availability of raw materials, competition, labor costs, freight and transportation costs, production costs, import duties and other trade restrictions. Steel prices are volatile and may increase as a result of increased demand from the automobile and consumer durable sectors. If the price of steel increases, our variable costs may increase. We may not be able to mitigate these increased costs through the implementation of permanent price increases or temporary invoice surcharges, especially if economic conditions remain weak and our distributors and end-users become more price sensitive. If we are unable to successfully mitigate such cost increases in the future, our gross margins could decline.

If petroleum prices increase, our results of operations could be adversely affected.

Petroleum prices have fluctuated significantly in recent years. Prices and availability of petroleum products are subject to political, economic and market factors that are outside our control. Political events in petroleum-producing regions as well as hurricanes and other weather-related events may cause the price of fuel to increase. If the price of fuel increases, the demand for our products may decline, which would adversely affect our financial condition and results of operations.

We depend on outside suppliers who may be unable to meet our volume and quality requirements, and we may be unable to obtain alternative sources.

We purchase certain components essential to our snowplows and sand and salt spreaders from outside suppliers, including off-shore sources. Most of our key supply arrangements can be discontinued at any time and are not covered by written contracts. A supplier may encounter delays in the production and delivery of such products and components or may supply us with products and components that do not meet our quality, quantity or cost requirements. Additionally, a supplier may be forced to discontinue operations. Any discontinuation or interruption in the availability of quality products and components from one or more of our suppliers may result in increased production costs, delays in the delivery of our products and lost end-user sales, which could have an adverse effect on our business and financial condition. During 2010, our top ten suppliers accounted for approximately 54% of our raw material and component purchasing.

In addition, we have begun to increase the number of our off-shore suppliers. Our increased reliance on off-shore sourcing may cause our business to be more susceptible to the impact of natural disasters, war and other factors that may disrupt the transportation systems or shipping lines used by our suppliers, a weakening of the dollar over an extended period of time and other uncontrollable factors such as changes in foreign regulation or economic conditions. In addition, reliance on off-shore suppliers may make it more difficult for us to respond to sudden changes in demand because of the longer lead time to obtain components from off-shore sources. We may be unable to mitigate this risk

19

by stocking sufficient materials to satisfy any sudden or prolonged surges in demand for our products. If we cannot satisfy demand for our products in a timely manner, our sales could suffer as distributors can cancel purchase orders without penalty until shipment.

We do not sell our products under long-term purchase contracts, and sales of our products are significantly impacted by factors outside of our control; therefore, our ability to estimate demand is limited.

We do not enter into long-term purchase contracts with our distributors and the purchase orders we receive may be cancelled without penalty until shipment. Therefore, our ability to accurately predict future demand for our products is limited. Nonetheless, we attempt to estimate demand for our products for purposes of planning our annual production levels and our long-term product development and new product introductions. We base our estimates of demand on our own market assessment, snowfall figures, quarterly field inventory surveys and regular communications with our distributors. Because wide fluctuations in the level, timing and location of snowfall, economic conditions and other factors may occur, each of which is out of our control, our estimates of demand may not be accurate. Underestimating demand could result in procuring an insufficient amount of materials necessary for the production of our products, which may result in increased production costs, delays in product delivery, missed sale opportunities and a decrease in customer satisfaction. Overestimating demand could result in the procurement of excessive supplies, which could result in increased inventory and associated carrying costs.

If we are unable to enforce, maintain or continue to build our intellectual property portfolio, or if others invalidate our intellectual property rights, our competitive position may be harmed.

We rely on a combination of patents, trade secrets and trademarks to protect certain of the proprietary aspects of our business and technology. We hold approximately 20 U.S. registered trademarks (including the trademarks WESTERN®, FISHER® and BLIZZARD®), 5 Canadian registered trademarks, 28 U.S. issued patents and 15 Canadian patents. Our patents relate to snowplow mounts, assemblies, hydraulics, electronics and lighting systems as well as sand and salt spreader assemblies and our patent applications relate to each of the foregoing except for hydraulics and sand and salt spreader assemblies. When granted, each patent has a 17 year duration. The duration of the patents we currently possess range between one year and 14 years of remaining life. Our patent applications date back as far as 2001 and as most recent as 2010. Although we work diligently to protect our intellectual property rights, monitoring the unauthorized use of our intellectual property is difficult, and the steps we have taken may not prevent unauthorized use by others. We believe that our trademarks are of great value and that the loss of any one or all of our trademark rights could lower sales and increase our costs. In addition, in the event a third party challenges the validity of our intellectual property rights, a court may determine that our intellectual property rights may not be valid or enforceable. An adverse determination with respect to our intellectual property rights may harm our business prospects and reputation. Third parties may design around our patents or may independently develop technology similar to our trade secrets. The failure to adequately build, maintain and enforce our intellectual property portfolio could impair the strength of our technology and our brands, and harm our competitive position. Although the Company has no reason to believe that its intellectual property rights are vulnerable, previously undiscovered intellectual property could be used to invalidate our rights.

If we are unable to develop new products or improve upon our existing products on a timely basis, it could have an adverse effect on our business and financial condition.

We believe that our future success depends, in part, on our ability to develop on a timely basis new technologically advanced products or improve upon our existing products in innovative ways that meet or exceed our competitors' product offerings. Continuous product innovation ensures that our

20

consumers have access to the latest products and features when they consider buying snow and ice control equipment. Maintaining our market position will require us to continue to invest in research and development and sales and marketing. Product development requires significant financial, technological and other resources. From 1992 to 2010, we invested approximately $64 million to support our manufacturing strategy and to maintain our competitive strength in the product manufacturing process. We may be unsuccessful in making the technological advances necessary to develop new products or improve our existing products to maintain our market position. Industry standards, end-user expectations or other products may emerge that could render one or more of our products less desirable or obsolete. If any of these events occur, it could cause decreases in sales, a failure to realize premium pricing and an adverse effect on our business and financial condition.

We face competition from other companies in our industry, and if we are unable to compete effectively with these companies, it could have an adverse effect on our sales and profitability. Price competition among our distributors could negatively affect our market share.

We primarily compete with regional manufacturers of snow and ice control equipment for light trucks. While we are the most geographically diverse company in our industry, we may face increasing competition in the markets in which we operate. In saturated markets, price competition may lead to a decrease in our market share or a compression of our margins, both of which would affect our profitability. Moreover, current or future competitors may grow their market share and develop superior service and may have or may develop greater financial resources, lower costs, superior technology or more favorable operating conditions than we maintain. As a result, competitive pressures we face may cause price reductions for our products, which would affect our profitability or result in decreased sales and operating income. Additionally, saturation of the markets in which we compete or channel conflicts among our brands and shifts in consumer preferences may increase these competitive pressures or may result in increased competition among our distributors and affect our sales and profitability. In addition, price competition among the distributors that sell our products could lead to significant margin erosion among our distributors, which could in turn result in compressed margins or loss of market share for us. Management believes that after Douglas, the next largest competitors in the market for snow and ice control equipment for light trucks are BOSS and Meyer, respectively, and accordingly represent our primary competitors for market share.

We are subject to complex laws and regulations, including environmental and safety regulations, that can adversely affect the cost, manner or feasibility of doing business.

Our operations are subject to certain federal, state and local laws and regulations relating to, among other things, the generation, storage, handling, emission, transportation, disposal and discharge of hazardous and non-hazardous substances and materials into the environment, the manufacturing of motor vehicle accessories and employee health and safety. We cannot be certain that existing and future laws and regulations and their interpretations will not harm our business or financial condition. We currently make and may be required to make large and unanticipated capital expenditures to comply with environmental and other regulations, such as:

While we monitor our compliance with applicable laws and regulations and attempt to budget for anticipated costs associated with compliance, we cannot predict the future cost of such compliance. While in 2010 the amount expended was insignificant, we could incur material expenses in the future in

21

the event of future legislation changes or unforeseen events, such as a workplace accident or environmental discharge, or if we otherwise discover we are in non-compliance with an applicable regulation. In addition, under these laws and regulations, we could be liable for:

Our operations could be significantly delayed or curtailed and our costs of operations could significantly increase as a result of regulatory requirements, restrictions or claims. We are unable to predict the ultimate cost of compliance with these requirements or their effect on our operations.

Financial market conditions have had a negative impact on the return on plan assets for our pension plans, which may require additional funding and negatively impact our cash flows.

Our pension expense and required contributions to our pension plans are directly affected by the value of plan assets, the projected rate of return on plan assets, the actual rate of return on plan assets and the actuarial assumptions we use to measure the defined benefit pension plan obligations. In 2010, contributions to our defined benefit pension plans were approximately $0.9 million. If plan assets continue to perform below expectations, future pension expense and funding obligations will increase, which would have a negative impact on our cash flows. Moreover, under the Pension Protection Act of 2006, it is possible that continued losses of asset values may necessitate accelerated funding of our pension plans in the future to meet minimum federal government requirements.

The statements regarding our industry, market positions and market share in this prospectus are based on our management's estimates and assumptions. While we believe such statements are reasonable, such statements have not been independently verified.

Information contained in this prospectus concerning the snow and ice control equipment industry for light trucks, our general expectations concerning this industry and our market positions and other market share data regarding the industry are based on estimates our management prepared using end-user surveys, anecdotal data from our distributors and distributors that carry our competitors' products, our results of operations and management's past experience, and on assumptions made, based on our management's knowledge of this industry, all of which we believe to be reasonable. These estimates and assumptions are inherently subject to uncertainties, especially given the year-to-year variability of snowfall and the difficulty of obtaining precise information about our competitors, and may prove to be inaccurate. In addition, we have not independently verified the information from any third-party source and thus cannot guarantee its accuracy or completeness, although management also believes such information to be reasonable. Our actual operating results may vary significantly if our estimates and outlook concerning the industry, snowfall patterns, our market positions or our market shares turn out to be incorrect.

We are subject to product liability claims, product quality issues, and other litigation from time to time that could adversely affect our operating results or financial condition.

The manufacture, sale and usage of our products expose us to the risk of product liability claims. If our products are defective or used incorrectly by our end-users, injury may result, giving rise to product liability claims against us. If a product liability claim or series of claims is brought against us for uninsured liabilities or in excess of our insurance coverage, and it is ultimately determined that we are liable, our business and financial condition could suffer. Any losses that we may suffer from any

22

liability claims, and the effect that any product liability litigation may have upon the reputation and marketability of our products, may divert management's attention from other matters and may have a negative impact on our business and operating results. Additionally, we could experience a material design or manufacturing failure in our products, a quality system failure or other safety issues, or heightened regulatory scrutiny that could warrant a recall of some of our products. A recall of some of our products could also result in increased product liability claims. Any of these issues could also result in loss of market share, reduced sales, and higher warranty expense.

We are heavily dependent on our Chief Executive Officer and management team.

Our continued success depends on the retention, recruitment and continued contributions of key management, finance, sales and marketing personnel, some of whom could be difficult to replace. Our success is largely dependent upon our senior management team, led by our Chief Executive Officer and other key managers. The loss of any one or more of such persons could have an adverse effect on our business and financial condition.

Our indebtedness could adversely affect our operations, including our ability to perform our obligations and pay dividends.

As of April 18, 2011, we had approximately $125 million of senior secured indebtedness and $70 million of borrowing availability under our amended revolving credit facility. We may also be able to incur substantial indebtedness in the future, including senior indebtedness, which may or may not be secured. For example, our amended revolving credit facility allows Douglas Holdings' wholly-owned subsidiaries, Douglas Dynamics, L.L.C. ("DDI LLC"), Douglas Dynamics Finance Company ("DDI Finance") and Fisher, LLC ("Fisher") to request the establishment of one or more additional revolving commitments in an aggregate amount not in excess of $40 million and our new term loan facility allows DDI LLC to request the establishment of one or more additional term loan commitments in an aggregate amount not in excess of $60 million, in each case, subject to specified terms and conditions. Our indebtedness could have important consequences to you, including the following:

If any of these consequences occur, our financial condition, results of operations and ability to pay dividends could be adversely affected. This, in turn, could negatively affect the market price of our common stock, and we may need to undertake alternative financing plans, such as refinancing or

23

restructuring our debt, selling assets, reducing or delaying capital investments or seeking to raise additional capital. We cannot assure you that any refinancing would be possible, that any assets could be sold, or, if sold, of the timing of the sales and the amount of proceeds that may be realized from those sales, or that additional financing could be obtained on acceptable terms, if at all.

Our variable rate indebtedness subjects us to interest rate risk, which could cause our debt service obligations to increase significantly and could impose adverse consequences.