UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11.

Douglas Dynamics, Inc.

11270 West Park Place

Milwaukee, WI 53224

NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS

To the Stockholders of Douglas Dynamics, Inc.:

On behalf of our Board of Directors, you are cordially invited to attend our 2024 annual meeting of stockholders, which will be held on Tuesday, April 23, 2024, at 10:00 a.m. (Central Time) at the Douglas Dynamics principal executive offices located at 11270 West Park Place, Milwaukee, WI 53224, for the following purposes:

|

1. |

Election of two persons to our Board of Directors to hold office until the 2027 meeting of stockholders; |

|

2. |

Advisory vote to approve the compensation of our named executive officers as disclosed in the accompanying proxy statement; |

|

3. |

Approval of the Company’s 2024 Stock Incentive Plan; |

|

4. |

Ratification of the appointment of Deloitte & Touche LLP to serve as our independent registered public accounting firm for 2024; and |

|

5. |

Transaction of such other business as may properly come before the meeting or any adjournment or postponement thereof. |

Our Board of Directors has fixed the close of business on March 1, 2024 as the record date for the determination of the stockholders entitled to notice of, and to vote at, our annual meeting. A proxy statement and proxy card are enclosed. Whether or not you expect to attend our annual meeting, it is important that you promptly complete, sign, date and mail the proxy card in the enclosed envelope so that you may vote your shares. If you hold your shares in a brokerage account, you should be aware that, if you do not instruct your broker how to vote your shares at least 10 days prior to the annual meeting, your broker will not be permitted to vote your shares for the election of directors or on the advisory vote on the compensation of our named executive officers.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on April 23, 2024. The Douglas Dynamics, Inc. proxy statement for the 2024 Annual Meeting of Stockholders and the 2023 Annual Report to Stockholders are available at

http://ir.douglasdynamics.com/financial- information.

We will provide audio access to the annual meeting again this year. Instructions for accessing the live audio presentation of the annual meeting are provided in this proxy statement. Please note that stockholders will not be able to vote or revoke a proxy through the live audio, nor participate actively. As always, we encourage you to vote your shares prior to the annual meeting.

|

By order of the Board of Directors,

Sarah C. Lauber Executive Vice President, Chief Financial Officer and Secretary |

Milwaukee, Wisconsin

March 22, 2024

TABLE OF CONTENTS

|

Notice of 2024 Annual Meeting of Stockholders |

1 |

|

Proxy Statement |

3 |

|

Attendance and Voting Matters |

3 |

|

Election of Directors (Proposal 1) |

5 |

|

Corporate Governance |

8 |

|

Stock Ownership of Certain Beneficial Owners and Management |

15 |

|

Executive Compensation |

17 |

|

Director Compensation |

45 |

|

Compensation Committee Report |

46 |

|

Advisory Vote on the Compensation of Our Named Executive Officers (Proposal 2) |

47 |

|

Approval of the Company’s 2024 Stock Incentive Plan (Proposal 3) |

48 |

|

Audit Committee Report |

56 |

|

Ratification of Appointment of Independent Registered Public Accounting Firm (Proposal 4) |

57 |

|

Stockholder Proposals |

58 |

|

Cost of Proxy Solicitation |

58 |

|

Delinquent Section 16(a) Reports |

58 |

|

Other Matters |

58 |

|

Annual Report |

59 |

|

Appendix A Douglas Dynamics, Inc. 2024 Stock Incentive Plan |

A-1 |

PROXY STATEMENT

FOR 2024 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON TUESDAY, APRIL 23, 2024

ATTENDANCE AND VOTING MATTERS

Douglas Dynamics, Inc. (“we”, “our”, “us” or “Company”), a Delaware corporation, is mailing this proxy statement and the accompanying form of proxy to stockholders in connection with a solicitation of proxies by our Board of Directors (our “Board”) for use at our 2024 annual meeting of stockholders to be held on Tuesday, April 23, 2024 at 10:00 a.m. (Central Time) at the Douglas Dynamics principal executive offices located at 11270 West Park Place, Milwaukee, WI 53224, and all adjournments or postponements thereof (“Annual Meeting”), for the purposes set forth in the attached Notice of 2024 Annual Meeting of Stockholders. Our common stock is listed on the New York Stock Exchange LLC (“NYSE”) under the symbol PLOW.

Voting at Our Annual Meeting

Execution of a proxy given in response to this solicitation will not affect a stockholder’s right to attend our Annual Meeting and to vote in person. Presence at our Annual Meeting of a stockholder who has signed a proxy does not in itself revoke that proxy. Any stockholder giving a proxy may revoke it at any time before or at the Annual Meeting by giving notice thereof to us in writing, by attending our Annual Meeting and voting in person or by delivering a proxy bearing a later date.

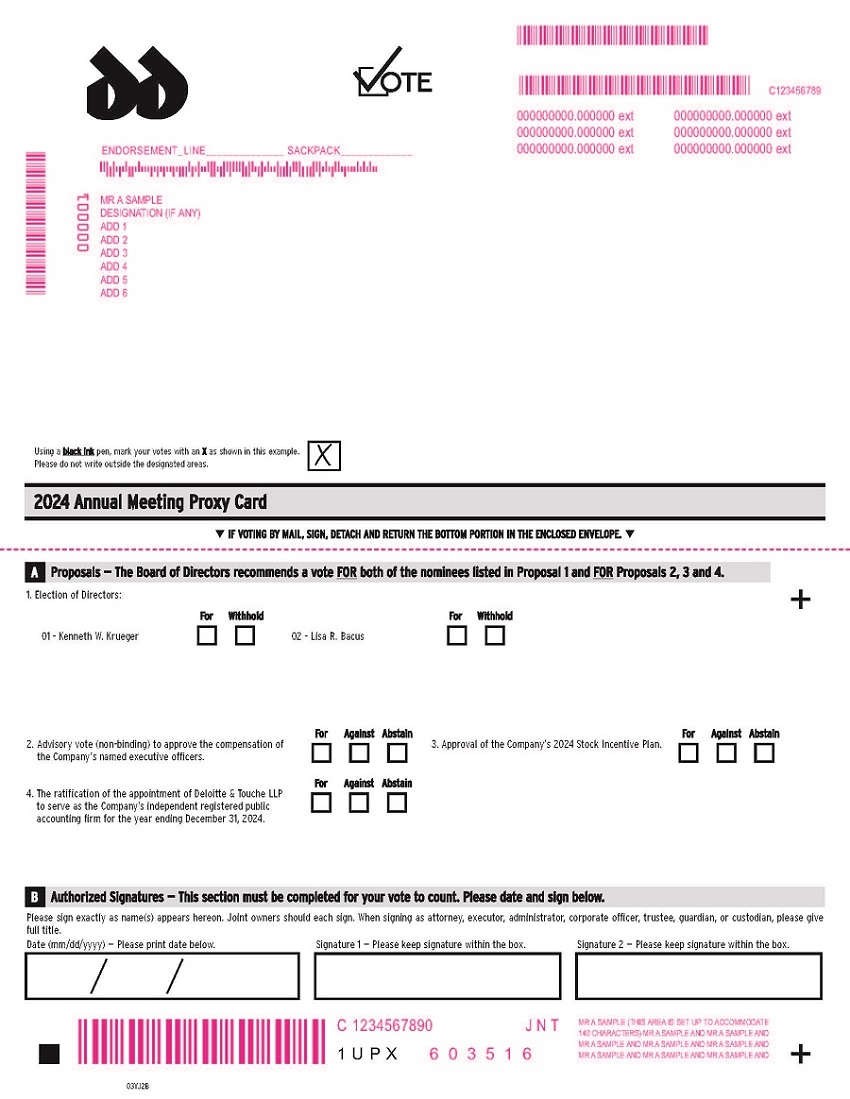

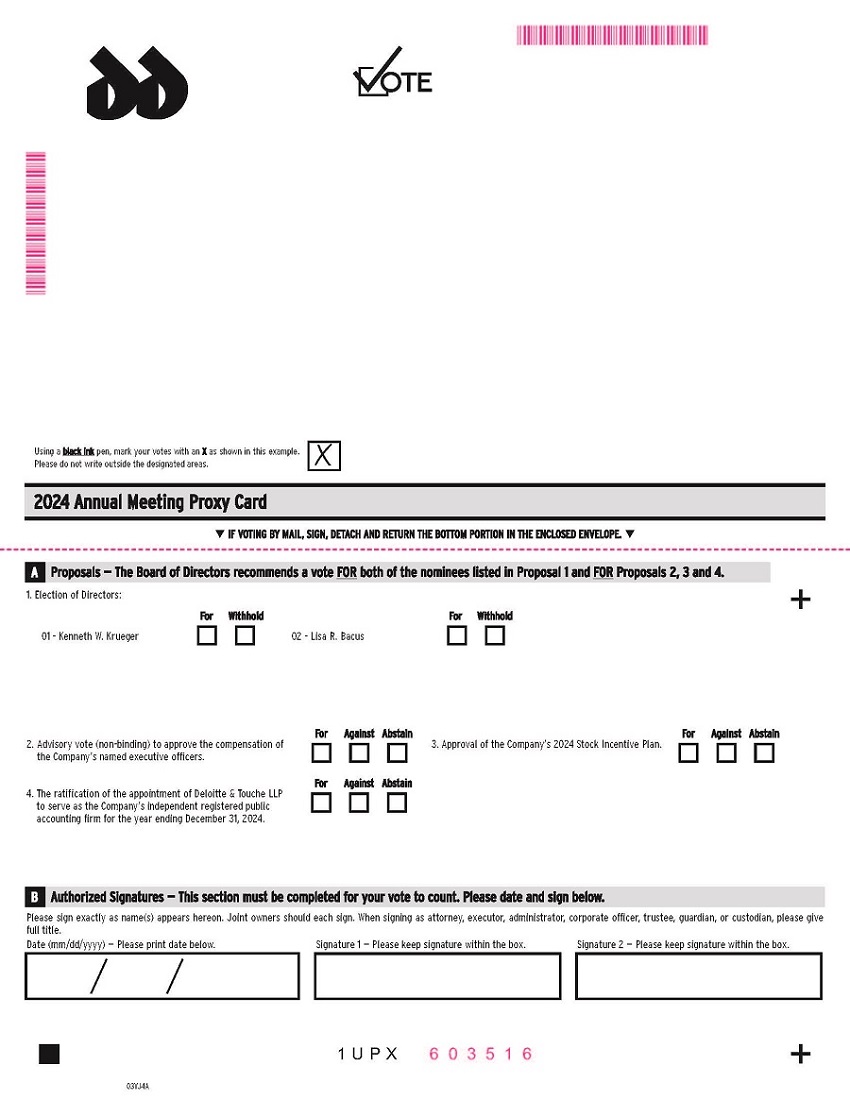

Voting by Proxy

You may arrange to vote your shares by proxy or by mail following the instructions in the form of proxy card. If you choose to vote by mail, please complete your proxy card and return it to us before our Annual Meeting. We will vote your shares as you direct on your properly executed proxy card. The shares represented by executed but unmarked proxies will be voted (i) FOR the election to our Board of the nominees for director named below, (ii) FOR approval of the compensation of our named executive officers as disclosed in this proxy statement, (iii) FOR approval of the Company’s 2024 Stock Incentive Plan, (iv) FOR ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2024, and (v) on such other business or matters as may properly come before our Annual Meeting in accordance with the best judgment of the persons named as proxies in the enclosed form of proxy. Other than the items noted above, our Board has no knowledge of any other matters to be presented for action by our stockholders at the Annual Meeting.

As discussed below, you will not be able to vote your shares or revoke a proxy through the live audio presentation of the Annual Meeting.

Who Can Vote and the Number of Votes You Have

Only holders of record of our common stock at the close of business on March 1, 2024 (the “Record Date”) are entitled to notice of, and to vote at, our Annual Meeting. On the Record Date, 22,983,965 shares of our common stock were outstanding and entitled to vote. Each such share is entitled to one vote on each matter submitted for stockholder approval at our Annual Meeting.

Participants in the Douglas Dynamics, L.L.C. 401(k) Plan (the “401(k) Plan”) who have allocated amounts to the common stock fund in that Plan are entitled to instruct the trustee of the 401(k) Plan how to vote shares allocated to their accounts. To the extent participants do not provide timely directions to the trustee on how to vote the shares allocated to their accounts, the trustee will vote the shares with respect to which proper direction has not been received in the same proportion as those shares for which proper direction has been received.

As discussed below, you will not be able to vote your shares or revoke a proxy through the live audio presentation of the Annual Meeting.

Live Audio Presentation Provided for the Annual Meeting

To listen to the live audio presentation of the Annual Meeting, please dial (833)-634-5024 (or, for international callers, ((412) 902-4205) by phone or visit https://ir.douglasdynamics.com/. Those planning to listen to the live audio presentation should connect at least 10 minutes prior to the planned start of the Annual Meeting. For further questions regarding how to access the Annual Meeting via live audio, please contact Investor Relations at investorrelations@douglasdynamics.com.

We will provide live audio access to the Annual Meeting again this year. You will NOT be able to vote your shares or revoke a proxy through the live audio access, nor ask questions or otherwise participate actively in the Annual Meeting. Therefore, to ensure that every vote is counted at the Annual Meeting, we strongly encourage you to vote by following the instructions on the proxy card mailed to you, or through your broker, bank or other nominee’s voting instruction form.

Required Vote

Proposal 1: Directors are elected by a plurality of the votes cast at our Annual Meeting. To be elected by a “plurality” of the votes cast means that the individuals who receive the largest number of votes are elected as directors. Therefore, any shares not voted, whether by an indication on the proxy card that you wish to “withhold authority,” by a broker non-vote (which may occur because brokers or other nominees who hold shares for you do not have the discretionary authority to vote your uninstructed shares in the election of directors) or otherwise, have no effect in the election of directors except to the extent that the failure to vote for an individual results in another individual receiving a larger number of votes.

Proposal 2: The affirmative vote of the holders of a majority of shares of our common stock represented and entitled to vote at our Annual Meeting is required to approve the advisory vote on compensation of our named executive officers. Abstentions will have the effect of votes against this proposal, but broker non-votes will have no effect on approval of this proposal. Because your vote is advisory, it will not be binding on the Board or the Company. However, the Compensation Committee will review the voting results and take them into consideration when making future decisions regarding executive compensation.

Proposal 3: The affirmative vote of the holders of a majority of shares of our common stock represented and entitled to vote at our Annual Meeting is required for approval of the Company’s 2024 Stock Incentive Plan. Abstentions will have the effect of votes against this proposal, but broker non-votes will have no effect on approval of this proposal.

Proposal 4: The affirmative vote of the holders of a majority of shares of our common stock represented and entitled to vote at our Annual Meeting is required for ratification of the appointment of Deloitte & Touche LLP to serve as our independent registered public accounting firm for 2024. Brokers may vote uninstructed shares for this proposal as it is considered to be a “routine” proposal. Abstentions will have the effect of votes against this proposal.

A quorum of stockholders is necessary to take action at our Annual Meeting. A majority of the outstanding shares of our common stock entitled to vote, represented in person or by proxy, will constitute a quorum of stockholders at our Annual Meeting. Votes cast by proxy or in person at our Annual Meeting will be tabulated by the inspector of election appointed for our Annual Meeting. Our Vice President of Finance, Controller & Treasurer will serve as the inspector of election for our Annual Meeting. For purposes of determining whether a quorum is present, abstentions and broker non-votes (which may occur because brokers or other nominees who hold shares for you do not have the discretionary authority to vote your uninstructed shares in the election of directors, with respect to the advisory vote on the compensation of our named executive officers or for approval of the Company’s 2024 Stock Incentive Plan) will count toward the quorum requirement.

ELECTION OF DIRECTORS

(Proposal 1)

Our Board currently consists of seven members. Our Board is divided into three classes for purposes of election. The director or directors in one class are generally elected at each annual meeting of stockholders to serve for a three-year term and until their successors are duly elected and qualified. Each director elected at our Annual Meeting will hold office for a three-year term expiring at our 2027 annual meeting of stockholders and until his or her successor is duly elected and qualified. Other than the two directors who are nominated for election at our Annual Meeting, our other current directors are not up for election this year and will continue in office for the remainder of their terms. As of the date of this proxy statement, each of the nominees for election has indicated that he or she is able and willing to serve as a director. However, if some unexpected occurrence should require our Board to substitute some other person or persons for one or more of the nominees, it is intended that the shares represented by proxies received and voted for such other candidate or candidates, or not voted, will be voted for another nominee or nominees selected by our Board.

Nominees for Election at the Annual Meeting

The following sets forth certain information, as of the Record Date, about the nominees for election at our Annual Meeting. Each of the nominees is currently a director of our Company.

Director Nominees for Terms Expiring in 2027

Kenneth W. Krueger, 67, has been serving as a director since 2011. He also has served as Chairman of The Manitowoc Company, Inc., a capital goods manufacturer, since March 2016. Previously, he served as interim Chairman, President and Chief Executive Officer of The Manitowoc Company, Inc. from October 2015 through March 2016 and as a director and Chairman of the Audit Committee for that company from 2004 until October 2015. He also has served as a director of Albany International Corp., a global advanced textiles and materials processing company, since December 2016. Mr. Krueger is the Chairman of the Audit Committee of Albany International Corp. From May 2006 until August 2009, Mr. Krueger was the Chief Operating Officer of Bucyrus International, Inc., a global mining equipment manufacturer headquartered in South Milwaukee, Wisconsin. Mr. Krueger also served as Bucyrus International, Inc.’s Executive Vice President from December 2005 until May 2006. Prior to joining Bucyrus International, Inc., Mr. Krueger was Senior Vice President and Chief Financial Officer of A. O. Smith Corporation, a global manufacturer of water heaters in Milwaukee, Wisconsin, from August 2000 until June 2005. Mr. Krueger’s qualifications to serve on our Board include his leadership experience at a publicly traded company and his background in the manufacturing industry as a member of the senior management team at a global manufacturer of mining equipment.

Lisa R. Bacus, 59, has been serving as a director since October 2020. Ms. Bacus served as the Executive Vice President and Global Chief Marketing Officer at Cigna Corporation, a global health care services company, from May 2013 until her retirement in July 2019. Prior to joining Cigna, Ms. Bacus was the Executive Vice President and Chief Marketing Officer at American Family Insurance Group, a property and casualty insurance company. Earlier in her career, Ms. Bacus spent 22 years with Ford Motor Company, where she held a number of executive leadership positions, including Executive Director of Global Market Research and Insights, Executive Director of Global Marketing Strategy, and head of marketing for Ford in Mexico. Ms. Bacus currently serves on the boards of directors of publicly-traded Teradata Corporation and Selective Insurance Group, Inc., as well as the board of privately-held Culver Franchising System, Inc. Ms. Bacus’ qualifications to serve on our Board include her leadership experience at complex global enterprises in multiple industries, her background in marketing, strategic planning and data analytics, as well as her vast multi-cultural and international business experience. In addition to her extensive professional experience, Ms. Bacus contributes to the Board’s diversity.

OUR BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” EACH OF THE FOREGOING NOMINEES FOR ELECTION AS A DIRECTOR.

Directors Remaining in Office Until 2025

Margaret S. Dano, 64, has been serving as a director since 2012. She also has served as a member of the board of directors and the governance and compensation committees of Neenah Paper Inc. (NYSE: NP) since April 2015 and in 2018 retired as the chairman of the board of directors of Superior Industries International, Inc. (NYSE: SUP), a designer and manufacturer of aluminum road wheels for sale to original equipment manufacturers, where she served as lead director since 2010 and as a member of the board of directors since 2007. Ms. Dano was Vice President, Worldwide Operations of Garrett Engine Boosting Systems, a division of Honeywell International, Inc., from June 2002 until her retirement from that position in 2005. From April 2002 to June 2002, she was Vice President, Global Operations, Automation and Controls Solutions of Honeywell. Before joining Honeywell, Ms. Dano served in executive or management roles with Avery Dennison Corporation, Black & Decker Corporation and General Electric Corporation. Ms. Dano has been a member of the board of directors of Industrial Container Services, a provider of reusable container solutions in the United States, since 2011, and currently serves as lead director and as a member of the compensation committee. She has served on the board of directors and the audit, compensation and governance committees of Fleetwood Enterprises, Inc., and on the board of directors and as lead director and chair of the compensation committee of Anthony International Equipment Services Corp. Ms. Dano’s qualifications to serve on our Board include her leadership experience at publicly traded manufacturing companies and her background in the manufacturing industry as a member of senior management teams with responsibility for global operations.

Donald W. Sturdivant, 63, has been serving as a director since 2010. Since December 2021, Mr. Sturdivant has served as an operating partner with TruArc LLC, a middle market private equity firm. From September 2016 until December 2021, Mr. Sturdivant served as an operating partner with Snow Phipps Group, LLC, predecessor to TruArc LLC. He has served as chairman of the board of directors at Teasdale Latin Foods since June 2019 and previously served as the chairman of the board of directors at Brook & Whittle Corporation from September 2017 to November 2021. He previously served as Chief Executive Officer of FleetPride, Inc., from June of 2015 through March of 2016 and served as a director at FleetPride from 2014 to 2016. Mr. Sturdivant was the Chief Executive Officer of Marietta Corporation from 2009 to 2015. He also served on the board of directors at Serta Simmons Bedding Company from 2010 to 2012. Earlier in his career, Mr. Sturdivant held various executive leadership roles including Chief Operating Officer at Altivity Packaging and Division President roles at Graphic Packaging International and Fort James Corporation. Mr. Sturdivant holds an MBA from the Florida Institute of Technology, and a B.S. from the University of Maine and served as a Chemical Corps Officer in the United States Army. Mr. Sturdivant’s qualifications to serve on our Board include his leadership experience at several publicly held corporations and his background in the manufacturing industry as a member of senior management at a number of manufacturing companies.

Robert L. McCormick, 63, has been serving as our President and Chief Executive Officer and as a director since January 2019. Previously, Mr. McCormick served as our Chief Operating Officer from August 2017 until January 2019. Prior to becoming Chief Operating Officer, Mr. McCormick served as our Executive Vice President and Chief Financial Officer from September 2004 through August 2017, as our Secretary from May 2005 through August 2017, as our Assistant Secretary from September 2004 to May 2005 and as our Treasurer from September 2004 through December 2010. Prior to joining us, Mr. McCormick served as President and Chief Executive Officer of Xymox Technology Inc. from 2001 to 2004. Prior to that, Mr. McCormick served in various capacities in the Newell Rubbermaid Corporation, including President from 2000 to 2001 and Vice President Group Controller from 1997 to 2000. Mr. McCormick has served on the board of directors of Mayville Engineering Company, Inc. (NYSE: MEC) since December 2022. We believe that Mr. McCormick’s experience in various leadership positions both inside and outside the Company, as well as his deep understanding of the Company’s business, operations and strategy, qualify him to serve on our Board.

Directors Remaining in Office Until 2026

Joher Akolawala, 57, has been serving as a director since 2022. Mr. Akolawala has served as Executive Vice President and Chief Financial Officer of Pella Corporation, a privately-held manufacturer of windows and doors, since March, 2020. Prior to joining Pella, Mr. Akolawala was the Senior Vice President, Chief Financial Officer - International of Walgreens Boots Alliance, Inc., a publicly traded pharmaceutical retailer, from November, 2019 to March, 2020. From June, 2014 to October, 2019, Mr. Akolawala served Mondelez International, Inc., a publicly traded multinational food and beverage company (a successor company to Kraft Foods Group), in roles of increasing responsibility, most recently as Senior Vice President, Global Finance. Prior to that, Mr. Akolawala spent nearly 23 years with Kraft Foods Group, where he held a number of senior leadership positions, including Chief Financial Officer, Kraft Grocery; Vice President, Business Systems; and Chief Financial Officer, Kraft Foodservice. Mr. Akolawala’s qualifications to serve on our Board include his leadership experience at complex global enterprises in multiple industries, his extensive background in finance, information technology, cybersecurity, M&A, and strategy, as well as his vast multi-cultural and international business experience. In addition to his extensive professional experience, Mr. Akolawala contributes to the Board’s diversity.

James L. Janik, 67, has been serving as our Chairman since 2014 and as a director since 2004. Mr. Janik served as our Executive Chairman from January 2019 until his retirement as an officer of our Company in April of 2020 Mr. Janik previously served as our President and Chief Executive Officer from 2004 until January 2019. Mr. Janik also served as President and Chief Executive Officer of Douglas Dynamics Incorporated, the entity that previously operated our business, from 2000 to 2004. Mr. Janik was Director of Sales of our Western Products division from 1992 to 1994, General Manager of our Western Products division from 1994 to 2000 and Vice President of Marketing and Sales from 1998 to 2000. Prior to joining us, Mr. Janik was the Vice President of Marketing and Sales of Sunlite Plastics Inc., a custom extruder of thermoplastic materials, for two years. During the 11 prior years, Mr. Janik held a number of key marketing, sales and production management positions for John Deere Company. Mr. Janik has served on the board of directors of Jason Industries L.L.C. since August 2020. Mr. Janik’s qualifications to serve on our Board include his 30 years of experience at our Company, including his 18 years of experience as our and Douglas Dynamics Incorporated’s President and Chief Executive Officer, as well as his depth of experience at businesses affected by weather-related seasonality. This experience, comprehensive knowledge of the snow and ice control equipment industry, and inside perspective of the day-to-day operations of the Company provides essential insight and guidance to our Board and qualifies him to serve as our Chairman.

CORPORATE GOVERNANCE

Board Leadership Structure

Our Board does not have a policy on whether the roles of Chief Executive Officer and Chairman should be separate. Our bylaws and Corporate Governance Guidelines provide us with the flexibility to combine or separate these roles, and our Board reserves the right to vest the responsibilities of the Chief Executive Officer and Chairman in different individuals or in the same individual depending on our Board’s judgment as to the best interests of our Company.

Previously, Mr. Janik had served in the combined role of Chairman and Chief Executive Officer. In January 2019, Mr. Janik transitioned from his role as our Chief Executive Officer to our Executive Chairman and Mr. McCormick was appointed as our new Chief Executive Officer and as a member of our Board. As a part of this transition, our Board determined that it was in the best interests of our Company for the roles of Chairman and Chief Executive Officer to be separated. In February 2020, Mr. Janik provided, and the Board accepted, Mr. Janik’s notice of retirement as Executive Chairman under the terms of his Employment Agreement, effective immediately following the 2020 annual meeting of stockholders. The Board determined, such that the Company could continue to benefit from his leadership, to elect Mr. Janik as the non-executive Chairman of our Board immediately following the 2020 annual meeting of stockholders. Our Board believes that Mr. Janik remains the person best qualified to serve as our Chairman in light of his having served as our Chairman and Chief Executive Officer, his extensive experience and qualifications with our Company and within our industry and in-depth knowledge of our markets and customer base. Our Board also believes that having Mr. Janik serve as our Chairman allows him to leverage his prior knowledge as our former Chief Executive Officer to provide strategic leadership on our Board.

In the circumstance where the responsibilities of the Chief Executive Officer and Chairman are vested in the same individual, or where the Chairman is not considered independent, the Board will designate a Lead Independent Director from among the independent directors to preside over the executive sessions of the non-employee directors. Our Board has determined that Mr. Janik is not an independent Chairman due to his prior service as an executive officer. Mr. Sturdivant has served as our Lead Independent Director since 2023. Mr. Sturdivant was selected for this position because of his knowledge of and history with our Company as a result of his service on our Board since 2010, including his past leadership role as chair of our Compensation Committee, as well as his extensive leadership and board experience.

Our Lead Independent Director’s responsibilities, as set forth in our Corporate Governance Guidelines, include:

|

• |

presiding at all meetings of the Board in the event of the absence of the Chairman of the Board; |

|

• |

presiding at all executive sessions of the independent directors; |

|

• |

serving as a liaison between the Chairman of the Board and the independent directors; |

|

• |

facilitating information flow and communication among the directors, including approving (i) agendas for meetings of the Board, (ii) scope of information being provided to the directors and (iii) meeting schedules, to ensure allotted time is sufficient for discussion; and |

|

• |

being available for consultation and direct communication with major stockholders if requested by such stockholders. |

Our Lead Independent Director also has the authority to call meetings of the independent directors.

Our Board believes that this leadership structure currently assists our Board in creating a unified vision for our Company, streamlines accountability for our performance and facilitates our Board’s efficient and effective functioning.

Risk Management and Oversight

Our full Board oversees our risk management process. Our Board oversees a Company-wide approach to risk management, carried out by management. Our full Board determines the appropriate risk for our Company generally, assesses the specific risks we face, including cybersecurity risks and risk related to climate change, and reviews the steps taken by management to manage those risks.

While the full Board maintains the ultimate oversight responsibility for the risk management process, its committees oversee risk in certain specified areas. In particular, our Compensation Committee is responsible for overseeing the management of risks relating to the Company’s executive compensation plans and arrangements and the incentives created by the compensation awards it administers. Our Audit Committee oversees management of enterprise risks as well as financial risks, cybersecurity and is also responsible for overseeing potential conflicts of interests. Cybersecurity is a critical part of risk management for the Company. The Audit Committee appreciates the rapidly evolving nature of threats presented by cybersecurity incidents and is committed to the prevention, timely detection and mitigation of the effects of any such incidents on the Company. With respect to cybersecurity, the Audit Committee receives regular reports from management, including updates on the internal and external cybersecurity threat landscape, incident response, assessment and training activities and relevant legislative, regulatory and technical developments. Our Nominating and Corporate Governance Committee is responsible for overseeing the management of risks associated with the independence of the Board. Pursuant to the Board’s instruction, management regularly reports on applicable risks to the relevant committee or the full Board, as appropriate, with additional review or reporting on risks conducted as needed or as requested by the Board and its committees.

Environmental, Social and Governance Matters

We believe that sound corporate citizenship and attention to environmental, social and governance (“ESG”) principles are essential to our success. We are committed to operating with integrity, contributing to the local communities surrounding our offices and facilities, promoting diversity, inclusion, equity and belonging, developing our employees, focusing on sustainability and being thoughtful environmental stewards. Our Board provides oversight of management’s efforts around these ESG topics and is committed to supporting the Company’s efforts to operate as a sound corporate citizen. We believe that an integrated approach to business strategy, corporate governance and corporate citizenship creates long-term value. Among the ways in which we have demonstrated our commitment to ESG matters are the following:

|

● |

Commitment to minimizing adverse impacts to the environment, including utilizing recycling programs and energy efficient lighting throughout our facilities. We utilize Environmental Health & Safety (“EHS”) Management Systems that cover aspects of Environmental, Health and Safety such as: Reporting/Record keeping, Health & Safety, Air Quality, Water Quality, Waste Management, Soil & Ground water, Emergency Plan and Preparedness, Community, Facility Permits, Training, and Certification Statements. |

|

● |

Promotion of environmental awareness and education throughout all levels of the Company, including evaluating our materials for conflict minerals and holding our suppliers to the highest ethical and quality standards. We are committed to providing world-class products and services that minimize harm to the environment and public health. We look to preserve the environment and will conduct business where feasible in an environmentally, sustainable way. |

|

● |

Creation of a strong corporate culture through our Winning Behaviors that promotes the highest standards of ethics and compliance for our business, including a Code of Business Conduct and Ethics that sets forth principles and provides guidance for all our employees, officers and directors to make the right decisions. Our Code of Conduct covers such topics as anti-corruption, discrimination, harassment, privacy, appropriate use of company assets, protecting confidential information and reporting Code of Conduct violations. |

|

● |

Prioritizing the health and safety of our workforce. We deliver world-class performance with a focus on preventing incidents and injuries. Health & Safety is fundamental to who we are and we are committed to protecting our people, our communities and our brands. We are committed to the safety of not only our products to our customers, but also in the way we conduct internal operations. |

|

● |

Commitment to the local communities where our facilities are located, including supporting various non-profits, charities and other community programs throughout the United States, which helps foster employee engagement across our locations. |

|

● |

Employee development and training opportunities to employees at all levels of the organization, focusing on critical organizational behaviors, leadership capabilities, and job skills. Our dedication to employee development and growth is essential to our organization’s success. We encourage employees to take active ownership of personal development while simultaneously supporting the development others. Our Douglas Dynamics University (DDU) is one of the services provided which supports our dedication to the performance, development, and growth of our talented people. We achieve this through virtual and in-person learning experiences, a focus on balanced development, performance development, and other learning experiences. |

|

● |

Our culture contains a continuous improvement mindset and leverages our Douglas Dynamics Management System (DDMS) to educate employees on lean initiatives and to provide them the necessary tools to identify opportunities for waste reduction and significant process improvements. |

|

● |

Anti-harassment policy that prohibits hostility or aversion towards individuals in protected categories, prohibits sexual harassment in any form, details how to report and respond to harassment issues and strictly prohibits retaliation against any employee for reporting harassment. |

|

● |

Commitment to fostering and promoting an inclusive and diverse work environment, including through equal employment opportunity hiring practices, policies and management of employees. |

|

● |

We are investing in multiple initiatives focused on identifying diverse talent. These include engaging with recruiting firms, utilizing job-posting sites and collaborating with university programs that specialize in connecting companies like Douglas Dynamics with a diverse array of candidates. Moving forward, we will continue to review and refine our initiatives as we seek to further diversify our workforce. |

|

● |

Maintenance of a whistleblower policy providing for confidential reporting of any suspected violations of policy. |

|

● |

The Nominating and Corporate Governance Committee assists the Board in its oversight of corporate social responsibilities, significant public policy issues and ESG matters. |

Board Meetings

In 2023, our Board held six meetings and the non-management directors of our Board met in executive session four times. Each of the directors currently serving on our Board attended at least 75% of the aggregate number of meetings of the Board held in 2023 and the total number of meetings held by each committee of the Board on which such director served during the period in which the director served on the Board or the applicable committee in 2023. We strongly encourage our directors to attend the annual meeting of stockholders each year. All but one of our directors attended, either virtually or in-person, the annual meeting of stockholders in 2023.

Corporate Governance and Independent Directors

Our Board has in effect Corporate Governance Guidelines that, in conjunction with the Board committee charters, establish processes and procedures to help ensure effective and responsive governance by the Board. The Corporate Governance Guidelines are available, free of charge, on our website, www.douglasdynamics.com. Our website address is provided as an inactive textual reference only. The information contained on our website is not incorporated into, and does not form a part of, this proxy statement or any other report or document on file with or furnished to the Securities and Exchange Commission (the “SEC”).

The Corporate Governance Guidelines provide that a majority of the members of the Board must be independent directors under the listing standards of the NYSE. An “independent” director is a director who meets the NYSE definition of independence, as determined by the Board. Pursuant to the Guidelines and the requirements of the NYSE, the Board has affirmatively determined by resolution that none of Messrs. Akolawala, Sturdivant or Krueger or Mses. Dano or Bacus has any material relationship with the Company, and, therefore, each is independent in accordance with the NYSE listing standards. The Board will regularly review the continuing independence of the directors.

The Corporate Governance Guidelines also provide that our directors may not serve on the boards of more than four companies, in addition to our Board, with the additional qualification that directors who are executive officers of public companies may not serve on the boards of more than two other companies, in addition to our Board.

Communications with the Board

Interested persons may contact any individual director, the Board as a group, or a specified Board committee or group, including the independent directors as a group, by sending a written communication to the Company’s Corporate Secretary at Douglas Dynamics, Inc., 11270 West Park Place, Milwaukee, Wisconsin 53224. Each communication should specify the applicable addressee or addressees as well as the general topic of communication. The Board has instructed the Corporate Secretary to review such correspondence and, in her discretion, not to forward items if she deems them to be of a commercial or frivolous nature or otherwise inappropriate. Concerns about questionable accounting or audit matters or possible violations of the Company’s Code of Business Conduct and Ethics should be reported pursuant to the procedures outlined in the Code of Business Conduct and Ethics. A copy of the Code of Business Conduct and Ethics is available on our website (www.douglasdynamics.com).

Board Committees

Our Board has three standing committees: an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. Each of these committees has the responsibilities set forth in formal written charters adopted by our Board. Copies of each of these charters are available on our website (www.douglasdynamics.com).

Audit Committee

The Audit Committee is currently comprised of Messrs. Akolawala, Sturdivant and Krueger and Mses. Dano and Bacus, and is chaired by Mr. Krueger. Our Board has determined that each of Messrs. Akolawala and Krueger is an “audit committee financial expert” as defined by the SEC. This committee is generally responsible for the appointment, compensation, retention and oversight of our independent registered public accounting firm; evaluation of our independent registered public accounting firm’s qualifications, independence and performance; review and approval of the scope of our annual audit and audit fee; review of our critical accounting policies and estimates; review of the results of our annual audit and our quarterly consolidated financial statements; oversight of our internal audit function; and oversight of our compliance program, including as related to cybersecurity, with respect to legal and regulatory requirements, policies and procedures for monitoring compliance. The Audit Committee met five times during 2023.

In accordance with Rule 10A-3 under the Securities Exchange Act of 1934 (the “Exchange Act”) and the listing standards of the NYSE, all of our Audit Committee members are independent within the meaning of Rule 10A‑3 under the Exchange Act and the listing standards of the NYSE.

Compensation Committee

The Compensation Committee is currently comprised of Messrs. Akolawala, Sturdivant and Krueger and Mses. Dano and Bacus, and is chaired by Ms. Bacus. This committee is generally responsible for oversight of our overall compensation structure, policies and programs; review and approval of the compensation programs applicable to our executive officers; administering, reviewing and making recommendations with respect to our equity compensation plans; and reviewing succession planning for our executive officers. The Compensation Committee met four times during 2023. In accordance with the listing standards of the NYSE, all of our Compensation Committee members are independent within the meaning the listing standards of the NYSE.

Our Compensation Committee’s role and duties are set forth in the Compensation Committee’s charter. Among other things, the Compensation Committee has responsibility to do the following:

|

• |

oversee our overall compensation structure, policies and programs; |

|

• |

assess whether our compensation structure establishes appropriate incentives for management and employees; |

|

• |

administer and make recommendations to our Board on equity- and incentive-based compensation plans that require approval from our Board; |

|

• |

review and approve corporate goals and objectives relevant to the compensation of our Chief Executive Officer, evaluate our Chief Executive Officer’s performance in light of those goals and objectives and set the Chief Executive Officer’s compensation level based on this evaluation; |

|

• |

oversee the evaluation of the other executive officers and set the compensation of other executive officers based upon the recommendation of the Chief Executive Officer; |

|

• |

approve stock option and other stock incentive awards for executive officers; |

|

• |

review and approve the design of other benefit plans pertaining to executive officers; |

|

• |

review and recommend employment agreements and severance and change of control arrangements for our executive officers; |

|

• |

approve, amend or modify the terms of any compensation or benefit plan that does not require stockholder approval; |

|

• |

review and discuss with management our Compensation Discussion and Analysis and related disclosures that SEC rules require be included in our annual report and proxy statement, recommend to our Board based on the review and discussions whether the Compensation Discussion and Analysis should be included in the annual report and proxy statement and prepare the compensation committee report required by SEC rules for inclusion in our annual report and proxy statement; |

|

• |

determine and recommend to our Board a desired frequency, if any, for the advisory stockholder vote on the compensation of our named executive officers (the “say on pay” vote) to be recommended to stockholders at the annual meeting at least once every six years in accordance with applicable law, SEC rules and NYSE listing requirements and prior stockholder votes on this subject; |

|

• |

oversee our response to the outcome of stockholder votes on say on pay and the frequency of say on pay; and |

|

• |

review and oversee risks associated with our compensation policies and practices. |

Under its charter, the Compensation Committee may delegate authority to a subcommittee consisting of no fewer than two members of the Compensation Committee. The Compensation Committee has not delegated its authority as it relates to the compensation of executive officers and does not currently intend to do so. Our executive officers do not currently play a direct role in determining the amount or form of executive officer or director compensation. Our Chief Executive Officer and Chief Financial Officer, however, attend meetings (other than executive sessions) of the Compensation Committee at the invitation of the Compensation Committee, make recommendations to the Compensation Committee concerning compensation of our executive officers (other than themselves) and assist the Compensation Committee in evaluating the performance of our executive officers (other than themselves).

The Compensation Committee has the authority under its charter to retain, obtain the advice of and terminate compensation consultants, outside counsel, other experts and other advisors to assist it. It may, however, select such advisors only after taking into consideration all factors relevant to the advisors’ independence from management, including those specified in the NYSE Listed Company Manual. The Compensation Committee is directly responsible for the appointment, compensation and oversight of the work of any advisor retained by the Compensation Committee, and we provide for appropriate funding, as determined by the Compensation Committee, for payment of reasonable compensation to advisors retained by the Compensation Committee.

The Compensation Committee has engaged an independent compensation consultant, Frederic W. Cook & Co, Inc. (“FW Cook”), to provide advice in connection with its decisions regarding executive compensation, as described in further detail under “Executive Compensation—Compensation Discussion and Analysis.” In 2023, the Committee engaged FW Cook to provide advice concerning the design of our executive compensation programs and the Committee’s administration of those programs and market practice. The Compensation Committee has assessed the independence of FW Cook pursuant to SEC rules and NYSE listing standards and concluded that FW Cook’s work for the Compensation Committee does not raise any conflict of interest. Except for this engagement, the Compensation Committee did not otherwise retain a compensation consultant for purposes of determining executive officer and director compensation for 2023, and FW Cook did not provide any other services to our Company.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is currently comprised of Messrs. Akolawala, Sturdivant and Krueger and Mses. Dano and Bacus, and is chaired by Ms. Dano. This committee is generally responsible for recruiting and retaining qualified persons to serve on our Board, including proposing such individuals to our Board for nomination for election as directors; evaluating the performance, size and composition of our Board; establishing procedures for the consideration of Board of Director candidates recommended by the Company’s stockholders; assessing the independence of each member of our Board; reviewing the compensation of directors for service on our Board and its committees and recommend to the full Board changes in compensation; assisting the Board in its oversight of corporate social responsibility, significant public policy issues and ESG matters; providing oversight, guidance and perspective to management regarding the Company’s initiatives, processes, policies, and public disclosures pertaining to ESG matters within the Company’s ESG strategy; reviewing the Company’s significant corporate social responsibility issues, if any, that impact the Company’s ESG strategy, including but not limited to employee health and safety considerations and the environmental impact of the Company’s operations; and overseeing our compliance activities. The Nominating and Corporate Governance Committee met four times during 2023.

The Nominating and Corporate Governance Committee identifies director candidates based upon suggestions by non-employee directors, management members or stockholders. The selection criteria for membership on our Board include, at a minimum, the following: (i) personal and professional ethics and integrity; (ii) specific business experience and competence, including an assessment of whether the candidate has experience in, and possesses an understanding of, business issues applicable to the success of a publicly traded company; (iii) financial acumen, including whether the candidate, through education or experience, has an understanding of financial matters and the preparation and analysis of financial statements; (iv) educational background; and (v) whether the candidate has expressed a willingness to devote sufficient time to carrying out his or her duties and responsibilities effectively and is committed to service on the Board. The Committee considers these criteria in the context of the perceived needs of the Board as whole and seeks to achieve a diversity of experience, opinion and occupational and personal backgrounds on the Board.

The Nominating and Corporate Governance Committee will consider director candidates recommended by our stockholders based upon the same criteria as applied to candidates identified by our Board or our management. Under our Bylaws, stockholder nominations of directors must be received by us at 11270 West Park Place, Milwaukee, WI 53224, directed to the attention of the Corporate Secretary, not less than 90 days nor more than 120 days prior to the anniversary date of the immediately preceding annual meeting of stockholders and any such nominations must contain the information specified in our Bylaws. The deadline for submission of nominations for the Annual Meeting has passed. Candidate submissions by stockholders for our 2025 annual meeting of stockholders must be received by us no later than January 23, 2025 and no earlier than December 24, 2024.

Policies and Procedures Governing Related Person Transactions

Our Board has adopted written policies and procedures regarding related person transactions. These policies and procedures require the review and approval of all transactions involving us or any of our subsidiaries and a related person in which (i) the aggregate amount involved will or may be expected to exceed $120,000 in any fiscal year and (ii) a related person has or will have a direct or indirect interest (other than solely as a result of being a director or less than 10% beneficial owner of another entity) prior to entering into such transaction.

For purposes of the policy, related persons include our directors, executive officers, 5% or greater stockholders and parties related to the foregoing, such as immediate family members and entities they control. In reviewing such transactions, the policy requires our Audit Committee to consider all of the relevant facts and circumstances available to the Audit Committee, including the extent of the related person’s interest in the transaction and whether the relationship should be continued or eliminated. In determining whether to approve a related party transaction, the standard applied by the Audit Committee is whether the transaction is on terms no less favorable than terms generally available to an unaffiliated third party under the same or similar circumstances and whether or not a particular relationship serves the best interest of our Company and our stockholders. In addition, the policy delegates to the chair of the Audit Committee the authority to pre-approve any transaction with a related person in which the aggregate amount involved is expected to be less than $1,000,000.

Compensation Committee Interlocks and Insider Participation

None of the members of our Compensation Committee is an officer or employee of our Company. None of our executive officers currently serves, or in the past year has served, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on our Board or our Compensation Committee.

Certain Relationships and Related Party Transactions

There were no transactions since December 31, 2022 to which we have been a party in which the amount involved in the transaction exceeded or will exceed $120,000, and in which any of our directors, executive officers or beneficial holders of more than 5% of our capital stock had or will have a direct or indirect material interest.

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Significant Stockholders

The following table sets forth the beneficial ownership of our common stock as of the Record Date (or such other date as is indicated) by each person who is known to us to be the beneficial owner of more than 5% of our outstanding common stock as of the Record Date (or such other date). Beneficial ownership of these shares consists of sole voting power and sole investment power except as noted below.

|

Name of Beneficial Owner |

Number of Shares |

Percent |

||||||

|

Conestoga Capital Advisors LLC(1) |

2,339,723 | 10.2 | % | |||||

|

Allspring Global Investments Holdings, LLC(2) |

2,371,391 | 10.3 | % | |||||

|

JPMorgan Chase & Co.(3) |

1,904,672 | 8.3 | % | |||||

|

BlackRock, Inc.(4) |

1,636,995 | 7.1 | % | |||||

|

The Vanguard Group(5) |

1,353,360 | 5.9 | % | |||||

(1) Based on information contained in a Schedule 13G/A filed with the SEC on January 5, 2024, which reports sole voting power for 2,191,913 shares and sole dispositive power for 2,339,723 shares.

(2) Based on information contained in a Schedule 13G/A filed jointly by Allspring Global Investments Holdings, LLC (“AGIH”), Allspring Global Investments, LLC (“AGI”) and Allspring Funds Management, LLC (“AFM”) with the SEC on January 12, 2024, in which AGIH reports beneficial ownership of 2,371,391 shares, sole voting power for 2,292,182 shares and sole dispositive power for 2,371,391 shares; AGI reports beneficial ownership of 2,368,966 shares, sole voting power for 348,662 shares and sole dispositive power for 2,368,966 shares; and AFM reports beneficial ownership of 1,945,946 shares, sole voting power for 1,943,521 shares and sole dispositive power for 2,425 shares.

(3) Based on information contained in a Schedule 13G/A filed with the SEC on January 18 2024, which reports sole voting power for 1,805,345 shares and sole dispositive power for 1,904,672 shares.

(4) Based on information contained in a Schedule 13G/A filed with the SEC on January 26, 2024, which reports sole voting power for 1,610,354 shares and sole dispositive power for 1,636,995 shares.

(5) Based on information contained in a Schedule 13G/A filed with the SEC on February 13, 2024, which reports sole voting power for 0 shares, shared voting power for 41,928 shares, sole dispositive power for 1,291,665 shares and shared dispositive power for 61,695 shares.

Executive Officers and Directors

The following table sets forth the beneficial ownership, as of the Record Date, of our common stock by each of our directors, each of our named executive officers (see “Compensation Discussion and Analysis” below), and by all of our current directors and executive officers as a group. Beneficial ownership of these shares consists of sole voting power and sole investment power except as noted below.

|

Name of Beneficial Owner |

Number of Shares |

Percentage of Class |

||||||

|

Robert L. McCormick(1) |

199,600 | * | ||||||

|

James L. Janik(2) |

134,884 | * | ||||||

|

Sarah C. Lauber |

35,647 | * | ||||||

|

Mark Van Genderen |

4,899 | * | ||||||

|

Joher Akolawala |

8,692 | * | ||||||

|

Linda R. Evans |

28,700 | * | ||||||

|

Donald W. Sturdivant |

37,445 | * | ||||||

|

Kenneth W. Krueger |

35,613 | * | ||||||

|

Margaret S. Dano |

33,604 | * | ||||||

|

Lisa R. Bacus |

13,111 | * | ||||||

|

All current directors and executive officers as a group (11 persons) |

532,195 | 2.316 | % | |||||

* Denotes ownership of less than 1%.

(1) Includes shares held by the Robert L. McCormick Revocable Trust.

(2) Includes shares held by the James L. and Susan S. Janik Revocable Trust.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Executive Summary

We are home to some of the most trusted brands in the industry and are a premier North American manufacturer and up‑fitter of work truck attachments and equipment. Our portfolio of products and services is separated into two segments: First, the work truck attachments segment, which includes commercial snow and ice control attachments sold under the FISHER®, WESTERN® and SNOWEX® brands, as well as our vertically integrated products. Second, the work truck solutions segment, which includes manufactured municipal snow and ice control products under the HENDERSON® brand the up‑fit of market leading attachments and storage solutions under the HENDERSON® brand, and the DEJANA® brand and its related sub‑brands.

We believe our business benefits from an exceptional management team that is responsible for establishing our leadership in the industry. Our senior management team has an average of approximately eleven years of weather‑related industry experience and an average of eleven years with our Company. We have sought to establish competitive compensation programs that enable us to attract and retain skillful, experienced and dedicated executive officers as well as to motivate management to maximize performance while building stockholder value.

Our named executive officers for 2023 were Robert L. McCormick, our President and Chief Executive Officer; Sarah C. Lauber, our Executive Vice President - Chief Financial Officer; Linda R. Evans, our Chief Human Resources Officer; and Mark Van Genderen, our President, Work Truck Attachments.

2023 Say on Pay Vote

In April 2023, we held an advisory stockholder vote on the compensation of our named executive officers at our annual stockholders’ meeting. Consistent with the recommendation of our Board, our stockholders approved our executive compensation, with more than 99% of votes cast in favor. The Compensation Committee considered these voting results and, consistent with the strong vote of stockholder approval they represented, elected not to undertake any material changes to our executive compensation programs in response to the outcome of the vote.

Developments Affecting 2023 Compensation

The primary actions that we took in 2023 with respect to the compensation of our named executive officers were the following:

|

• |

The Compensation Committee made decisions regarding the base salaries of each of our named executive officers. |

|

• |

The Compensation Committee established performance goals and target awards under our Annual Incentive Plan, as described further below under “Elements of Executive Compensation – Annual Incentive Plan.” |

|

• |

The Compensation Committee made annual grants of performance share units and time‑vesting restricted stock units under our Amended and Restated 2010 Stock Incentive Plan (“2010 Stock Plan”), as described further below under “Elements of Executive Compensation – Long-Term Incentive Compensation.” |

Other Highlights of Our Compensation Programs

We periodically review best practices in the area of executive compensation and update our compensation policies and practices to reflect those that we believe are appropriate for our Company, including, in addition to the examples listed above, the following:

|

• |

The key components of our compensation program for our named executive officers for 2023 were base salary, annual cash incentive awards under our Annual Incentive Plan, long‑term incentive awards under our long‑term equity program and other compensation consisting primarily of matching 401(k) contributions, health and welfare benefits, and other perquisites. |

|

• |

We pay for performance, offering our named executive officers the opportunity to earn a substantial amount of variable compensation based on our profitability, free cash flow and return on net assets. |

|

• |

We set compensation programs to focus our named executive officers on both our short- and long‑term Company performance by providing a mix of both short and long-term compensation in the form of our Annual Incentive Plan and our equity compensation program. |

|

• |

We do not provide “single trigger” change of control severance, which means that, for an executive officer to receive severance benefits under an employment agreement, in addition to the change in control there must be some adverse change in the circumstances of the executive officer’s employment. |

|

• |

Our equity compensation plan does not permit repricing of stock options without stockholder approval. |

|

• |

We periodically review our pay practices to ensure that they do not encourage excessive risk taking. |

|

• |

We do not guarantee salary increases or bonuses for our executive officers. |

Objectives of our Compensation Programs

We believe that a skilled, experienced and dedicated senior management team is essential to the future performance of our Company and to building stockholder value. We have sought to establish competitive compensation programs that enable us to attract and retain executive officers with these qualities as well as to motivate management to maximize performance while building stockholder value.

We compensate our named executive officers through both short-term cash programs, including annual salary and an Annual Incentive Plan, and long-term incentive programs, reflecting a mix of fixed and variable compensation. Although our compensation program provides for a mix of both short and long-term compensation and cash and non‑cash compensation, we do not have any specific policy on those allocations. Our compensation philosophy is centered on providing an opportunity for an executive’s total annual compensation to exceed what we believe is the general market level of compensation for similar executive roles. Our business is subject to variability of earnings due to year‑to‑year variations in snowfall. Accordingly, we have designed our compensation program to provide for a competitive annual salary while offering our named executive officers the opportunity to earn a substantial amount of variable compensation based on our profitability and free cash flow. This program aligns named executive officer compensation with our variable earnings model and is intended to differentiate us from our competitors when attracting and motivating our executives.

Role of the Compensation Committee and Management in the Compensation-Setting Process

Our Compensation Committee’s role in reviewing and approving executive compensation includes the duties and responsibilities set forth in the Compensation Committee’s charter. Among other things, the Compensation Committee has responsibility to do the following:

|

• |

oversee our overall compensation structure, policies and programs; |

|

• |

assess whether our compensation structure establishes appropriate incentives for management and employees; |

|

• |

administer and make recommendations to our Board on equity‑ and incentive‑based compensation plans that require approval from our Board; |

|

• |

review and approve corporate goals and objectives relevant to the compensation of our Chief Executive Officer, evaluate our Chief Executive Officer’s performance in light of those goals and objectives and set the Chief Executive Officer’s compensation level based on this evaluation; |

|

• |

oversee the evaluation of the other executive officers and set the compensation of other executive officers based upon the recommendation of the Chief Executive Officer; |

|

• |

approve stock option and other stock incentive awards for executive officers; |

|

• |

review and approve the design of other benefit plans pertaining to executive officers; |

|

• |

review and approve employment agreements and severance and change of control arrangements for our executive officers; |

|

• |

approve, amend or modify the terms of any compensation or benefit plan that does not require stockholder approval; |

|

• |

review and discuss with management our Compensation Discussion and Analysis and related disclosures that the Securities and Exchange Commission (“SEC”) rules require be included in our annual report and proxy statement, recommend to our Board based on the review and discussions whether the Compensation Discussion and Analysis should be included in the annual report and proxy statement and prepare the compensation committee report required by SEC rules for inclusion in our annual report and proxy statement; |

|

• |

determine and recommend to our Board a desired frequency, if any, for the advisory stockholder vote on the compensation of our named executive officers (the “say on pay” vote) to be recommended to stockholders at the annual meeting at least once every six years in accordance with applicable law, SEC rules and New York Stock Exchange (“NYSE”) listing requirements and prior stockholder votes on this subject; |

|

• |

oversee our response to the outcome of stockholder votes on say on pay and the frequency of say on pay; |

|

• |

review and oversee risks associated with our compensation policies and practices; and |

|

• |

select consultants or other advisors only after taking into consideration all factors relevant to that person’s independence from management. |

Our Chief Executive Officer recommends base salaries for our executive officers other than himself to the Compensation Committee for its approval and recommends performance targets under the Annual Incentive Plan for approval by the Compensation Committee, as explained in more detail under the section entitled “Annual Incentive Plan” below. Our Chief Executive Officer also negotiates employment agreements with executive officers, subject to review by the Compensation Committee, and makes recommendations to the Compensation Committee with respect to equity awards for our named executive officers other than himself. All compensation elements for our Chief Executive Officer are reviewed and approved by the Compensation Committee.

Role of Benchmarking in the Compensation-Setting Process

As described above under “Objectives of our Compensation Programs,” the Compensation Committee’s goal is to offer competitive compensation to our executive officers. To assist it in setting competitive pay levels and other benefits, the Compensation Committee has periodically engaged FW Cook, an independent compensation consultant. The Compensation Committee assessed the independence of FW Cook pursuant to SEC rules and NYSE listing standards and concluded that FW Cook’s work for the Compensation Committee does not raise any conflict of interest.

In 2022, the Compensation Committee worked with FW Cook to identify an updated peer group that was used by the Compensation Committee in evaluating and setting compensation and other benefits for our executive officers for 2023. For this review, FW Cook considered peer group data from a group of 16 peer companies as well as broader survey data from a national general industry survey. The 16 peer companies were selected for our peer group based on their reasonable comparability to our Company in terms of size, industry and scope of operations. For size‑related screens, the focus was on ensuring that the peer group was appropriate from both revenue and market capitalization perspectives because we believe that these two metrics are most strongly correlated to compensation levels. The peer companies (the “2022 Peer Group”) were the following:

|

• Alamo Group Inc. |

• Hurco Companies, Inc. |

|

• Astec Industries |

• Kadant Corporation |

|

• CECO Environmental Corp. |

• Lindsay Corporation |

|

• CIRCOR Int’l |

• Mayville Engineering Co. |

|

• Compass Minerals |

• Motorcar Parts of America |

|

• Enerpac Tool Group |

• Northwest Pipe Co. |

|

• ESCO Technologies |

• Standex Int’l |

|

• Federal Signal Corp. |

• The Shyft Group |

The Compensation Committee considered 2022 Peer Group data as one factor in setting compensation levels in 2023 for our named executive officers, but the 2022 Peer Group data was not the only factor or the determinative factor. Rather, the Compensation Committee also considered the individual named executive officer’s qualifications, experience and level of responsibility, internal pay equity considerations and the collective experience of the members of our Board, Compensation Committee and Mr. McCormick (with respect to the compensation of our other named executive officers), their business judgment and their experiences in recruiting and retaining executives.

Elements of Executive Compensation

The key components of our compensation program for our named executive officers for 2023 were base salary, annual cash incentive awards under our Annual Incentive Plan, long‑term equity incentive awards under our 2010 Stock Plan and other compensation consisting primarily of matching 401(k) contributions, health and welfare benefits and other perquisites. Each component of our compensation program has an important role in creating compensation arrangements that motivate and reward strong performance and in retaining the named executive officers who deliver strong performance.

Base Salary

We pay our named executive officers a base salary to compensate them for services rendered and to provide them with a steady source of income for living expenses throughout the year. In general, the base salary of each executive was initially established through arm’s‑length negotiations at the time the individual was hired, taking into account the individual’s qualifications, experience, level of responsibility, as well as internal pay equity considerations.

In early 2023, the Compensation Committee conducted a review of the base salaries of our named executive officers, taking into account the considerations described above under "—Role of Benchmarking in the Compensation-Setting Process."

Based on this review, in early 2023, the Compensation Committee approved, effective March 1, 2023, base salary increases for each of our named executive officers. The increases were intended to bring the named executive officers’ base salaries closer to the 2022 Peer Group median and, in the case of Mr. Van Genderen, to reflect his appointment to the role of President, Work Truck Attachments. Our named executive officers’ annual base salaries for 2022 and 2023, effective March 1, 2023, as well as the percentage increases, were as follows:

|

Executive |

2022 |

% Increase for 2023 |

2023 |

|||||||||

|

Robert L. McCormick |

$ | 721,000 | 3.00 | % | $ | 757,000 | ||||||

|

Sarah C. Lauber |

$ | 450,390 | 5.00 | % | $ | 472,910 | ||||||

|

Linda R. Evans |

$ | 292,040 | 5.00 | % | $ | 306,642 | ||||||

|

Mark Van Genderen |

$ | 279,115 | 21.81 | % | $ | 340,000 | ||||||

The amount of base salary that we actually paid to each of our named executive officers in 2023 can be found in the “Salary” column of the Summary Compensation Table below. Note that the amount of base salary that we actually paid to the named executive officers in 2023 is less than the amount shown in the table above because their base salary increases became effective on March 1, 2023.

Annual Incentive Plan

Our named executive officers, as well as certain other management employees, participate in the Annual Incentive Plan, which provides an opportunity to earn a cash bonus upon achievement of certain performance targets approved by the Compensation Committee. These performance objectives are designed to link management’s focus with overall Company objectives by providing the executive an opportunity to earn additional short‑term compensation. We emphasize variable compensation to provide an opportunity for total annual compensation for our named executive officers to exceed what the Compensation Committee believes, based on its members’ collective experience, business judgment and experiences in recruiting and retaining executives, to be the general market level of compensation for similarly situated executives in the event of superior performance.

The 2023 performance metrics under the Annual Incentive Plan for all of our named executive officers were adjusted operating income and free cash flow, weighted 70% and 30%, respectively. As in 2022, the payouts for Mr. McCormick, Ms. Lauber and Ms. Evans for 2023 were based entirely on our consolidated business results, while Mr. Van Genderen’s performance metrics for 2023 were based 75% on the performance of our Work Truck Attachments segment and 25% on our consolidated performance.

In 2023, adjusted operating income was weighted 70% under the Annual Incentive Plan. This weighting reflects the Compensation Committee’s belief that any incentive compensation should be driven principally by the Company’s profitability. Our management is given discretion to recommend the performance metric or metrics that will comprise the remaining 30% of the annual bonus opportunity. This allows our management to select a metric or metrics that reflect the current focus of our business, which are then submitted by the Chief Executive Officer to the Compensation Committee for approval. Management recommended free cash flow for 2023, based on its use of free cash flow as a primary measure of the Company’s profitability and our ability to pay dividends and its view that free cash flow is influenced to a lesser degree by factors below the operating profit level than some other performance measures.

For 2023, Mr. McCormick had a target bonus level of 100% of his base salary. Each other named executive officer had a target bonus level of 75% of his or her annual base salary. These target potential payment levels were set based on a review of the 2022 Peer Group companies and were based on what the Compensation Committee believed, based on its members’ collective experience, business judgment and experiences in recruiting and retaining executives, to be a competitive level of annual incentive compensation to provide appropriate incentives and retention. The Compensation Committee also established maximum potential payment levels under the Annual Incentive Plan of 200% of annual base salary for Mr. McCormick, and 150% for each other named executive officer, based on a review of 2022 Peer Group company practices. See below for a detailed discussion of our performance metrics and the calculation of payouts for 2023.

For the year ending December 31, 2023, we paid out the following bonuses as a percentage of base salary to our named executive officers:

|

Name |

Payout Based On: |

Total Paid salary) |

% Bonus Paid |

% Bonus Paid |

|||||||||

|

Robert L. McCormick |

Consolidated Business |

21.5 | % | 21.5 | % | 0.0 | % | ||||||

|

Sarah C. Lauber |

Consolidated Business |

16.1 | % | 16.1 | % | 0.0 | % | ||||||

|

Linda R. Evans |

Consolidated Business |

16.1 | % | 16.1 | % | 0.0 | % | ||||||

|

Mark Van Genderen |

75% Work Truck Attachments Segment and 25% Consolidated Business |

9.5 | % | 9.5 | % | 0.0 | % | ||||||

The adjusted operating income metric, as defined in the Annual Incentive Plan, measures the degree by which actual adjusted operating income performance achieves, exceeds or falls short of baseline adjusted operating income. Actual adjusted operating income is defined as earnings before interest, taxes, depreciation and amortization less depreciation, plus other expense, adjusted for non‑recurring expenses, as approved by the Compensation Committee. Baseline adjusted operating income is set annually by the Compensation Committee. For 2023, if actual adjusted operating income fell below 50% of baseline adjusted operating income, no adjusted operating income bonus would be earned. If actual adjusted operating income fell between 50% and 100% of baseline adjusted operating income, adjusted operating income bonus would be reduced linearly for each 1% reduction in actual adjusted operating income below baseline adjusted operating income. If actual adjusted operating income exceeded baseline adjusted operating income, adjusted operating income bonus would be increased linearly for each 1% increase in actual adjusted operating income above baseline adjusted operating income.

For 2023, the Compensation Committee set the baseline adjusted operating income targets under the Annual Incentive Plan based on historical trends and assumptions recommended by management. Specifically, in setting the 2023 baseline targets, we assumed average snowfall, increasing truck sales and a slight improvement in overall economic conditions. For 2023, the baseline adjusted operating income targets and actual adjusted operating income (calculated according to the Annual Incentive Plan as described below) were as follows:

|

Target |

Actual |

|||||||

|

Consolidated Business (million) |

$ | 87.2 | $ | 57.0 | ||||

|

Work Truck Attachments Segment (million) |

$ | 74.8 | $ | 42.5 | ||||