Table of Contents

PART I

Forward Looking Statements

This Annual Report on Form 10‑K contains “forward‑looking statements” made within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “anticipate,” “believe,” “intend,” “estimate,” “expect,” “continue,” “should,” “could,” “may,” “plan,” “project,” “predict,” “will” and similar expressions are intended to identify forward‑ looking statements. In addition, statements covering our future sales or financial performance and our plans, performance and other objectives, expectations or intentions are forward‑looking statements, such as statements regarding our liquidity, debt, planned capital expenditures, and adequacy of capital resources and reserves. Factors that could cause our actual results to differ materially from those expressed or implied in such forward‑looking statements include, but are not limited to:

|

·

| |

Weather conditions, particularly lack of or reduced levels of snowfall and the timing of such snowfall; |

|

·

| |

A significant decline in economic conditions; |

|

·

| |

Our inability to maintain good relationships with our distributors; |

|

·

| |

Lack of available or favorable financing options for our end‑users or distributors; |

|

·

| |

Increases in the price of steel or other materials necessary for the production of our products that cannot be passed on to our distributors; |

|

·

| |

Increases in the price of fuel; |

|

·

| |

The inability of our suppliers to meet our volume or quality requirements; |

|

·

| |

Inaccuracies in our estimates of future demand for our products; |

|

·

| |

Our inability to protect or continue to build our intellectual property portfolio; |

|

·

| |

The effects of laws and regulations and their interpretations on our business and financial conditions; |

|

·

| |

Our inability to develop new products or improve upon existing products in response to end‑user needs; |

|

·

| |

Losses due to lawsuits arising out of personal injuries associated with our products; |

|

·

| |

Factors that could impact the future declaration and payment of dividends; |

|

·

| |

Our inability to compete effectively against competition; and |

|

·

| |

Our inability to achieve the projected financial performance with the assets of TrynEx, Inc. (“TrynEx”), which we acquired in 2013, or the business of Henderson Enterprises Group, Inc. (“Henderson”) which we acquired in 2014, and unexpected costs or liabilities related to such acquisitions. |

We undertake no obligation to revise the forward‑looking statements included in this Annual Report on Form 10‑K to reflect any future events or circumstances. Our actual results, performance or achievements could differ materially from the results expressed in, or implied by, these forward‑looking statements. Factors in addition to those listed above that could cause or contribute to such differences are discussed in Item 1A, “Risk Factors” of the Annual Report on Form 10‑K.

Item 1. Business

Overview

Home to the best selling brands in the industry, Douglas Dynamics, Inc. (the “Company,” “we,” “us,” “our”) is North America's premier manufacturer of vehicle attachments and equipment. For more than 65 years, the Company has been innovating products that enable end users to perform their jobs more efficiently and effectively, providing opportunities for businesses to increase profitability. Our commitment to continuous improvement enables us to consistently produce high quality products and drive shareholder value. The Douglas Dynamics portfolio includes snow and ice management attachments sold under the BLIZZARD®, FISHER®, SNOWEX® and WESTERN® brands, turf care equipment under the TURFEX® brand, and industrial maintenance equipment under the SWEEPEX® brand. On December 31, 2014, we completed our acquisition of Henderson by merging a wholly-owned subsidiary of the Company with and into Henderson pursuant to a merger agreement. The acquisition provides the Company with Henderson’s diverse product portfolio including ice control equipment, snow plows, dump bodies, muni-bodies, and replacement parts. Additionally, as a result of the Henderson acquisition, the Company acquired Henderson’s brands, and access to Henderson’s network of authorized dealers. We operate as a single segment.

We offer a broad product line of snowplows and sand and salt spreaders for light trucks that we believe to be the most complete line offered in the U.S. and Canadian markets. We also provide a full range of related parts and accessories, which generates an ancillary revenue stream throughout the lifecycle of our snow and ice control equipment. As a result of the acquisition of Henderson, we also provide customized turnkey solutions to governmental agencies such as Departments of Transportation (“DOTs”) and municipalities. We also believe that, with the addition of Henderson, we are now the market leader in the heavy-duty segment of the North American snow and ice control market which includes equipment for class 7 and class 8 truck chassis. For the years ended December 31, 2014, 2013 and 2012, 84%, 85% and 88% of our net sales were generated from sales of snow and ice control equipment, respectively, and 16%, 15% and 12% of our net sales were generated from sales of parts and accessories, respectively.

We sell our products through a distributor network primarily to professional snowplowers who are contracted to remove snow and ice from commercial, municipal and residential areas. Over the last 50 years, we have engendered exceptional customer loyalty for our products because of our ability to satisfy the stringent demands of our customers for a high degree of quality, reliability and service. As a result, we believe our installed base is the largest in the light truck market with over 500,000 snowplows and sand and salt spreaders in service. Because sales of snowplows and sand and salt spreaders are primarily driven by the need of our core end‑user base to replace worn existing equipment, we believe our substantial installed base provides us with a high degree of predictable sales over any extended period of time.

We believe we have the industry’s most extensive distribution network worldwide, which consists of over 2,200 points of sale including 125 independent truck equipment distributors as a result of the Henderson acquisition. Additionally we have added Henderson’s five truck equipment installation facilities located throughout the United States. Direct points of shipment are predominantly through North American truck equipment and lawn care equipment distributors. Most of our distributors are located throughout the snow belt regions in North America (primarily the Midwest, East and Northeast regions of the United States as well as all provinces of Canada). We have longstanding relationships with many of our distributors. We continually seek to grow and optimize our network by opportunistically adding high‑quality, well‑capitalized distributors in select geographic areas and by cross‑selling our industry‑leading brands within our distribution network. Beginning in 2005, we have extended our reach to international markets, establishing distribution relationships in Northern Europe and Asia, where we believe meaningful growth opportunities exist.

We believe we are the industry’s most operationally efficient manufacturer due to our vertical integration, highly variable cost structure and intense focus on lean manufacturing. We continually seek to use lean principles to reduce costs and increase the efficiency of our manufacturing operations. During the year ended December 31, 2014 we manufactured our products in three facilities that we own in Milwaukee, Wisconsin, Rockland, Maine, and Madison Heights, Michigan. As a result of the December 31, 2014 acquisition of Henderson, we also have added a manufacturing facility in Manchester, Iowa. Furthermore, our manufacturing efficiency allows us to deliver desired

products quickly to our customers during times of sudden and unpredictable snowfall events when our customers need our products immediately.

Our Industry

Both the light truck and heavy duty snow and ice control equipment industries in North America consist predominantly of domestic participants that manufacture their products in North America. The annual demand for snow and ice control equipment is driven primarily by the replacement cycle of the existing installed base, which is predominantly a function of the average life of a snowplow or spreader and is driven by usage and maintenance practices of the end‑user. We believe actively‑used snowplows are typically replaced, on average, every 9 to 12 years.

We believe that both light and heavy duty snow and ice control equipment are both driven primarily by the replacement cycle of the existing installed base, which is predominantly a function of the average life of a snowplow or spreader and is driven by usage and maintenance practices of the end‑user. However, we believe that demand for heavy duty trucks is less elastic than light trucks. Heavy duty truck end users typically are comprised of local governments and municipalities which plan for and execute planned replacement of equipment over time.

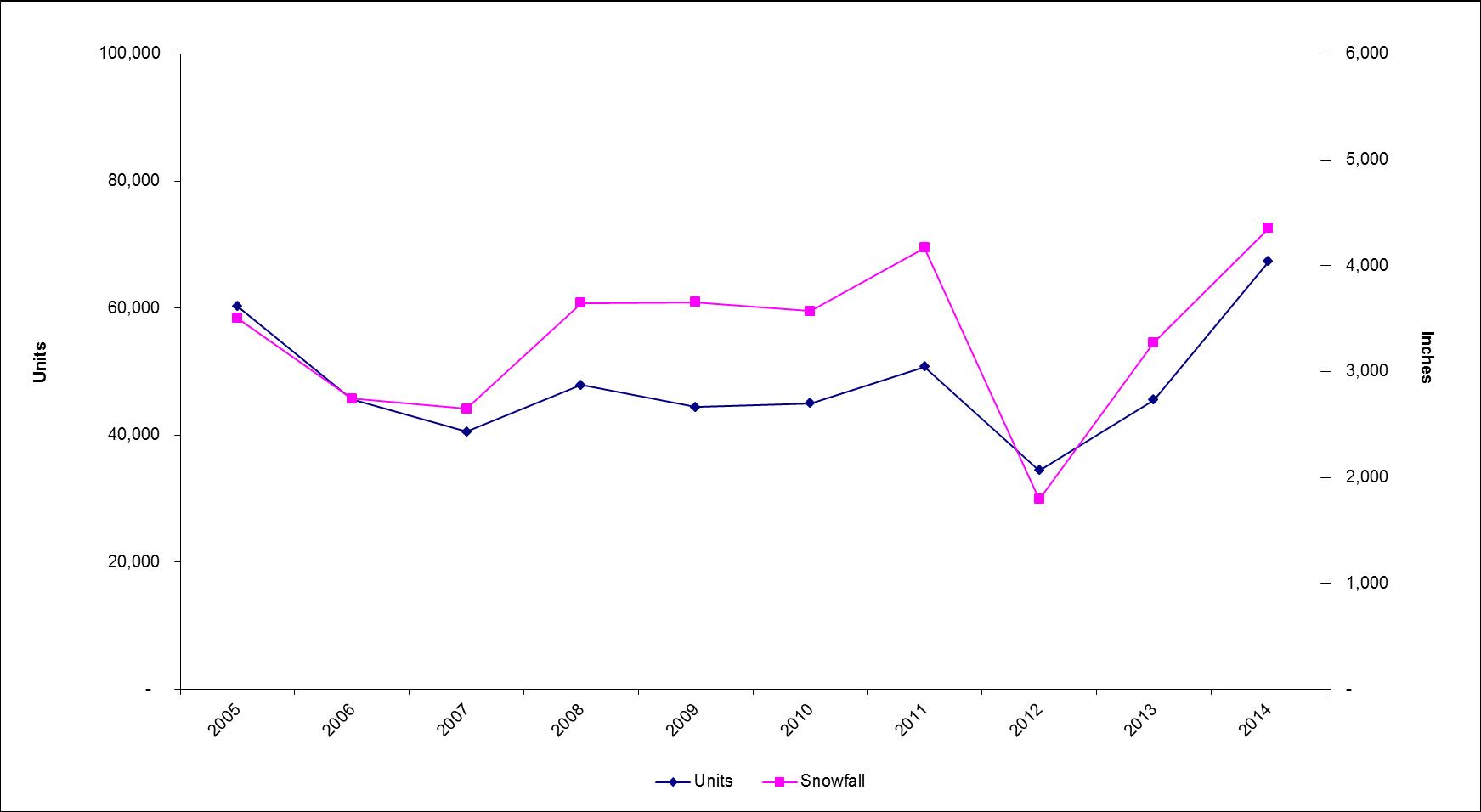

The primary factor influencing the replacement cycle for snow and ice control equipment for light trucks is the level, timing and location of snowfall. Sales of snow and ice control equipment in any given year and region are most heavily influenced by local snowfall levels in the prior snow season. Heavy snowfall during a given winter causes equipment usage to increase, resulting in greater wear and tear and shortened life cycles, thereby creating a need for replacement equipment and additional parts and accessories.

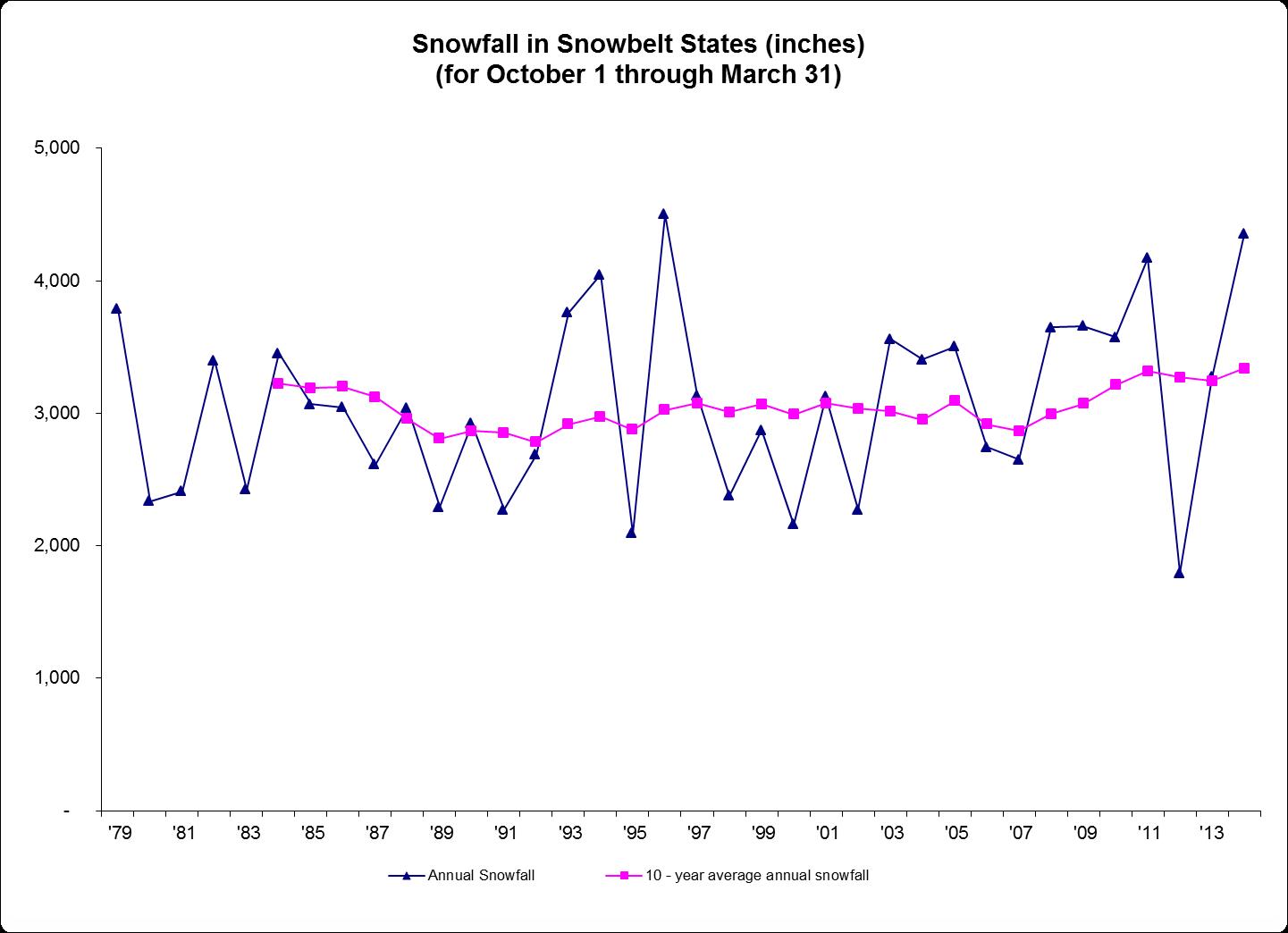

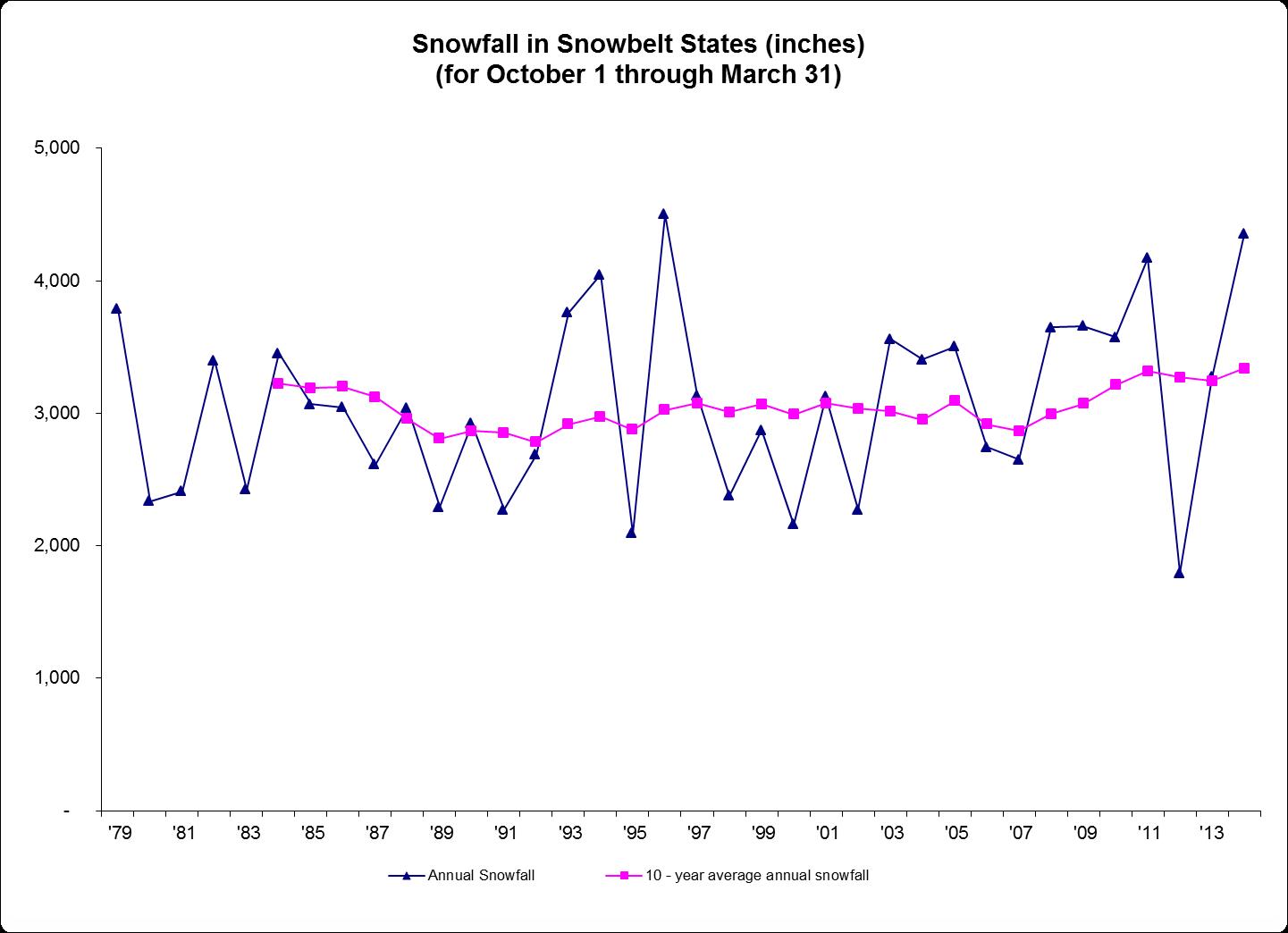

While snowfall levels vary within a given year and from year‑to‑year, snowfall, and the corresponding replacement cycle of snow and ice control equipment, is relatively consistent over multi‑year periods. The following chart depicts aggregate annual and ten‑year (based on the typical life of our snowplows) rolling average of the aggregate snowfall levels in 66 cities in 26 snow belt states across the Northeast, East, Midwest and Western United States where we monitor snowfall levels from 1980 to 2014. As the chart indicates, since 1984 aggregate snowfall levels in any given rolling ten‑year period have been fairly consistent, ranging from 2,742 to 3,318 inches.

Note:The 10‑year rolling average snowfall is not presented prior to 1984 for purposes of the calculation due to lack of snowfall data prior to 1975. Snowfall data in this chart is not adjusted for snowfall outside of the 66 cities in the 26 states reflected.

Source:National Oceanic and Atmospheric Administration’s National Weather Service.

The demand for snow and ice control equipment can also be influenced by general economic conditions in the United States, as well as local economic conditions in the snow‑belt regions in North America. In stronger economic conditions, our end‑users may choose to replace or upgrade existing equipment before its useful life has ended, while in weak economic conditions, our end‑users may seek to extend the useful life of equipment, thereby increasing the sales of parts and accessories. However, since snow and ice control management is a non‑discretionary service necessary to ensure public safety and continued personal and commercial mobility in populated areas that receive snowfall, end‑users cannot extend the useful life of snow and ice control equipment indefinitely and must replace equipment that has become too worn, unsafe or unreliable, regardless of economic conditions. While our parts and accessories yield slightly higher gross margins than our snow and ice control equipment, they yield significantly lower revenue than equipment sales, which adversely affects our results of operations.

Sales of parts and accessories for 2014 were approximately 89% higher than average annual parts and accessories sales over the preceding ten years. The higher than average parts and accessories sales were partially due primarily driven by above average snowfall, in addition to TrynEx parts and accessory sales being sold for a full year in 2014 versus only a partial year in 2013. TrynEx parts and accessories sales contributed approximately 18% of increased parts and accessory sales in 2014 compared to 2013. The remaining 47% increase can be attributed to the timing, location and amount of the snowfall for the six‑month snow season ended March 31, 2014.

Long‑term growth in the overall snow and ice control equipment market also results from geographic expansion of developed areas in the snow belt regions of North America, as well as consumer demand for technological enhancements in snow and ice control equipment and related parts and accessories that improves efficiency and reliability. Continued construction in the snow belt regions in North America increases the aggregate area requiring snow and ice removal, thereby growing the market for snow and ice control equipment. In addition, the development and sale of more reliable, more efficient and more sophisticated products have contributed to an approximate 2% to 4% average unit price increase in each of the past five years.

Our Competitive Strengths

We compete solely with other North American manufacturers who do not benefit from our extensive distributor network, manufacturing efficiencies and depth and breadth of products. As the market leader in snow and ice control equipment for light trucks and following the Henderson acquisition, heavy duty trucks, we enjoy a set of competitive advantages versus smaller equipment providers, which allows us to generate robust cash flows in all snowfall environments and to support continued investment in our products, distribution capabilities and brand regardless of annual volume fluctuations. We believe these advantages are rooted in the following competitive strengths and reinforces our industry leadership over time.

Exceptional Customer Loyalty and Brand Equity. Our brands enjoy exceptional customer loyalty and brand equity in the snow and ice control equipment industry with both end‑users and distributors, which have been developed through over 50 years of superior innovation, productivity, reliability and support, consistently delivered season after season. We believe past brand experience, rather than price, is the key factor impacting snowplow purchasing decisions.

Broadest and Most Innovative Product Offering. We provide the industry’s broadest product offering with a full range of snowplows, sand and salt spreaders and related parts and accessories. We believe we maintain the industry’s largest and most advanced in‑house new product development program, historically introducing several new and redesigned products each year. Our broad product offering and commitment to new product development is essential to maintaining and growing our leading market share position as well as continuing to increase the profitability of our business.

Extensive North American Distributor Network. With over 2,200 points of sale, we benefit from having the most extensive distributor network in the industry, providing a significant competitive advantage over our peers. Our distributors function not only as sales and support agents (providing access to parts and service), but also as industry partners providing real‑time end‑user information, such as retail inventory levels, changing consumer preferences or desired functionality enhancements, which we use as the basis for our product development efforts.

Leader in Operational Efficiency. We believe we are a leader in operational efficiency in our industry, resulting from our application of lean manufacturing principles and a highly variable cost structure. By utilizing lean principles, we are able to adjust production levels easily to meet fluctuating demand, while controlling costs in slower periods. This operational efficiency is supplemented by our highly variable cost structure, driven in part by our access to a sizable temporary workforce (comprising approximately 10‑15% of our total workforce during average snowfall years), which we can quickly adjust, as needed. These manufacturing efficiencies enable us to respond rapidly to urgent customer demand during times of sudden and unpredictable snowfalls, allowing us to provide exceptional service to our existing customer base and capture new customers from competitors that we believe cannot service their customers’ needs with the same speed and reliability.

Strong Cash Flow Generation. We are able to generate significant cash flow as a result of relatively consistent high profitability, low capital spending requirements and predictable timing of our working capital requirements. Our cash flow results will also benefit substantially from approximately $19.0 million of annual tax‑deductible intangible and goodwill expense over the next four years, which has the impact of reducing our corporate taxes owed by approximately $7.3 million on an annual basis during this period, in the event we have sufficient taxable income to utilize such benefit. Our significant cash flow has allowed us to reinvest in our business, pay down long term debt, and pay substantial dividends on a pro rata basis to our stockholders.

Experienced Management Team. We believe our business benefits from an exceptional management team that is responsible for establishing our leadership in the snow and ice control equipment industry for light trucks.

Our senior management team, consisting of four officers, has an average of approximately 24 years of weather‑related industry experience and an average of over fourteen years with our company. James Janik, our Chairman, President and Chief Executive Officer, has been with us for over 22 years and in his role as President and Chief Executive Officer since 2000, and through his strategic vision, we have been able to expand our distributor network and grow our market leading position.

Our Business Strategy

Our business strategy is to capitalize on our competitive strengths to maximize cash flow to pay dividends, reduce indebtedness and reinvest in our business to create stockholder value. The building blocks of our strategy are:

Continuous Product Innovation. We believe new product innovation is critical to maintaining and growing our market‑leading position in the snow and ice control equipment industry. We will continue to focus on developing innovative solutions to increase productivity, ease of use, reliability, durability and serviceability of our products and on incorporating lean manufacturing concepts into our product development process, which has allowed us to reduce the overall cost of development and, more importantly, to reduce our time‑to‑market by nearly one‑half.

Distributor Network Optimization. We will continually seek opportunities to continue to expand our extensive distribution network by adding high‑ quality, well‑capitalized distributors in select geographic areas and by cross‑selling our industry‑leading brands within our distribution network to ensure we maximize our ability to generate revenue while protecting our industry leading reputation, customer loyalty and brands. We will also focus on optimizing this network by providing in‑depth training, valuable distributor support and attractive promotional and incentive opportunities. As a result of these efforts, we believe a majority of our distributors choose to sell our products exclusively. We believe this sizable high quality network is unique in the industry, providing us with valuable insight into purchasing trends and customer preferences, and would be very difficult to replicate.

Aggressive Asset Management and Profit Focus. We will continue to aggressively manage our assets in order to maximize our cash flow generation despite seasonal and annual variability in snowfall levels. We believe our ability is unique in our industry and enables us to achieve attractive margins in all snowfall environments. Key elements of our asset management and profit focus strategies include:

|

·

| |

employment of a highly variable cost structure, which allows us to quickly adjust costs in response to real‑time changes in demand; |

|

·

| |

use of enterprise‑wide lean principles, which allow us to easily adjust production levels up or down to meet demand; |

|

·

| |

implementation of a pre‑season order program, which incentivizes distributors to place orders prior to the retail selling season and thereby enables us to more efficiently utilize our assets; and |

|

·

| |

development of a vertically integrated business model, which we believe provides us cost advantages over our competition. |

Additionally, although modest, our capital expenditure requirements and operating expenses can be temporarily reduced in response to anticipated or actual lower sales in a particular year to maximize cash flow.

Flexible, Lean Enterprise Platform. We will continue to utilize lean principles to maximize the flexibility, efficiency and productivity of our manufacturing operations while reducing the associated costs, enabling us to increase distributor and end‑user satisfaction. For example, in an environment where shorter lead times and near‑perfect order fulfillment are important to our distributors, we believe our lean processes have helped us to improve our shipping performance and build a reputation for providing industry leading shipping performance.

Our Growth Opportunities

Opportunistically Seek New Products and New Markets. On December 31, 2014 the Company completed its acquisition of Henderson, which gave the Company Henderson’s full line of product offerings and access to its network of dealers. Previously, on May 6, 2013, the Company acquired substantially all of the assets of TrynEx, including its full line of product offerings and access to its network of authorized dealers. We expect to continue to consider external growth opportunities within the snow and ice control industry and other equipment or component markets. We plan to continue to evaluate other acquisition opportunities within our industry that can help us expand our distribution reach, enhance our technology and as a consequence improve the breadth and depth of our product lines. We also consider diversification opportunities in adjacent markets that complement our business model and could offer us the ability to leverage our core competencies to create stockholder value.

Increase Our Industry Leading Market Share. We plan to leverage our industry leading position, distribution network and new product innovation capabilities to capture market share in the North American snow and ice control equipment market, focusing our primary efforts on increasing penetration in those North American markets where we believe our overall market share is less than 50% and of Henderson, the heavy duty truck market. We also plan to continue growing our presence in the snow and ice control equipment market outside of North America, particularly in Asia and Europe, which we believe could provide significant growth opportunities in the future.

Employees

As of December 31, 2014, we employed 993 employees on a full‑time basis, including 363 employees at the newly acquired Henderson business. None of our employees are represented by a union and we are not party to any collective bargaining agreements.

Financing program

We are party to a financing program in which certain distributors may elect to finance their purchases from us through a third party financing company. We provide the third party financing company recourse against us regarding the collectability of the receivable under the program due to the fact that if the third party financing company is unable to collect from the distributor the amounts due in respect of the product financed, we would be obligated to repurchase any remaining inventory related to the product financed and reimburse any legal fees incurred by the financing company. During the years ended December 31, 2014, 2013 and 2012, distributors financed purchases of $5.6 million, $2.9 million and $1.6 million through this financing program, respectively. At both December 31, 2014 and December 31, 2013, there was $0 of uncollectible outstanding receivables related to sales financed under the financing program. The amount owed by our distributors to the third party financing company under this program at December 31, 2014 and 2013 was $1.9 million and $1.3 million, respectively. We were required to repurchase repossessed inventory of $0, $0, and $0.2 million for the years ended December 31, 2014, 2013 and 2012, respectively.

In the past, minimal losses have been incurred under this agreement. However, an adverse change in distributor retail sales could cause this situation to change and thereby require us to repurchase repossessed units. Any repossessed units are inspected to ensure they are current, unused product and are restocked and resold.

Intellectual Property

We maintain patents relating to snowplow mounts, assemblies, hydraulics, electronics and lighting systems, brooms as well as sand, salt and fertilizer spreader assemblies and our patent applications relate to each of the foregoing except for hydraulics. Patents are valid for the longer period of 17 years from issue date or 20 years from filing date. The duration of the patents we currently possess range between two years and 19 years of remaining life. Our patent applications date from 1996 through 2014.

We rely on a combination of patents, trade secrets and trademarks to protect certain of the proprietary aspects of our business and technology. We hold approximately 36 U.S. registered trademarks (including the

trademarks WESTERN®, FISHER® BLIZZARD®, SNOWEX®, TURFEX®, SWEEPEX®, HENDERSON® and BRINEXTREME®) 11 Canadian registered trademarks, 5 European trademarks, 58 U.S. issued patents, 11 Canadian patents and two Chinese and Mexican trademarks.

Raw Materials

During 2014, we experienced slightly unfavorable commodity costs compared to the slightly favorable prices paid for commodities in 2013. Historically, we have mitigated, and we currently expect to continue to mitigate, commodity cost increases in part by engaging in proactive vendor negotiations, reviewing alternative sourcing options, substituting materials, engaging in internal cost reduction efforts, and increasing prices on some of our products, all as appropriate.

Most of the components of our products are also affected by commodity cost pressures and are commercially available from a number of sources. In 2014, we experienced no significant work stoppages because of shortages of raw materials or commodities. The highest raw material and component costs are generally for steel, which we purchase from several suppliers.

Other Information

We were formed as a Delaware corporation in 2004. We maintain a website with the address www.douglasdynamics.com. We are not including the information contained on our website as part of, or incorporating it by reference into, this report. We make available free of charge (other than an investor’s own Internet access charges) through our website our Annual Report on Form 10‑K, quarterly reports on Form 10‑Q and current reports on Form 8‑K, and amendments to these reports, as soon as reasonably practicable after we electronically file such material with, or furnish such material to, the Securities and Exchange Commission (“SEC”).

Item 1A. Risk Factors

The Company operates in an environment that involves numerous known and unknown risks and uncertainties. Our business, prospects, financial condition and operating results could be materially adversely affected by any of these risks, as well as other risks not currently known to us or that we currently consider immaterial. The risks described below highlight some of the factors that have affected, and in the future could affect our operations.

Our results of operations depend primarily on the level, timing and location of snowfall. As a result, a decline in snowfall levels in multiple regions for an extended time could cause our results of operations to decline and adversely affect our ability to pay dividends.

As a manufacturer of snow and ice control equipment for both light and heavy duty trucks, and related parts and accessories, our sales depend primarily on the level, timing and location of snowfall in the regions in which we offer our products. A low level or lack of snowfall in any given year in any of the snow‑belt regions in North America (primarily the Midwest, East and Northeast regions of the United States as well as all provinces of Canada) will likely cause sales of our products to decline in such year as well as the subsequent year, which in turn may adversely affect our results of operations and ability to pay dividends. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Seasonality and Year‑to‑Year Variability.” A sustained period of reduced snowfall events in one or more of the geographic regions in which we offer our products could cause our results of operations to decline and adversely affect our ability to pay dividends.

The year‑to‑year variability of our business can cause our results of operations and financial condition to be materially different from year‑to‑year; whereas the seasonality of our business can cause our results of operations and financial condition to be materially different from quarter‑to‑quarter.

Because our business depends on the level, timing and location of snowfall, our results of operations vary from year‑to‑year. Additionally, because the annual snow season typically only runs from October 1 through March 31, our distributors typically purchase our products during the second and third quarters. As a result, we

operate in a seasonal business. We not only experience seasonality in our sales, but also experience seasonality in our working capital needs. Consequently, our results of operations and financial condition can vary from year‑to‑year, as well as from quarter‑to‑quarter, which could affect our ability to pay dividends. If we are unable to effectively manage the seasonality and year‑to‑year variability of our business, our results of operations, financial condition and ability to pay dividends may suffer.

If economic conditions in the United States continue to remain weak or deteriorate further, or if spending by governmental agencies is limited or reduced, our results of operations, financial condition and ability to pay dividends may be adversely affected.

Historically, demand for snow and ice control equipment for light and heavy duty trucks has been influenced by general economic conditions in the United States, as well as local economic conditions in the snow‑belt regions in North America. During the last few years, economic conditions throughout the United States have been extremely weak and spending by governmental agencies such as Departments of Transportation (“DOTs”) and municipalities has been constrained. Although conditions improved from 2011 through 2014, they may not become strong in the foreseeable future. Weakened economic conditions and limited or reduced government spending may cause our end‑users to delay purchases of replacement snow and ice control equipment and instead repair their existing equipment, leading to a decrease in our sales of new equipment. Weakened economic conditions and limited or reduced governmental spending may also cause our end‑users to delay their purchases of new light and heavy duty trucks. Because our end‑users tend to purchase new snow and ice control equipment concurrent with their purchase of new light or heavy duty trucks, their delay in purchasing new light or heavy duty trucks can also result in the deferral of their purchases of new snow and ice control equipment. The deferral of new equipment purchases during periods of weak economic conditions or limited or reduced government spending may negatively affect our results of operations, financial condition and ability to pay dividends.

Weakened economic conditions or limited or reduced government spending may also cause our end‑users to consider price more carefully in selecting new snow and ice control equipment. Historically, considerations of quality and service have outweighed considerations of price, but in a weak economy, or an environment of constrained government spending, price may become a more important factor. Any refocus away from quality in favor of cheaper equipment could cause end‑users to shift away from our products to less expensive competitor products, or to shift away from our more profitable products to our less profitable products, which in turn would adversely affect our results of operations and our ability to pay dividends.

Our failure to maintain good relationships with our distributors, the loss or consolidation of our distributor base or the actions or inactions of our distributors could have an adverse effect on our results of operations and our ability to pay dividends.

We depend on a network of truck equipment distributors to sell, install and service our products. Nearly all of these sales and service relationships are at will, so almost all of our distributors could discontinue the sale and service of our products at any time, and those distributors that primarily sell our products may choose to sell competing products at any time. Further, difficult economic or other circumstances could cause any of our distributors to discontinue their businesses. Moreover, if our distributor base were to consolidate or if any of our distributors were to discontinue their business, competition for the business of fewer distributors would intensify. If we do not maintain good relationships with our distributors, or if we do not provide product offerings and pricing that meet the needs of our distributors, we could lose a substantial amount of our distributor base. A loss of a substantial portion of our distributor base could cause our sales to decline significantly, which would have an adverse effect on our results of operations and ability to pay dividends.

In addition, our distributors may not provide timely or adequate service to our end‑users. If this occurs, our brand identity and reputation may be damaged, which would have an adverse effect on our results of operations and ability to pay dividends.

Lack of available financing options for our end‑users or distributors may adversely affect our sales volumes.

Our end‑user base is highly concentrated among professional snowplowers, who comprise over 50% of our end‑users, many of whom are individual landscapers who remove snow during the winter and landscape during the

rest of the year, rather than large, well‑capitalized corporations. These end‑users often depend upon credit to purchase our products. If credit is unavailable on favorable terms or at all, our end‑users may not be able to purchase our products from our distributors, which would in turn reduce sales and adversely affect our results of operations and ability to pay dividends.

In addition, because our distributors, like our end‑users, rely on credit to purchase our products, if our distributors are not able to obtain credit, or access credit on favorable terms, we may experience delays in payment or nonpayment for delivered products. Further, if our distributors are unable to obtain credit or access credit on favorable terms, they could experience financial difficulties or bankruptcy and cease purchases of our products altogether. Thus, if financing is unavailable on favorable terms or at all, our results of operations and ability to pay dividends would be adversely affected.

The price of steel, a commodity necessary to manufacture our products, is highly variable. If the price of steel increases, our gross margins could decline.

Steel is a significant raw material used to manufacture our products. During 2014, 2013 and 2012, our steel purchases were approximately 13%, 13% and 18% of our revenue, respectively. The steel industry is highly cyclical in nature, and steel prices have been volatile in recent years and may remain volatile in the future. Steel prices are influenced by numerous factors beyond our control, including general economic conditions domestically and internationally, the availability of raw materials, competition, labor costs, freight and transportation costs, production costs, import duties and other trade restrictions. Steel prices are volatile and may increase as a result of increased demand from the automobile and consumer durable sectors. If the price of steel increases, our variable costs may increase. We may not be able to mitigate these increased costs through the implementation of permanent price increases or temporary invoice surcharges, especially if economic conditions remain weak and our distributors and end‑users become more price sensitive. If we are unable to successfully mitigate such cost increases in the future, our gross margins could decline.

If petroleum prices increase, our results of operations could be adversely affected.

Petroleum prices have fluctuated significantly in recent years. Prices and availability of petroleum products are subject to political, economic and market factors that are outside of our control. Political events in petroleum‑producing regions as well as hurricanes and other weather‑related events may cause the price of fuel to increase. If the price of fuel increases, the demand for our products may decline, which would adversely affect our financial condition and results of operations.

We depend on outside suppliers who may be unable to meet our volume and quality requirements, and we may be unable to obtain alternative sources.

We purchase certain components essential to our snowplows and sand and salt spreaders from outside suppliers, including off‑shore sources. Most of our key supply arrangements can be discontinued at any time. A supplier may encounter delays in the production and delivery of such products and components or may supply us with products and components that do not meet our quality, quantity or cost requirements. Additionally, a supplier may be forced to discontinue operations. Any discontinuation or interruption in the availability of quality products and components from one or more of our suppliers may result in increased production costs, delays in the delivery of our products and lost end‑user sales, which could have an adverse effect on our business and financial condition.

We have continued to increase the number of our off‑shore suppliers. Our increased reliance on off‑shore sourcing may cause our business to be more susceptible to the impact of natural disasters, war and other factors that may disrupt the transportation systems or shipping lines used by our suppliers, a weakening of the dollar over an extended period of time and other uncontrollable factors such as changes in foreign regulation or economic conditions. In addition, reliance on off‑shore suppliers may make it more difficult for us to respond to sudden changes in demand because of the longer lead time to obtain components from off‑shore sources. We may be unable to mitigate this risk by stocking sufficient materials to satisfy any sudden or prolonged surges in demand for our products. If we cannot satisfy demand for our products in a timely manner, our sales could suffer as distributors can cancel purchase orders without penalty until shipment.

We do not sell our products under long‑term purchase contracts, and sales of our products are significantly impacted by factors outside of our control; therefore, our ability to estimate demand is limited.

We do not enter into long‑term purchase contracts with our distributors and the purchase orders we receive may be cancelled without penalty until shipment. Therefore, our ability to accurately predict future demand for our products is limited. Nonetheless, we attempt to estimate demand for our products for purposes of planning our annual production levels and our long‑term product development and new product introductions. We base our estimates of demand on our own market assessment, snowfall figures, quarterly field inventory surveys and regular communications with our distributors. Because wide fluctuations in the level, timing and location of snowfall, economic conditions and other factors may occur, each of which is out of our control, our estimates of demand may not be accurate. Underestimating demand could result in procuring an insufficient amount of materials necessary for the production of our products, which may result in increased production costs, delays in product delivery, missed sale opportunities and a decrease in customer satisfaction. Overestimating demand could result in the procurement of excessive supplies, which could result in increased inventory and associated carrying costs.

If we are unable to enforce, maintain or continue to build our intellectual property portfolio, or if others invalidate our intellectual property rights, our competitive position may be harmed.

Our patents relate to snowplow mounts, assemblies, hydraulics, electronics and lighting systems, brooms as well as sand, salt and fertilizer spreader assemblies and our patent applications relate to each of the foregoing except for hydraulics. Patents are valid for the longer period of 17 years from issue date or 20 years from filing date. The duration of the patents we currently possess range between two years and 19 years of remaining life. Our patent applications date from 1996 through 2014.

We rely on a combination of patents, trade secrets and trademarks to protect certain of the proprietary aspects of our business and technology. We hold approximately 36 U.S. registered trademarks (including the trademarks WESTERN®, FISHER® BLIZZARD®, SNOWEX®, TURFEX®, SWEEPEX®, HENDERSON® and BRINEXTREME®) 11 Canadian registered trademarks, 5 European trademarks, 58 U.S. issued patents, 11 Canadian patents and two Chinese and Mexican trademarks. Although we work diligently to protect our intellectual property rights, monitoring the unauthorized use of our intellectual property is difficult, and the steps we have taken may not prevent unauthorized use by others. In addition, in the event a third party challenges the validity of our intellectual property rights, a court may determine that our intellectual property rights may not be valid or enforceable. An adverse determination with respect to our intellectual property rights may harm our business prospects and reputation. Third parties may design around our patents or may independently develop technology similar to our trade secrets. The failure to adequately build, maintain and enforce our intellectual property portfolio could impair the strength of our technology and our brands, and harm our competitive position. Although we have no reason to believe that our intellectual property rights are vulnerable, previously undiscovered intellectual property could be used to invalidate our rights.

If we are unable to develop new products or improve upon our existing products on a timely basis, it could have an adverse effect on our business and financial condition.

We believe that our future success depends, in part, on our ability to develop on a timely basis new technologically advanced products or improve upon our existing products in innovative ways that meet or exceed our competitors’ product offerings. Continuous product innovation ensures that our consumers have access to the latest products and features when they consider buying snow and ice control equipment. Maintaining our market position will require us to continue to invest in research and development and sales and marketing. Product development requires significant financial, technological and other resources. We may be unsuccessful in making the technological advances necessary to develop new products or improve our existing products to maintain our market position. Industry standards, end‑user expectations or other products may emerge that could render one or more of our products less desirable or obsolete. If any of these events occur, it could cause decreases in sales, a failure to realize premium pricing and an adverse effect on our business and financial condition.

We face competition from other companies in our industry, and if we are unable to compete effectively with these companies, it could have an adverse effect on our sales and profitability. Price competition among our distributors could negatively affect our market share.

We primarily compete with regional manufacturers of snow and ice control equipment for light trucks. While we are the most geographically diverse company in our industry, we may face increasing competition in the markets in which we operate. In saturated markets, price competition may lead to a decrease in our market share or a compression of our margins, both of which would affect our profitability. Moreover, current or future competitors may grow their market share and develop superior service and may have or may develop greater financial resources, lower costs, superior technology or more favorable operating conditions than we maintain. As a result, competitive pressures we face may cause price reductions for our products, which would affect our profitability or result in decreased sales and operating income. Additionally, saturation of the markets in which we compete or channel conflicts among our brands and shifts in consumer preferences may increase these competitive pressures or may result in increased competition among our distributors and affect our sales and profitability. In addition, price competition among the distributors that sell our products could lead to significant margin erosion among our distributors, which could in turn result in compressed margins or loss of market share for us. Management believes that, after ourselves, the next largest competitors in the market for snow and ice control equipment for light trucks are Northern Star Industries, Inc. (the manufacturer of the Boss brand of snow and ice control equipment) and Meyer Products LLC, and accordingly represent our primary competitors for market share.

We are subject to complex laws and regulations, including environmental and safety regulations that can adversely affect the cost, manner or feasibility of doing business.

Our operations are subject to certain federal, state and local laws and regulations relating to, among other things, the generation, storage, handling, emission, transportation, disposal and discharge of hazardous and non‑hazardous substances and materials into the environment, the manufacturing of motor vehicle accessories and employee health and safety. We cannot be certain that existing and future laws and regulations and their interpretations will not harm our business or financial condition. We currently make and may be required to make large and unanticipated capital expenditures to comply with environmental and other regulations, such as:

|

·

| |

Applicable motor vehicle safety standards established by the National Highway Traffic Safety Administration; |

|

·

| |

Reclamation and remediation and other environmental protection; and |

|

·

| |

Standards for workplace safety established by the Occupational Safety and Health Administration. |

While we monitor our compliance with applicable laws and regulations and attempt to budget for anticipated costs associated with compliance, we cannot predict the future cost of such compliance. In 2014, the amount expended for such compliance was insignificant, but we could incur material expenses in the future in the event of future legislation changes or unforeseen events, such as a workplace accident or environmental discharge, or if we otherwise discover we are in non‑compliance with an applicable regulation. In addition, under these laws and regulations, we could be liable for:

|

·

| |

Product liability claims; |

|

·

| |

Investigation and remediation of environmental contamination and other governmental sanctions such as fines and penalties; and |

|

·

| |

Other environmental damages. |

Our operations could be significantly delayed or curtailed and our costs of operations could significantly increase as a result of regulatory requirements, restrictions or claims. We are unable to predict the ultimate cost of compliance with these requirements or their effect on our operations.

Financial market conditions have had a negative impact on the return on plan assets for our pension plans, which may require additional funding and negatively impact our cash flows.

Our pension expense and required contributions to our pension plan are directly affected by the value of plan assets, the projected rate of return on plan assets, the actual rate of return on plan assets and the actuarial assumptions we use to measure the defined benefit pension plan obligations. Despite modest recent market recoveries, the funding status of our pension plans, remain impacted by the financial market downturn over the last several years, which had severely impacted the funded status of our pension plans. As of December 31, 2014, our pension plans were underfunded by approximately $12.3 million. In 2014, contributions to our defined benefit pension plans were approximately $1.4 million. If plan assets perform below expectations, future pension expense and funding obligations will increase, which would have a negative impact on our cash flows. Moreover, under the Pension Protection Act of 2006, it is possible that losses of asset values may necessitate accelerated funding of our pension plans in the future to meet minimum federal government requirements.

The statements regarding our industry, market positions and market share in this filing are based on our management’s estimates and assumptions. While we believe such statements are reasonable, such statements have not been independently verified.

Information contained in this Annual Report on Form 10‑K concerning the snow and ice control equipment industry for light trucks, our general expectations concerning this industry and our market positions and other market share data regarding the industry are based on estimates our management prepared using end‑user surveys, anecdotal data from our distributors and distributors that carry our competitors’ products, our results of operations and management’s past experience, and on assumptions made, based on our management’s knowledge of this industry, all of which we believe to be reasonable. These estimates and assumptions are inherently subject to uncertainties, especially given the year‑to‑year variability of snowfall and the difficulty of obtaining precise information about our competitors, and may prove to be inaccurate. In addition, we have not independently verified the information from any third‑party source and thus cannot guarantee its accuracy or completeness, although management also believes such information to be reasonable. Our actual operating results may vary significantly if our estimates and outlook concerning the industry, snowfall patterns, our market positions or our market shares turn out to be incorrect.

We are subject to product liability claims, product quality issues, and other litigation from time to time that could adversely affect our operating results or financial condition.

The manufacture, sale and usage of our products expose us to a risk of product liability claims. If our products are defective or used incorrectly by our end‑users, injury may result, giving rise to product liability claims against us. If a product liability claim or series of claims is brought against us for uninsured liabilities or in excess of our insurance coverage, and it is ultimately determined that we are liable, our business and financial condition could suffer. Any losses that we may suffer from any liability claims, and the effect that any product liability litigation may have upon the reputation and marketability of our products, may divert management’s attention from other matters and may have a negative impact on our business and operating results. Additionally, we could experience a material design or manufacturing failure in our products, a quality system failure or other safety issues, or heightened regulatory scrutiny that could warrant a recall of some of our products. A recall of some of our products could also result in increased product liability claims. Any of these issues could also result in loss of market share, reduced sales, and higher warranty expense.

We are heavily dependent on our Chief Executive Officer and management team.

Our continued success depends on the retention, recruitment and continued contributions of key management, finance, sale and marketing personnel, some of whom could be difficult to replace. Our success is largely dependent upon our senior management team, led by our Chief Executive Officer and other key managers. The loss of any one or more of such persons could have an adverse effect on our business and financial condition.

Our indebtedness could adversely affect our operations, including our ability to perform our obligations and pay dividends.

As of December 31, 2014, we had approximately $190 million of senior secured indebtedness, no outstanding borrowings under our revolving credit facility and $75 million of borrowing availability under the revolving credit facility. We may also be able to incur substantial indebtedness in the future, including senior indebtedness, which may or may not be secured.

Our indebtedness could have important consequences, including the following:

|

·

| |

We could have difficulty satisfying our debt obligations, and if we fail to comply with these requirements, an event of default could result; |

|

·

| |

We may be required to dedicate a substantial portion of our cash flow from operations to required payments on indebtedness, thereby reducing the cash flow available to pay dividends or fund working capital, capital expenditures and other general corporate activities; |

|

·

| |

Covenants relating to our indebtedness may restrict our ability to make distributions to our stockholders; |

|

·

| |

Covenants relating to our indebtedness may limit our ability to obtain additional financing for working capital, capital expenditures and other general corporate activities, which may limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; |

|

·

| |

We may be more vulnerable to general adverse economic and industry conditions; |

|

·

| |

We may be placed at a competitive disadvantage compared to our competitors with less debt; and |

|

·

| |

We may have difficulty repaying or refinancing our obligations under our senior credit facilities on their respective maturity dates. |

If any of these consequences occur, our financial condition, results of operations and ability to pay dividends could be adversely affected. This, in turn, could negatively affect the market price of our common stock, and we may need to undertake alternative financing plans, such as refinancing or restructuring our debt, selling assets, reducing or delaying capital investments or seeking to raise additional capital. We cannot assure you that any refinancing would be possible, that any assets could be sold, or, if sold, of the timing of the sales and the amount of proceeds that may be realized from those sales, or that additional financing could be obtained on acceptable terms, if at all.

Our variable rate indebtedness subjects us to interest rate risk, which could cause our debt service obligations to increase significantly and could impose adverse consequences.

Certain of our borrowings, including our term loan and any revolving borrowings under our senior credit facilities, are at variable rates of interest and expose us to interest rate risk. In addition, the interest rate on any revolving borrowings is subject to an increase in the interest rate if the average daily availability under our revolving credit facility falls below a certain threshold. If interest rates increase, our debt service obligations on the variable rate indebtedness would increase even though the amount borrowed remained the same, and our net income and cash flows would correspondingly decrease.

Our senior credit facilities impose restrictions on us, which may also prevent us from capitalizing on business opportunities and taking certain corporate actions. One of these facilities also includes minimum availability requirements, which if unsatisfied, could result in liquidity events that may jeopardize our business.

Our senior credit facilities contain, and future debt instruments to which we may become subject may contain, covenants that limit our ability to engage in activities that could otherwise benefit our company. Under the credit facilities as modified most recently in December 2014, these covenants include restrictions on our ability to:

|

·

| |

incur, assume or permit to exist additional indebtedness or contingent obligations; |

|

·

| |

incur liens and engage in sale and leaseback transactions; |

|

·

| |

make loans and investments in excess of agreed upon amounts; |

|

·

| |

declare dividends, make payments or redeem or repurchase capital stock in excess of agreed upon amounts and subject to certain other limitations; |

|

·

| |

engage in mergers, acquisitions and other business combinations; |

|

·

| |

prepay, redeem or purchase certain indebtedness or amend or alter the terms of our indebtedness; |

|

·

| |

make further negative pledges; |

|

·

| |

create restrictions on distributions by subsidiaries; |

|

·

| |

change our fiscal year; |

|

·

| |

engage in activities other than, among other things, incurring the debt under our new senior credit facilities and the activities related thereto, holding our ownership interest in DDI LLC, making restricted payments, including dividends, permitted by our senior credit facilities and conducting activities related to our status as a public company; |

|

·

| |

amend or waive rights under certain agreements; |

|

·

| |

transact with affiliates or our stockholders; and |

|

·

| |

alter the business that we conduct. |

Our amended revolving credit facility also includes limitations on capital expenditures and requires that if we fail to maintain the greater of $12,500,000 and 12.5% of the revolving commitments in borrowing availability, we must comply with a fixed charge coverage ratio test. In addition, if a liquidity event occurs because our borrowing availability is less than the greater of $15,000,000 and 15% of the aggregate revolving commitments (or an event of default occurs and is continuing), subject to certain limited cure rights, all proceeds of our accounts receivable and other collateral will be applied to reduce obligations under our amended revolving credit facility, jeopardizing our ability to meet other obligations. Our ability to comply with the covenants contained in our senior credit facilities or in the agreements governing our future indebtedness, and our ability to avoid liquidity events, may be affected by events, or our future performance, which are subject to factors beyond our control, including prevailing economic, financial, industry and weather conditions, such as the level, timing and location of snowfall and general economic conditions in the snowbelt regions of North America. A failure to comply with these covenants could result in a default under our senior credit facilities, which could prevent us from paying dividends, borrowing additional amounts and using proceeds of our inventory and accounts receivable, and also permit the lenders to accelerate the payment of such debt. If any of our debt is accelerated or if a liquidity event (or event of

default) occurs that results in collateral proceeds being applied to reduce such debt, we may not have sufficient funds available to repay such debt and our other obligations, in which case, our business could be halted and such lenders could proceed against any collateral securing that debt. Further, if the lenders accelerate the payment of the indebtedness under our senior credit facilities, our assets may not be sufficient to repay in full the indebtedness under our senior credit facilities and our other indebtedness, if any. We cannot assure you that these covenants will not adversely affect our ability to finance our future operations or capital needs to pursue available business opportunities or react to changes in our business and the industry in which we operate.

Provisions of Delaware law and our charter documents could delay or prevent an acquisition of us, even if the acquisition would be beneficial to you.

Provisions in our certificate of incorporation and bylaws may have the effect of delaying or preventing a change of control or changes in our management. These provisions include:

|

·

| |

the absence of cumulative voting in the election of our directors, which means that the holders of a majority of our common stock may elect all of the directors standing for election; |

|

·

| |

the ability of our Board of Directors to issue preferred stock with voting rights or with rights senior to those of our common stock without any further vote or action by the holders of our common stock; |

|

·

| |

the division of our Board of Directors into three separate classes serving staggered three‑year terms; |

|

·

| |

the ability of our stockholders to remove our directors is limited to cause and only by the vote of at least 662/3% of the outstanding shares of our common stock; |

|

·

| |

the prohibition on our stockholders from acting by written consent and calling special meetings; |

|

·

| |

the requirement that our stockholders provide advance notice when nominating our directors or proposing business to be considered by the stockholders at an annual meeting of stockholders; and |

|

·

| |

the requirement that our stockholders must obtain a 662/3% vote to amend or repeal certain provisions of our certificate of incorporation. |

We are also subject to Section 203 of the Delaware General Corporation Law, which, subject to certain exceptions, prohibits us from engaging in any business combination with any interested stockholder, as defined in that section, for a period of three years following the date on which that stockholder became an interested stockholder. This provision, together with the provisions discussed above, could also make it more difficult for you and our other stockholders to elect directors and take other corporate actions, and could limit the price that investors might be willing to pay in the future for shares of our common stock.

Our dividend policy may limit our ability to pursue growth opportunities.

If we continue to pay dividends at the level contemplated by our dividend policy, as in effect on the date of this filing, or if we increase the level of our dividend payments in the future, we may not retain a sufficient amount of cash to finance growth opportunities, meet any large unanticipated liquidity requirements or fund our operations in the event of a significant business downturn. In addition, because a significant portion of cash available will be distributed to holders of our common stock under our dividend policy, our ability to pursue any material expansion of our business, including through acquisitions, increased capital spending or other increases of our expenditures, will depend more than it otherwise would on our ability to obtain third party financing. We cannot assure you that such financing will be available to us at all, or at an acceptable cost. If we are unable to take timely advantage of growth opportunities, our future financial condition and competitive position may be harmed, which in turn may adversely affect the market price of our common stock.

Security breaches and other disruptions could compromise our information and expose us to liability, which would cause our business and reputation to suffer.

In the ordinary course of our business, we collect and store sensitive data, including our proprietary business information and that of our customers, suppliers and business partners, as well as personally identifiable information of our customers and employees, in our data centers and on our networks. The secure processing, maintenance and transmission of this information is critical to our operations and business strategy. Despite our security measures, our information technology and infrastructure may be vulnerable to malicious attacks or breached due to employee error, malfeasance or other disruptions, including as a result of rollouts of new systems. Any such breach could compromise our networks and the information stored there could be accessed, publicly disclosed, lost or stolen. Any such access, disclosure or other loss of information could result in legal claims or proceedings and/or regulatory penalties, disrupt our operations, damage our reputation, and/or cause a loss of confidence in our products and services, which could adversely affect our business.

We may be unable to identify, complete or benefit from strategic transactions.

Our long‑term growth strategy includes building value for our company through a variety of methods. These methods may include acquisition of, investment in, or joint ventures involving, complementary businesses. We cannot assure that we will be able to identify suitable parties for these transactions. If we are unable to identify suitable parties for strategic transactions we may not be able to capitalize on market opportunities with existing and new customers, which could inhibit our ability to gain market share. Even if we identify suitable parties to participate in these transactions, we cannot assure that we will be able to make them on commercially acceptable terms, if at all.

In December 2014, we acquired Henderson. In May 2013, we acquired substantially all of the assets of TrynEx. We may not be able to achieve the projected financial performance or incur unexpected costs or liabilities as a result of either transaction. In addition, if in the future we acquire another company or its assets, it may be difficult to assimilate the acquired businesses, products, services, technologies and personnel into our operations. These difficulties could disrupt our ongoing business, distract our management and workforce, increase our expenses and adversely affect our operating results and ability to compete and gain market share. Mergers and acquisitions are inherently risky and are subject to many factors outside our control. No assurance can be given that any future acquisitions will be successful and will not materially adversely affect our business, operating results, or financial condition. In addition, we may incur debt or be required to issue equity securities to pay for future acquisitions or investments. The issuance of any equity securities could be dilutive to our stockholders. We also may need to make further investments to support any acquired company and may have difficulty identifying and acquiring appropriate resources. If we divest or otherwise exit certain portions of our business in connection with a strategic transaction, we may be required to record additional expenses, and our estimates with respect to the useful life and ultimate recoverability of our carrying basis of assets, including goodwill and purchased intangible assets, could change.

Item 1B. Unresolved Staff Comments

Not applicable.

Item 2. Properties

We are headquartered in Milwaukee, WI and currently have manufacturing facilities in Milwaukee, WI, Rockland, ME and Madison Heights, MI. Additionally, we operate a sourcing office in China. As a result of the Henderson acquisition on December 31, 2014, we also own a manufacturing facility in Manchester, Iowa and lease five truck equipment distribution locations in Illinois, Iowa, New Jersey, New York and Ohio. We operate as a single segment.

Item 3. Legal Proceedings

In the ordinary course of business, we are engaged in various litigation primarily including product liability and intellectual property disputes. However, management does not believe that any current litigation is material to our operations or financial position. In addition, we are not currently party to any environmental‑related claims or legal matters.

Item 4. Mine Safety Disclosures

Not applicable.

Executive Officers of the Registrant

Our executive officers as of December 31, 2014 were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

Age

|

|

Position

|

|

James Janik

|

|

|

58

|

|

|

Chairman, President and Chief Executive Officer

|

|

Robert McCormick

|

|

|

54

|

|

|

Executive Vice President, Chief Financial Officer and Secretary

|

|

Mark Adamson

|

|

|

56

|

|

|

Senior Vice President, Sales and Marketing

|

|

Keith Hagelin

|

|

|

54

|

|

|

Senior Vice President, Operations

|

James Janik has been serving as our President and Chief Executive Officer since 2000 and as a director since 2004. Since 2014, Mr. Janik also has served as our Chairman of the Board. Mr. Janik was General Manager of our Western Products division from 1994 to 2000 and Vice President of Marketing and Sales from 1998 to 2000. Prior to joining us, Mr. Janik was the Vice President of Marketing and Sales of Sunlite Plastics Inc., a custom extruder of thermoplastic materials, for two years. During the 11 prior years, Mr. Janik held a number of key marketing, sales and production management positions for John Deere Company.

Robert McCormick has been serving as our Executive Vice President, Chief Financial Officer since September 2004 and as our Secretary since May 2005. Mr. McCormick served as our Assistant Secretary from September 2004 to May 2005 and as our Treasurer from September 2004 through December 2010. Prior to joining us, Mr. McCormick served as President and Chief Executive Officer of Xymox Technology Inc. from 2001 to 2004. Prior to that, Mr. McCormick served in various capacities in the Newell Rubbermaid Corporation, including President from 2000 to 2001 and Vice President Group Controller from 1997 to 2000. While Mr. McCormick served as President, he was responsible for Newell’s Mirro / Wearever Cookware, and as Vice President Group Controller, he was responsible for worldwide strategic and financial responsibilities for 12 company divisions with sales of over two billion dollars.

Mark Adamson has been serving as our Senior Vice President, Sales and Marketing since 2013. Prior to becoming our Senior Vice President, Sales and Marketing he had served as our Vice President, Sales and Marketing since 2007. Prior to joining us, Mr. Adamson held numerous senior level management positions with industry leaders in the grounds care industry, including John Deere Company from 1980 to 2002 and Gehl Corporation from 2002 to 2007. From 2003 to 2005, he was the Manager, Regional Sales & Distribution of Gehl Company, directing the sales and marketing activities of certain sales field managers in the northeastern United States responsible for Gehl product sales and rental, and from 2005 to 2007, he was the Director, Training and Customer Support, where he directed the aftermarket and training activities of five departments and thirty‑two individuals responsible for Gehl

and Mustang products worldwide. From 1980 to 2002, Mr. Adamson held several senior level management positions with John Deere Company.

Keith Hagelin has been serving as our Senior Vice President, Operations since September 2013. Prior to becoming our Senior Vice President, Operations, he had served as our Vice President, Operations since 2009, having previously spent twelve years in progressive roles with us, including Plant Manager and General Manager—Rockland and most recently Vice President of Manufacturing from 2007 to 2009. Prior to joining Douglas, Mr. Hagelin spent 13 years at Raytheon Corporation in various manufacturing, production and new product development roles.

Executive officers are elected by, and serve at the discretion of, the Board of Directors. There are no family relationships between any of our directors or executive officers.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

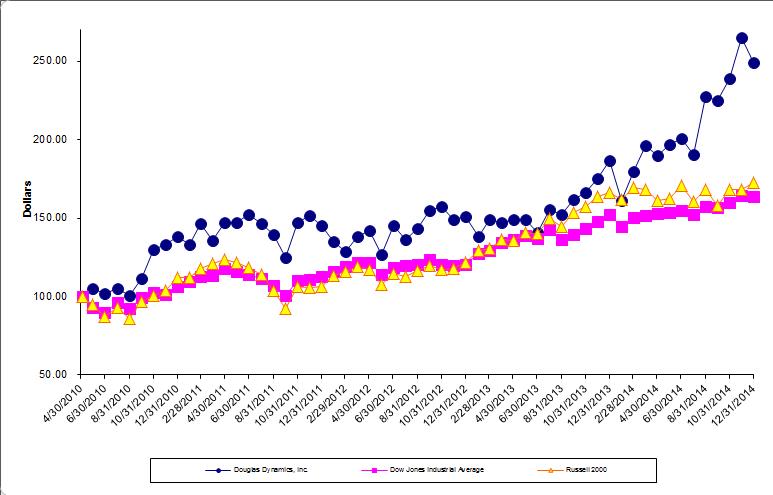

Our Common Stock has been traded on the New York Stock Exchange since the second quarter of 2010 under the symbol “PLOW.” The prices in the table set forth below indicate the high and low sales prices of our Common Stock per the New York Stock Exchange Composite Price History for each quarter in 2014 and 2013.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2014

|

|

2013

|

|

|

|

Price Range

|

|

Price Range

|

|

|

|

High

|

|

Low

|

|

Dividends

|

|

High

|

|

Low

|

|

Dividends

|

|

Fourth Quarter

|

|

$

|

24.90

|

|

$

|

18.40

|

|

$

|

0.22

|

|

$

|

17.45

|

|

$

|

14.41

|

|

$

|

0.21

|

|

Third Quarter

|

|

|

21.21

|

|

|

16.43

|

|

|

0.22

|

|

|

15.30

|

|

|

13.14

|

|

|

0.21

|

|

Second Quarter

|

|

|

18.28

|

|

|

16.45

|

|

|

0.22

|

|

|

14.55

|

|

|

12.72

|

|

|

0.21

|

|

First Quarter

|

|

|

18.55

|

|

|

14.12

|

|

|

0.22

|

|

|

14.86

|

|

|

12.65

|

|

|

0.21

|

At March 12, 2015, there were 23 record holders of our Common Stock.

In accordance with the Company’s dividend policy, dividends are declared and paid quarterly at the discretion of the board of directors. Additionally, special dividends may be declared and paid at the discretion of the board of directors. In the first, second and third quarters of 2013, the Company both declared and paid a dividend of $0.2075 per share. In the fourth quarter of 2013, the Company increased its annual implied dividend from $0.83 to $0.85 and both declared and paid a dividend of $0.2125 per share. In the first quarter of 2014, the Company increased its annual implied dividend from $0.85 to $0.87 per share and both declared and paid a dividend of $0.2175 per share. In the second, third and fourth quarters of 2014, the Company both declared and paid a dividend of $0.2175 per share.

The Company’s senior credit facilities include certain negative and operating covenants, including restrictions on its ability to pay dividends, and other customary covenants, representations and warranties and events of default. The senior credit facilities entered into and recorded by the Company’s subsidiaries significantly restrict its subsidiaries from paying dividends and otherwise transferring assets to Douglas Dynamics, Inc. The terms of the Company’s revolving credit facility specifically restrict the Company from paying dividends if a minimum availability under the revolving credit facility, the greater of $15.0 million and 15% of the aggregate revolving commitments at the time of determination, is not maintained. Additionally, both senior credit facilities restrict the Company from paying dividends above certain levels not to exceed $6.0 million in any fiscal quarter of 2014, $6.25 million in any fiscal quarter of 2015 and $6.5 million in any fiscal quarter of 2016 and thereafter or at all if an event of default has occurred. These restrictions would affect the Company indirectly since the Company relies principally on distributions from its subsidiaries to have funds available for the payment of dividends.

Securities Authorized for Issuance under Equity Compensation Plans

The following table sets forth information with respect to compensation plans under which equity securities of the Company are authorized for issuance as of December 31, 2014.

|

|

|

|

|

|

|

|

|

|

|

Equity Compensation Plan Information

|

|

|

|

|

|

|

Plan Category

|

Number of securities to be issued upon exercise of outstanding options, warrants and rights (a)

|

Weighted - average exercise price of outstanding options, warrants and rights (b)

|

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))

|

|

Equity Compensation plans approved by security holders (1):

|

|

|

|